CPA Australia: COVID-19 a double-edged sword for Taiwan’s small businesses

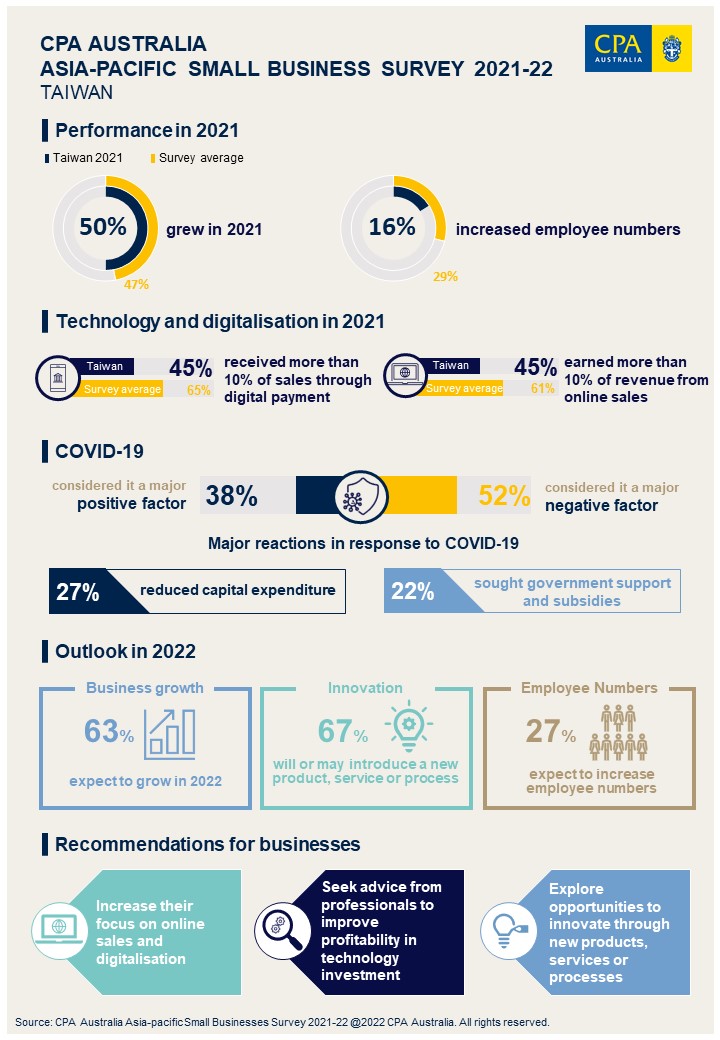

TAIPEI, TAIWAN - Media OutReach - 5 May 2022 - The pandemic has helped many Taiwanese small businesses unlock hidden growth opportunities, while wreaking havoc on others. Half of Taiwan's small businesses grew in 2021, while 63 per cent expect to expand this year.

Both results are the highest among the advanced economies included in a regional survey conducted by CPA Australia, one of the world's largest professional accounting bodies.

CPA Australia's annual "Asia-Pacific Small Business Survey" surveyed 4,252 small business owners or senior managers across 11 Asia-Pacific markets, including 310 from Taiwan. Conducted from November to December 2021, the survey was designed to understand local business conditions, challenges and confidence.

Mr Elic Lam FCPA (Aust.), Honorary Taiwan Adviser to CPA Australia, said, "COVID-19 is a double-edged sword for Taiwan. Fifty-two per cent of small businesses nominated COVID-19 as a major negative factor in 2021, up from 45 per cent in 2020. However, 38 per cent also said it was a major positive influence on their business. For the second consecutive year, COVID-19 was nominated as both the top positive and negative influence on local small businesses."

"This is not a coincidence. Taiwanese small businesses in export-oriented and technology sectors such as manufacturing, transportation and information technology continue to benefit from surging global demand," Lam explained.

"In addition, the rise of the Otaku ("stay‑at‑home") economy in Taiwan has boosted domestic demand for computer and internet-related devices, delivery services and gaming. Many small businesses have grasped these opportunities, even under strict social restrictions. However, tourism-related industries such as retail and hospitality registered relatively weaker performance due to a drop in local consumption and overseas travellers."

In response to COVID-19 last year, Taiwanese small businesses were most likely to reduce capital expenditure (27 per cent), followed by seeking government support and subsidies (22 per cent).

"The government's relief measures aided many small businesses to overcome major COVID-related challenges last year. However, with small businesses facing a new COVID-19 outbreak, increasing costs and the possible end of government support in June, they should be proactive in transforming their business model, especially increasing their focus on digitalisation."

Many Taiwanese small businesses improved their digital capabilities last year. Forty-five per cent reported more than 10 per cent of their sales were received through new digital payment technology in 2021, a record high for Taiwan. Another 45 per cent said that they earned more than 10 per cent of their revenue from online sales last year, also a record high for Taiwan. However, these figures were still well below the survey average of 65 per cent and 61 per cent, respectively.

"Stimulus voucher programs such as the '5000 Quintuple Stimulus Voucher Program' were successful initiatives that not only helped to stimulate the local economy but also accelerated the adoption of digital payments," Mr Lam explained. "The government may consider introducing similar stimulus measures to continue encouraging adoption of technology and to boost Taiwan's digital economy.

"Aside from digitalisation, the survey findings indicate that high-growth small businesses in the Asia-Pacific were more likely to focus on innovation. It's pleasing to see expectations to innovate in Taiwan this year rose to a record high of 67 per cent," Mr Lam said. "This is further evidence that COVID-19 has caused many businesses to look for hidden growth opportunities."

Based on the characteristics of high-growth small businesses from the survey, CPA Australia recommends that small businesses in Taiwan consider the following actions:

- increase their focus on online sales and digital transformation

- seek professional advice to improve the profitability of their technology investments

- explore opportunities to innovate through new products, services or processes

About CPA Australia

CPA Australia is one of the largest professional accounting bodies in the world, with more than 170,000 members in over 100 countries and regions, including more than 22,200 members in Greater China. Our core services include education, training, technical support and advocacy. CPA Australia provides thought leadership on local, national and international issues affecting the accounting profession and public interest. We engage with governments, regulators and industries to advocate policies that stimulate sustainable economic growth and have positive business and public outcomes. Find out more at cpaaustralia.com.au

#CPAAustralia

The issuer is solely responsible for the content of this announcement.