Signing of a binding merger for the sale of a block of shares in SMT Scharf AG

52.66% of the share capital of SMT Scharf AG to Yankuang Energy Group Company Limited with its registered office in Shandong Province, China at a price of EUR 11.10 per share.

At the time of signing of the transaction, Shareholder Value Beteiligungen AG owns more than one-fifth of the share capital of SMT Scharf AG. The subject of the transaction is the vast majority of the above-mentioned position of Shareholder Value Beteiligungen AG. This price per share is still subject to a fixed adjustment mechanism depending on certain variables until the closing of the transaction, which may lead to a deduction of the price per share.

According to the Management Board's current assessment, once the transaction has been completed and assuming normal business performance up to that point, this is expected to make a positive contribution to increasing the intrinsic value of the company compared to the last reporting date.

In particular, the closing of the agreement is still subject to the occurrence of customary closing conditions, in particular the conclusion of investment control proceedings in Germany and government regulatory approvals in other jurisdictions of subsidiaries of SMT Scharf AG as well as the approval of the competent Chinese authorities.

About the Purchaser

Yankuang Energy Group Company Limited was founded in 1997. The H share (ISIN CNE1000004Q8; ISIN ADR US9848461052 ) and the A share (ISIN CNE000000WV6) are listed on the Hong Kong Stock Exchange and the Shanghai Stock Exchange.

The company regards mining, high-end chemicals and new materials, new energies, high-end equipment manufacturing, and intelligent logistics as key industries of the future.

It is a major Chinese energy corporation with four major stock exchanges in China and beyond (Shanghai, Hong Kong, New York, Australia). Yankuang Energy Group Ltd ranked 69th on the 2022 Fortune Global 500 List and is part of the CSI 300 Index and the SSE 180 Index.

The company has three operating bases in Australia, Shandong and Shaanxi & Inner Mongolia.

The funds for the transaction are entirely borne by Yankuang Energy.

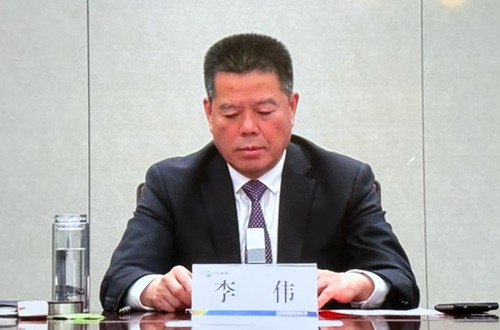

During the signing ceremony Yankuang Energy was represented by the Chairman Mr. Li Wei. Li Wei, born in September 1966, a research fellow in applied engineering technology and Ph.D. of engineering, is the chairman of the Company, the Party secretary, and chairman of Shandong Energy Group Company Limited.

He was appointed as vice-chairman of the Company in June 2016, the deputy Party secretary, director, and general manager of Hualu Holdings Co., Ltd. in August 2020, and Party secretary and chairman of Shandong Energy Group in June 2021. He was appointed as the chairman of the Company in August 2021. Mr. Li graduated from the University of Science and Technology Beijing.

Among others Mr. Li Wei was elected as "2022 China Economic Figure of the Year".

In accordance with the regulatory requirements of the jurisdiction where the Company is listed and the relevant provisions of the Articles of Association of Yankuang Energy, the Transaction falls within the scope of decisions made at the general manager's office meeting and is not required to be submitted to the Board and the general meeting of shareholders for approval.

The controlling shareholder of the purchaser is Shandong Energy Group Co., Ltd (Shandong).

Secretary of the CPC Shandong Energy Committee is Mr. Li Wei.

Other companies that belong to Shandong without claiming completeness are:

Shandong Energy Linyi Mining Group Co Ltd.,

Yankuang Energy Group Co Ltd (CNE000000WV6, US9848461052, CNE1000004Q8),

Yancoal Australia Ltd (AU000000YAL0),

Coal & Allied Industries Ltd (AU000000CNA2).

Financial Services for the Group are performed by

Yancoal Resources Ltd (AU000000FLX1)

March 31, 2021 the company emitted a bond with a placement amount of 550 Mio. USD (XS2337157510) maturing in 2028.

The link to the purchaser's press release in Chinese (please use google translate) is as follows:

http://www.cninfo.com.cn/new/disclosure/detail?stockCode=600188&announcementId=1219218807&orgId=gssh0600188&announcementTime=2024-03-02

The issuer is solely responsible for the content of this announcement.

About the Seller

The group of eleven sellers consists among others of several mutual funds (Frankfurter Aktienfonds für Stiftungen ISIN: DE000A1JSWP1; DE000A12BPQ2; DE000A2N5MA1; DE000A2N66D4; DE000A2JJ222; DE000A0M8HD2; DE000A12BPP4; DE000A2P1AS5; Frankfurter Stiftungsfonds ISIN: DE000A2DTMN6; Frankfurter- Value Focus Fund ISIN: LU0566535208; LU0399928414). Those vehicles are advised by the tied agent Shareholder Value Management AG. Shareholder Value Management AG itself is also one of the selling shareholders. Further Shareholder Value Beteiligungen AG, an exchange listed company, decided to take part in the transaction.

Future Development of SMT Scharf AG

In addition, SMT Scharf AG announces that it intends to apply for the admission of the shares of SMT Scharf AG to the Regulated Market of the Frankfurt Stock Exchange and to the sub-segment of the Regulated Market with further post-admission obligations (Prime Standard) after completion of the transaction.

To the knowledge of Shareholder Value Beteiligungen AG, the transaction itself does not give rise to any obligation to submit a takeover offer to the free float of SMT Scharf AG.