Australian housing values down

- Written by CoreLogic

|

December’s -1.1% fall takes Australian housing values down -5.3% over 2022 |

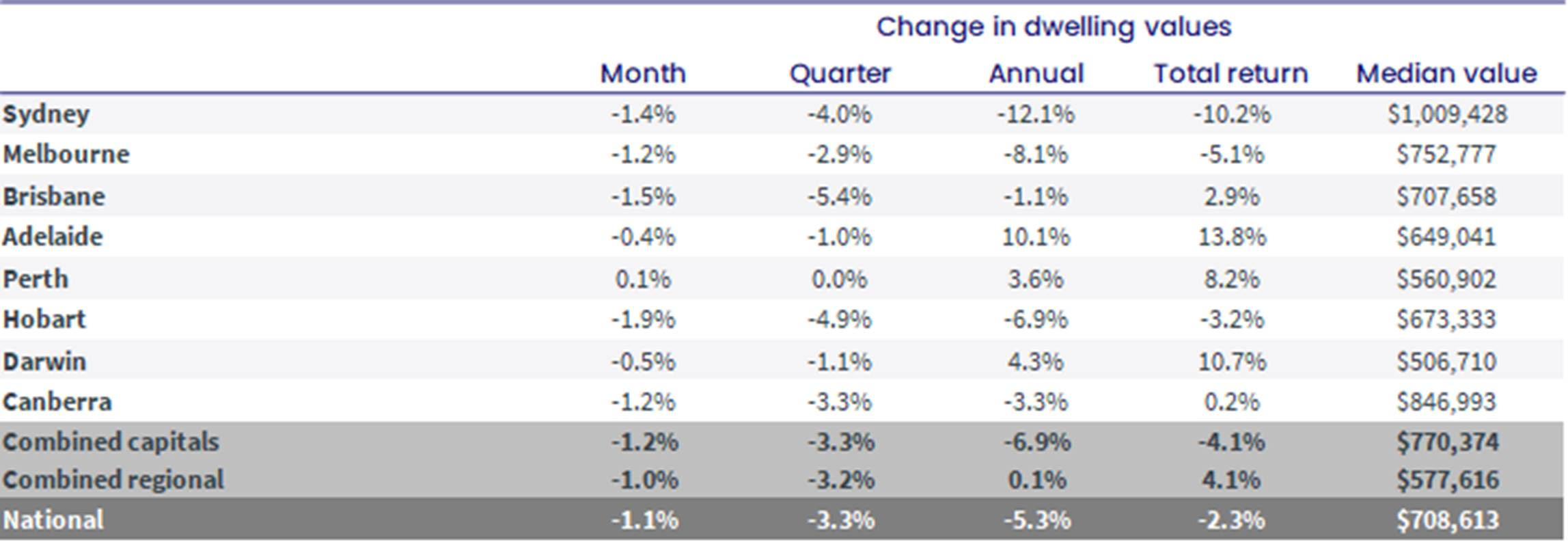

After the monthly rate of decline moderated between September and November, housing markets finished the year on a weaker note, with CoreLogic’s national Home Value Index falling -1.1% in December, taking values -5.3% lower over the 2022 calendar year.

The re-acceleration in the downwards trend was mostly driven by a worsening in the monthly rate of decline across Melbourne (which lifted 40 basis points between November’s -0.8%, and December’s -1.2% fall), but declines also accelerated across Sydney, Adelaide, Darwin and Canberra month-on-month. On the flip side, the pace of falls eased across Brisbane and Hobart, while value movements in Perth remained slightly positive for the second consecutive month.

The -5.3% drop in housing values through 2022 marks the first time since 2018 where national home values fell over the calendar year. The 12 months to December also mark the largest calendar year decline since 2008, when values were down -6.4% amid the Global Financial Crisis, and successive interest rate rises.

Annual value falls were the most significant in Sydney (-12.1%) and Melbourne (-8.1%) where conditions peaked early in the year. Hobart (-6.9%), the ACT (-3.3%), and Brisbane (-1.1%) also recorded an annual drop in housing values, while three capitals saw values rise over the year: Adelaide (10.1%), Darwin (4.3%), and Perth (3.6%).

CoreLogic’s research director, Tim Lawless, said this has been a year of contrasts, with housing values mostly rising through the first four months of the year, but falling sharply as the RBA commenced the fastest rate tightening cycle on record.

“Our daily index series saw national home values peak on May 7, shortly after the cash rate moved off emergency lows. Since then, CoreLogic’s national index has fallen -8.2%, following a dramatic 28.9% rise in values through the upswing.”

The upper quartile of the housing market led the downturn through 2022, with most capital city and broad ‘rest-of-state’ regions recording weaker performance across the upper quartile relative to the lower quartile and broad middle of the market.

“The more expensive end of the market tends to lead the cycles, both through the upswing and the downturn. Importantly, recent months have seen some cities recording less of a performance gap between the broad value-based cohorts. Sydney is a good example, where upper quartile house values actually fell at a slower pace than values across the lower quartile and broad middle of the market through the final quarter of the year,” Mr Lawless said.

Although housing values across the combined regional areas of Australia were roughly unchanged over the year (+0.1%), results were more mixed across the states. Annual falls across Regional NSW (-2.7%) and Regional Victoria (-1.3%) offset annual gains across the remaining regional markets.

“Regional SA has been the stand out for growth conditions over the past year, with values up 17.1% through 2022,” Mr Lawless said. “The well-known Barossa wine region led the capital gains with a 23.0% rise in values over the calendar year.”

Despite the downturn across many areas of the country, housing values generally remain well above pre-COVID levels. Across the combined capital cities, dwelling values remained 11.7% above where they were at the onset of COVID (March 2020), while values across the combined regional markets are still up 32.2%.

“Melbourne is the only capital city where the current downwards trend is getting close to wiping out the entirety of COVID gains, with dwelling values only 1.5% above March 2020 levels,” Mr Lawless said.

“The relatively small difference between March 2020 and December 2022 levels can be attributed to a number of factors, including a larger drop in values during the early phase of COVID, a milder upswing through the growth cycle and the -8.3% drop since values peaked in February.”

At the other end of the scale is Adelaide, where housing values remain 42.8% above pre-COVID levels. Adelaide dwelling values recorded a 44.7% gain through the upswing, and have held relatively firm since interest rates started to rise, down only -1.3% from the recent peak.