How to Perform CPR on a Baby: a Step-by-Step Guide

- Written by The Times

Introduction

When it comes to the health and safety of a baby, knowing how to perform CPR can be lifesaving. Baby first aid is essential knowledge for all parents, caregivers, and anyone who spends time with infants. This guide will walk you through the critical steps of performing CPR on a baby, ensuring you are prepared in an emergency. For a comprehensive course on baby first aid, visit our baby first aid page.

Step 1: Ensure Safety

Before starting CPR, ensure the area is safe for you and the baby. Look for any potential dangers and remove them if possible. Safety is paramount for both the rescuer and the infant.

Step 2: Check for Responsiveness

Gently tap the baby's foot and call out their name to check for any response. If there is no response, call emergency services immediately. In Australia, dial 000.

Step 3: Position the Baby

Place the baby on their back on a firm surface such as a table, bench, or the floor. Make sure their head is in a neutral position; do not tilt it too far back or forward as this can block the airway.

Step 4: Open the Airway

Gently lift the baby's chin to open the airway. Avoid excessive tilting of the head. Ensure the airway is open by holding the head in a neutral position.

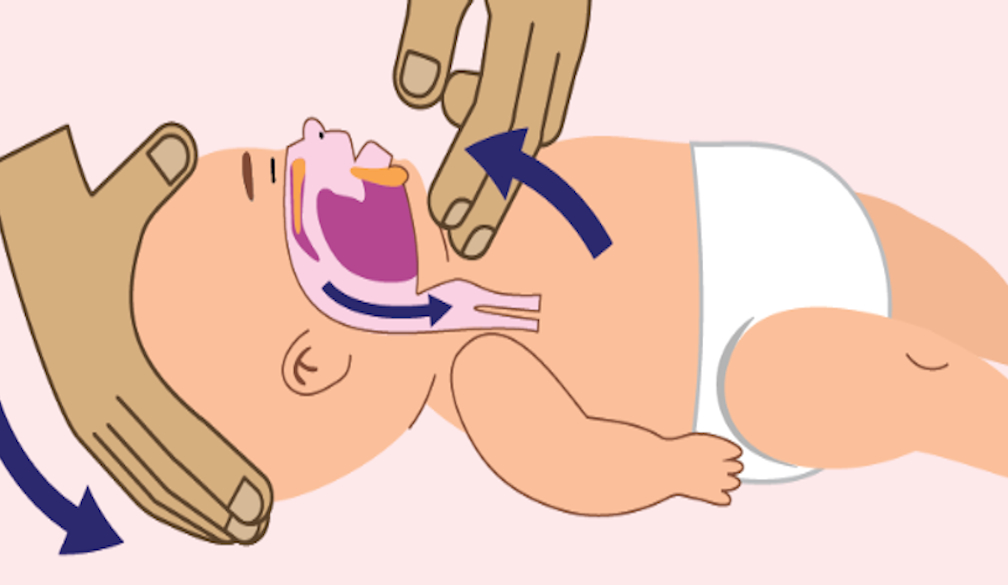

Step 5: Give Rescue Breaths

Seal Your Mouth Over the Baby’s Mouth and Nose: Take a breath and place your mouth over the baby’s mouth and nose, forming a tight seal.

Give Gentle Puffs: Puff gently for about 1 second, watching for the chest to rise. As soon as you see the chest rise, stop. Repeat for a second puff.

Remember: Infant and Baby lungs are much smaller and less developed than children and adult lungs, so only a small ‘puff’ of air is required. This will also avoid damaging the babies lungs.

Step 6: Perform Chest Compressions

Position Your Fingers: Place two fingers on the lower half of the baby’s sternum in the centre of the chest.

Press and Release: Press down the chest about one-third of it’s depth (approximately 4cm), then release the pressure allowing the chest to rise again. This counts as one compression.

Continue the Cycle: Perform 30 chest compressions followed by 2 rescue breaths. Continue this cycle at a rate of 100 to 120 compressions per minute.

Step 7: Continue Until Help Arrives

Continue performing CPR until one of the following occurs - The baby responds or resumes normal breathing. It becomes impossible to continue due to exhaustion. A healthcare professional takes over or directs you to stop. The situation becomes too dangerous to continue.

Conclusion:

Learning and understanding how to perform CPR on a baby is an invaluable skill that can make all the difference in a critical situation. Ensure you are prepared by taking a comprehensive baby first aid course. Being knowledgeable and confident in performing CPR can help save a baby's life when every second counts. Additionally, knowing baby first aid techniques can provide peace of mind to parents and caregivers, empowering them to act swiftly and effectively in emergencies. Remember, staying calm and following these steps methodically can significantly increase the chances of a positive outcome. By spreading awareness and educating others on the importance of baby first aid, we can create a safer environment for our little ones. Together, we can ensure that every parent and caregiver is equipped with the skills and confidence needed to protect and save the lives of infants in emergencies. The knowledge you gain from learning CPR and baby first aid is invaluable and can be the difference between life and death for a child. Never underestimate the power of being prepared.