Beyond Borders: XTransfer Insights-Opportunity in the Overlooked: The Underserved SME Cross-Border Market

The B2B cross-border trade payment market is immense, yet remain highly underserved

HONG KONG SAR - Media OutReach Newswire - 9 February 2026 - According to the World Bank, SMEs account for approximately 90% the world's businesses and contribute 65% of the global cross-border trade.SMEs play a pivotal rolein most economies, particularly in emerging markets. Estimates from the World Trade Organization (WTO) and the Organization for Economic Co-operation and Development (OECD) suggest that B2B cross-border trade payment market for SMEs is worth approximately $20 trillion.

However, traditional commercial banks have been facing multiple challenges in serving SMEs, including strict compliance and risk control requirements, lower profit generating, and license limitations, resulting in a large unmet demand through formal financial systems.

XTransfer's field research in emerging markets indicates that many SMEs resort to illicit settlement channels like underground banks out of necessity. In fact, the trade volume processed through these unofficial avenues could be 2 to 5 times larger than the official import and export figures.

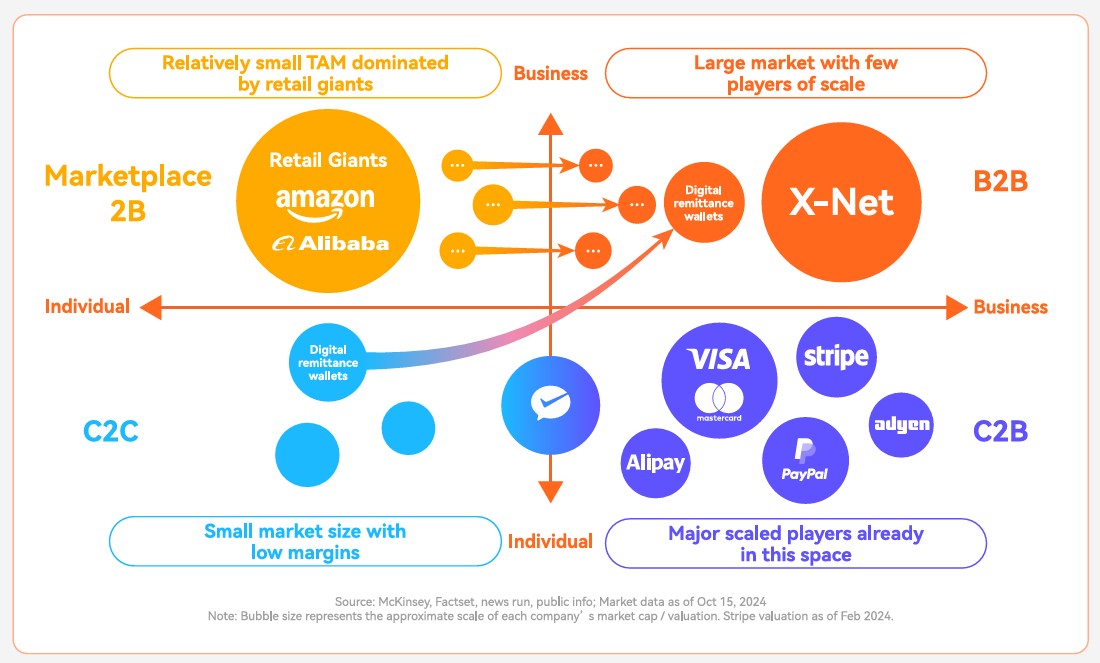

Compared to other segments, B2B cross-border payment presents vast opportunities

In the cross-border payment industry, services can be categorised into four segments based on money flows:

Marketplace 2B

These businesses provide payment processing services for sellers on e-commerce platforms. Risk control is primarily based on e-commerce platform's integrated of data streams (e.g., merchant details, logistics, transaction history). With relatively low technical barriers and compliance capabilities, the industry is highly saturated.

B2B

Focused on traditional cross-border trade enterprises, this segment has huge potential but features high risk control complexity and high barriers. Payment service providers must individually verify the entire information flow pertaining to each transaction (including buyer/seller details, orders, logistics, contracts, etc.), which results in many companies attempting to enter, but few succeed.

