Trust issues: Octa's survey about brokers' red flags

Many factors come into play when choosing a reliable broker to start your trading journey. For someone with limited experience in the markets, this choice can be very confusing, and the priorities are hard to define.

However, traders have their own trove of practical knowledge, and tapping into it can shed light on brokers' red flags. As part of its global research, global broker Octa surveyed hundreds of Malaysian CFD traders to determine what warning signs make them avoid financial brokers.

KUALA LUMPUR, MALAYSIA - Media OutReach Neswire - 21 March 2025 - Advertisements always show only one side of the coin, regardless of what is advertised. The drawbacks, on the other hand, often become known the hard way in practice. Everyone has had negative experiences with certain products or services and will never choose them again.

This is especially true of e-brokerage services, where the entire trader's journey depends on the broker and the trading platform. Any misstep on the part of the broker can be detrimental not only to the client's experience but also to their funds. So, what are the most common red flags in brokers, according to Malaysian traders?

The signs of unreliability

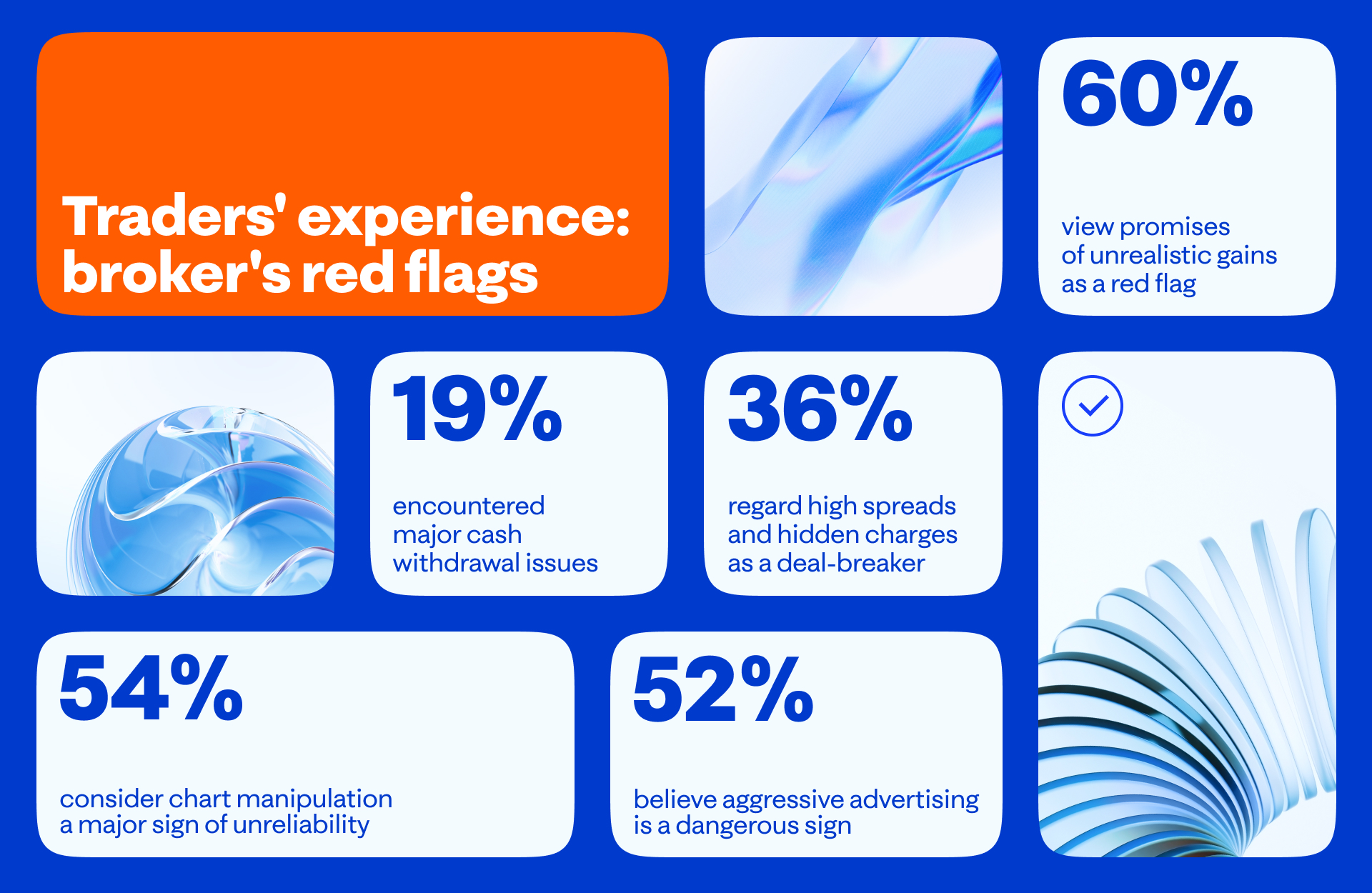

When asked what signs are most indicative of a broker's unreliability, survey participants named the following red flags:

- chart manipulations (54%)

- slow deposit or withdrawal transactions (51%)

- price slippage and non-execution of orders without any visible underlying market reason (36%)

- the broker's quotes significantly differ from the quotes of other brokers (34%).

