Hong Kong Investors Expanding Global Reach

Hong Kong outbound investment1 totaled US$4.5 billion in Q1 2023, up by 68% q-o-q and 54% y-o-y

- Outbound investment from Hong Kong capital has risen for two consecutive quarters

- Mainland China remains the most preferred destination, followed by Singapore and the United Kingdom

HONG KONG SAR - Media OutReach - 28 June 2023 - Cushman & Wakefield participated at the Mingtiandi Hong Kong Focus Forum held at the Sheraton Hong Kong Hotel & Towers on Tuesday, June 27, 2023. Francis Li, International Director, Head of Capital Markets, Greater China at Cushman & Wakefield represented the firm to share his experiences and views on Hong Kong's role in global capital markets at the event's keynote panel, together with fellow panelists from Link REIT, APG Asset Management and WeWork Greater China.

"Hong Kong's financial system is highly integrated with the global economy, and its status as an international financial center is underpinned by its openness, transparency, and adherence to international standards and best practices. Additionally, Hong Kong's banking system is well-capitalized and highly liquid, with banks holding substantial reserves and capital buffers. Backed by its resilient financial system, Hong Kong-based investors play an increasingly important role in the regional and global commercial real estate (CRE) market, and have become more active in their overseas acquisitions," said Li.

According to the latest data from MSCI, outbound investment from Hong Kong capital has been rising for two quarters in a row, totaling US$4.5 billion in Q1 2023, up by 68% q-o-q and 54% y-o-y, for deals over US$10 million excluding development sites.

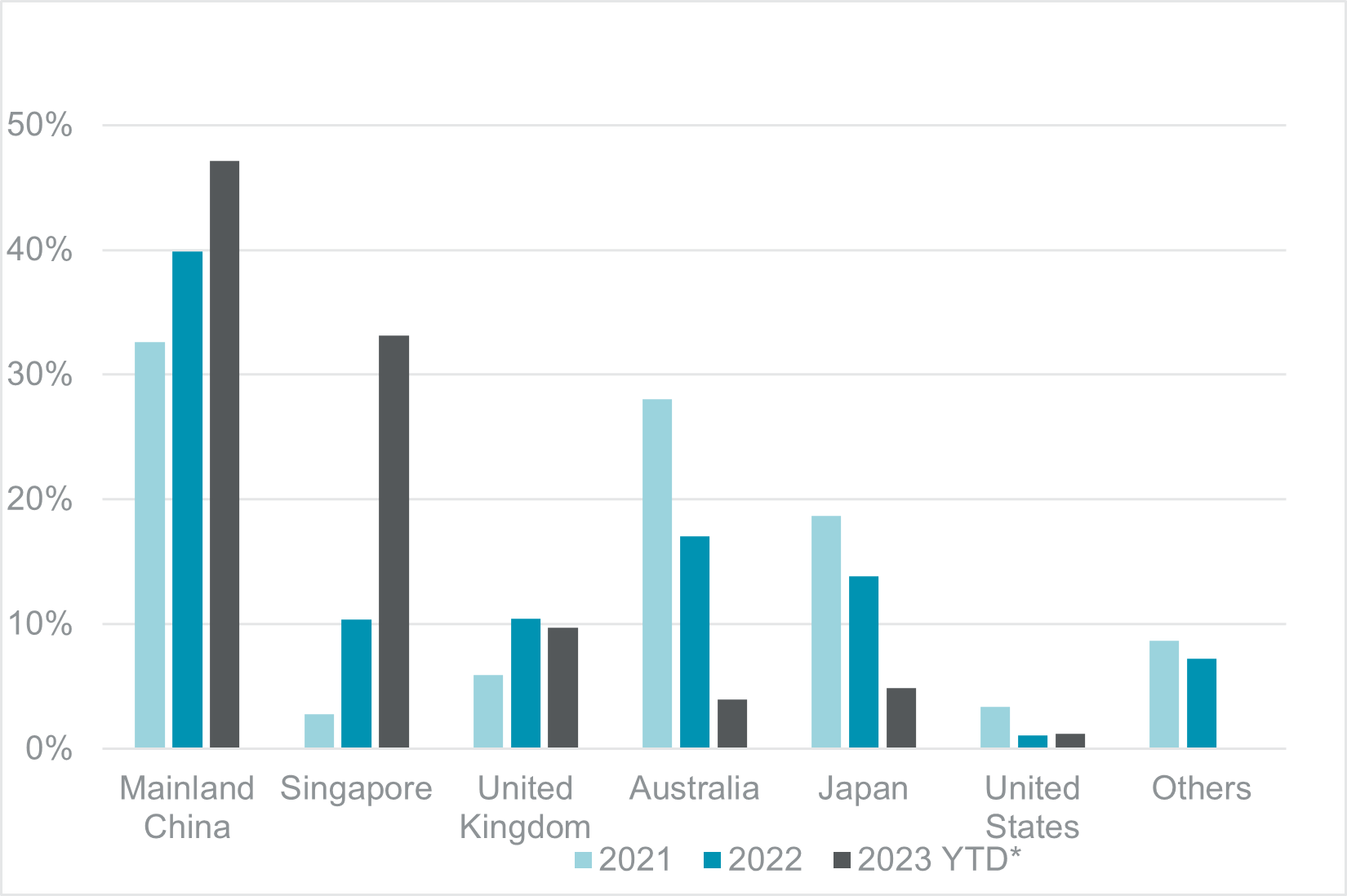

While mainland China remains the most preferred investment location for Hong Kong-based capital, accounting for 47% of the total cross-border transaction volume year-to-date as of June15, Singapore and the United Kingdom have become increasingly popular with Hong Kong investors, representing 33% and 10% of the total consideration, respectively. In contrast, the share of investment into the U.S. has been declining since 2019, and accounted for just 1% of the total outbound investment from Hong Kong for the year-to-date.

Share of Outbound CRE Investment from Hong Kong

Li added, "We expect that capital flows between mainland China and Hong Kong will expand as the border has now reopened. Currently we are seeing a growing number of mainland China companies and fund managers establishing operations in Hong Kong to tap into the international market. Mainland China has now overtaken the U.S. as the largest geographical source of regional headquarters in Hong Kong, according to the Census department. Likewise, with increasing integration between the two economies, Hong Kong-based investors and developers will likely continue to expand their allocations in mainland China, especially in Tier 1 and major Tier 2 cities including the Greater Bay Area."

In terms of growing outbound investment into other regions, James Young, Head of Investor Services, Asia Pacific & EMEA, Cushman & Wakefield, added, "Hong Kong-based investors continue to expand their global reach by increasing allocation in overseas markets to seize opportunities in different market cycles. For instance, the rapid macroeconomic changes, including interest rate hikes in Europe and the UK, have resulted in sellers being more willing to adjust prices quickly, which is attracting Asian capital to these markets."

Notes

1For deals over US$10 million excluding development sites.

Hashtag: #CushmanandWakefield

The issuer is solely responsible for the content of this announcement.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in approximately 400 offices and 60 countries. In Greater China, a network of 23 offices serves local markets across the region. In 2022, the firm reported global revenue of US$10.1 billion across its core services of valuation, consulting, project & development services, capital markets, project & occupier services, industrial & logistics, retail and others. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity and Inclusion (DEI), Environmental, Social and Governance (ESG) and more. For additional information, visit www.cushmanwakefield.com.