C2C

This primarily covers cross-border remittances between individuals. The overall market scale is relatively small, with limited use cases.

C2B

This is the most well-established segment, dominated by cross-border payment giants such as Visa, Mastercard, PayPal, and Stripe. The market is saturated with intense competition.

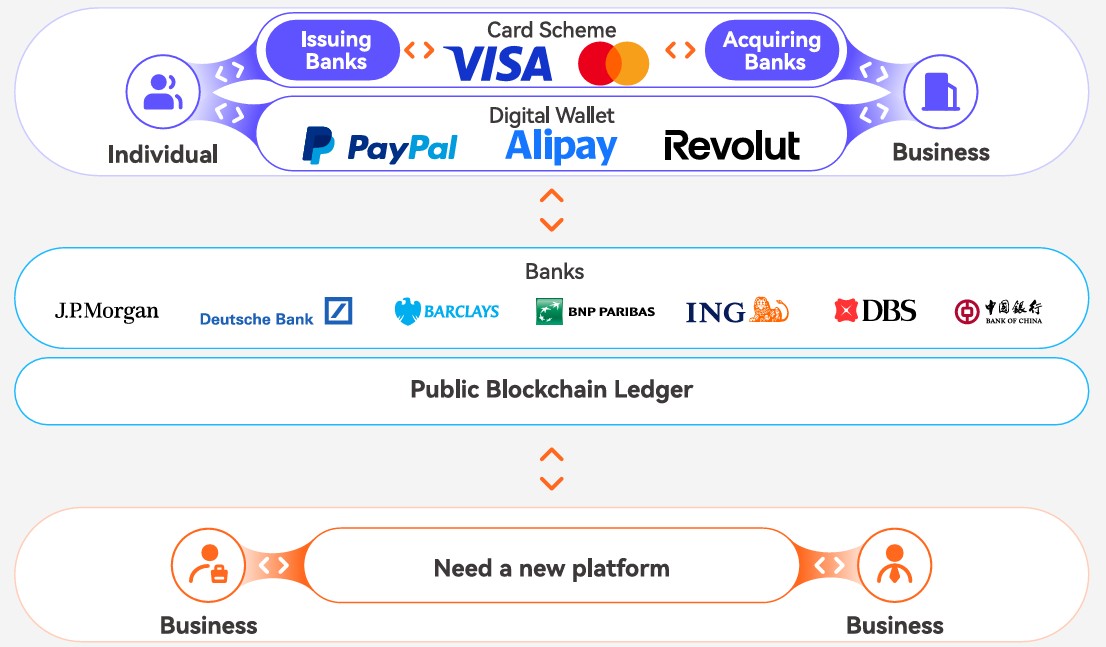

As a reference, the C2B cross-border payment industry has evolved dramatically over the last five decades, especially in the past ten years. Mobile wallet providers in China, the U.S. and Europe drove the mobile payment revolution, establishing a well-established cross-border settlement and risk control platform dominated by card schemes and wallets like PayPal. The system features significant advantages, including efficient transaction processes and unified risk control standards.

In contrast, B2B cross-border payments still primarily rely on traditional bank transfers. The sector as a whole is still on the cusp of the "mobile payment revolution" and has not yet formed a unified clearing mechanism or a standardized risk control system.

However, this development gap also points to a huge market opportunity. The B2B cross-border settlement market for SMEs desperately needs a shake-up. Service providers that possess a deep understanding of global customer needs and are equipped with technological and compliance capabilities will unleash vast growth potential in this space.

Beyond Borders: XTransfer Insights is a thought-leadership series that shares XTransfer's perspectives on the forces shaping global trade and financial services. Through research-driven insights and real-world observations, it highlights emerging trends, key challenges, and opportunities across international markets.

Hashtag: #XTransfer #Crossborder #Payment #SMEs #whitepaper

https://www.xtransfer.com

https://www.linkedin.com/company/xtransfer.cn

https://x.com/xtransferglobal

https://www.facebook.com/XTransferGlobal/

https://www.instagram.com/xtransfer.global

The issuer is solely responsible for the content of this announcement.