These results show that a predictable and fair trading environment is a crucial factor determining Malaysian traders' willingness to engage with a certain broker. As things stand, the broker is responsible for providing complete transparency and adequate proof of value to its clients.

As a trusted and highly experienced broker, Octa works with independent, third-party liquidity providers to offer non-distorted market prices to its clients. In turn, liquidity providers aggregate prices using data from multiple sources, including banks and large financial institutions. As a result, chart prices are beyond the broker’s control.

Octa also provides access to historical chart data so that traders can verify that the broker’s prices align with actual market conditions and that there were no chart manipulations or price slippages at any given time.

Fair commissions and fast withdrawals are top priorities

When asked what broker's flaw is the major deal-breaker, Malaysian traders highlighted three main factors:

- high spreads and disadvantageous trading commissions (36%)

- slow deposits or withdrawals (25%)

- non-transparent commission model for deposits and withdrawals (18%).

It is safe to say that withdrawal-related issues come to the fore for Malaysian traders when considering brokers' red flags. This is further substantiated by the fact that 47% of survey participants said they would stop working with a broker in case of unjustified delays in or blocking of withdrawal transactions.

Another 23% of respondents indicated they would immediately take their trading elsewhere if their broker charged higher withdrawal commissions than previously indicated.

At the end of the day, the only way to make sure your broker is trustworthy is by trying it out yourself. For example, Octa addresses this concern by offering a highly efficient and fast withdrawal procedure that helps traders establish a long and trusting relationship with the broker and focus on trading instead of background factors.

Whom to trust?

The difficulties in choosing a reliable source of insights and updates are a well-known issue in the trading community. The spreading of misinformation and the proliferation of online experts with questionable credentials can cause a lot of confusion, especially among less experienced traders.

When asked what signs indicate that a source of information can be fraudulent, 52% of respondents highlighted aggressive advertising. The most popular answers also include:

- promotion of scam investment projects (37%)

- trading signals manipulations (37%)

- lack of online reviews (31%)

- unconvincing member success stories (31%).

This distribution of answers in Octa’s survey reflects a high demand for security measures on the part of the broker. Malaysian traders' stance calls for thorough and efficient know-your-customer procedures that help brokers safeguard their clients from fraud and scams. Aggressive, self-imposing tactics in broker's advertising also come across as a major red flag.

Safety remains in the limelight

As the previous question shows, various kinds of fraud are significant issues for many Malaysian traders. What's more, when asked about fraud in trading education and mentoring, 23% of respondents professed to know traders who were scammed by fake educators, coaches, and mentors. What's more, 16% have paid for false trading signals, and 14% have paid for a useless trading course.

These results reflect a justifiably high dependency on efficient security measures and tools on the part of a broker. The modern cyber threat landscape is very complex, and keeping track of the best international practices is a must for any client-oriented broker. It is only natural that global brokers have a competitive edge in that respect. Their extensive reach allows them to absorb and integrate the most advanced security practices and tools from various regions, offering their clients the most efficient solutions.

Conclusion

According to Octa's survey, Malaysian CFD traders tend to view the ease and speed of withdrawals as a direct indicator of a broker's trustworthiness and reliability. A fast, hassle-free withdrawal process allows traders to feel more in control of their financial decisions, ensuring they can access their profits or capital when needed.

The research also established that Malaysian traders prefer to work with brokers that provide a sense of security and transparency. They look for fair and consistent processes and want to avoid hidden fees or complex withdrawal conditions. If these requirements are met, brokers will have a much higher chance of establishing long-term relationships with clients based on mutual respect and clarity.

Disclaimer: Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision.

Hashtag: #octa

The issuer is solely responsible for the content of this announcement.

Octa

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.In Southeast Asia, Octa received the 'Best Trading Platform Malaysia 2024' and the 'Most Reliable Broker Asia 2023' awards from Brands and Business Magazine and International Global Forex Awards, respectively.