OctaFX: Yen slides to a one-month low on BOJ liquidity injection

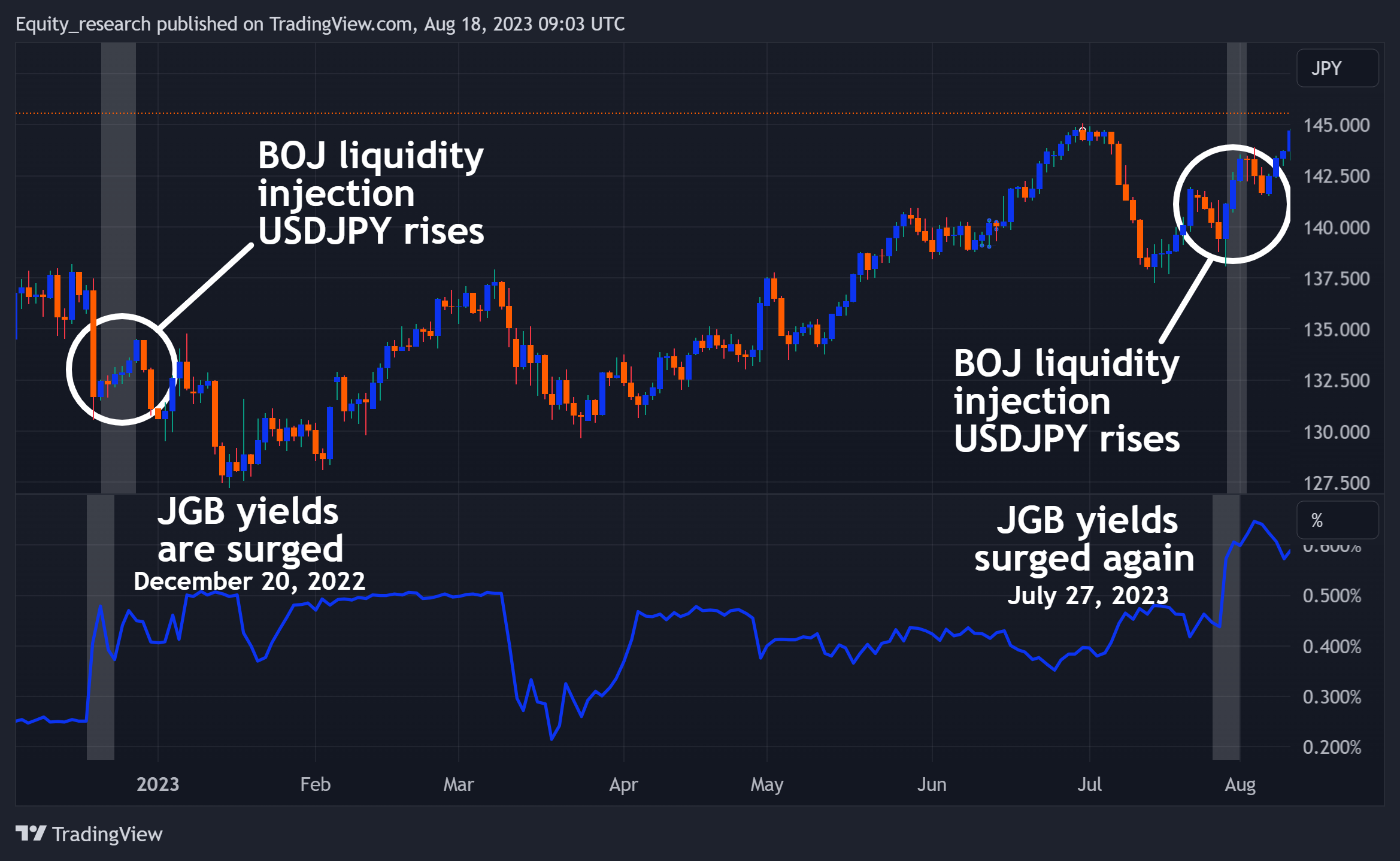

KUALA LUMPUR, MALAYSIA - Media OutReach - 22 August 2023 - The Japanese debt market has been under severe stress for the past year and a half. The reason is outside Japan: every time the Fed or ECB raises rates, Japanese government bond (JGB) yields are no longer attractive, and there is a massive sell-off on the interest rate differential between the yen, dollar, and euro. The process is followed by a rise in JGB yields and a sharp strengthening of the Japanese yen. To avoid collapse, the Japanese central bank starts buying bonds and flooding the economy with money—and the yen weakens again.

'The Bank of Japan is being forced to buy back its bonds: currently, over 50% of Japan's public debt is held by its central bank, a share that could rise to 60% by the end of 2023', said Kar Yong Ang, the OctaFX financial market analyst.

A striking example occurred on December 20, 2022, when the administration of the Bank of Japan decided to slightly relax the control of the yield curve, raising the allowed yield for 10-year bonds to 0.5%. By comparison, the rate on similar U.S. bonds is 3% higher. Almost instantly, investors began a rapid sell-off of Japanese bonds. Their real rate jumped to 0.47%, the highest since 2015, and the key indices of the national stock market collapsed by 3%. To keep the debt market from falling further, the Bank of Japan systematically bought government bonds for several days—yields stabilised, and the yen weakened.

Another case occurred on July 26, 2023, when the U.S. Federal Reserve raised rates by 25 basis points—and the yield on 10-year U.S. Treasuries rose to 4.2%. The next day, the 10-year JGB yield rose from 0.4% to 0.65%, and the Japanese yen experienced a one-step solid rise. It was too late to do anything on that day, but at the beginning of the next trading session on July 28, the Bank of Japan started buying the sagging bonds back and repeated this procedure on July 31. On the buying wave, USDJPY rose steadily for three trading days, eventually adding 6 yen and getting to 143.80.

'We saw the Bank of Japan increasing the amount of money to keep bonds from collapsing, which provided an opportunity to capitalise on the weakness of the Japanese yen for at least two trading sessions', said Kar Yong Ang, the OctaFX financial market analyst.

Meanwhile, the BOJ will continue to buy JGBs on an ad hoc basis every time risks increase in the U.S. In such a situation, investors should remember that after the yield gap between the U.S. and Japan becomes wide, the BOJ will most likely start buying government bonds, thus forcing USDJPY to rise on a predictable time horizon.

Hashtag: #OctaFX

The issuer is solely responsible for the content of this announcement.

About OctaFX

OctaFX is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services already utilised by clients from 180 countries with more than 42 million trading accounts. Free educational webinars, articles, and analytical tools they provide help clients reach their investment goals.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

OctaFX has also won more than 60 awards since its foundation, including the 'Best Online Broker Global 2022' award from World Business Outlook and the 'Best Global Broker Asia 2022' award from International Business Magazine.