More mergers to come under scrutiny in another leg of Chalmers’ competition policy

- Written by Michelle Grattan, Professorial Fellow, University of Canberra

Treasurer Jim Chalmers has unveiled new rules governing company mergers that will bring more of them under scrutiny to ensure they don’t worsen competition.

Chalmers says the changes – to be formally announced on Wednesday in a speech released ahead of time – are the most substantial in nearly half a century.

A mandatory notification system will be brought in and the Australian Competition and Consumer Commission will be the single decision-maker on all mergers.

At the moment, notifications are voluntary, with the ACCC having the right to object after they have gone ahead.

Mergers above a yet-to-be-determined threshold and mergers which could significantly change market concentration will have to be notified and approved before going ahead.

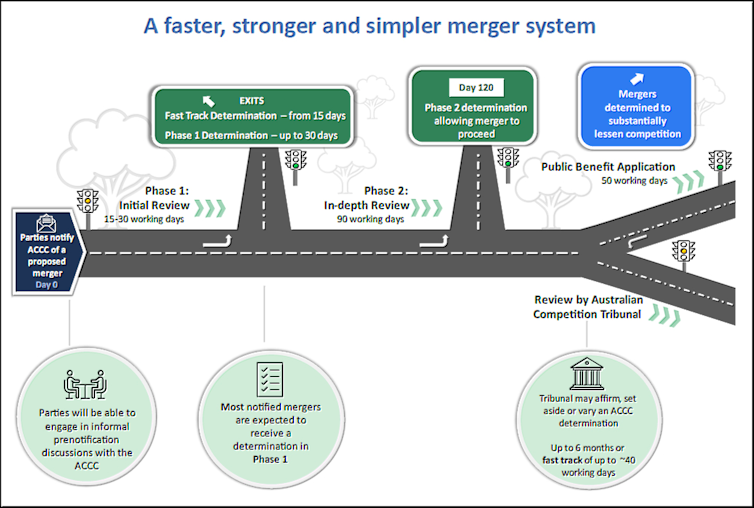

Under the new plan, which will apply from January 1 2026, mergers will be approved within 30 working days unless the ACCC raises concerns.

Firms will also have the option of “fast track” ruling within 15 working days.

Chalmers says the new system will be simpler, because there will be a single, streamlined path to approval, removing duplication and standardising notification requirements.

“It will be more targeted, because mergers that create, strengthen or entrench substantial market power will be identified and stopped while those consistent with our national economic interest will be fast tracked,” the Treasurer says.

For the first time, firms wanting to merge will be charged cost recovery fees, scaled to reflect the complexity and risk of the merger. The Treasury expects them to be in the range of $50,000 to $100,000, with additional fees for a review by the Competition Tribunal. The fees will not apply to small businesses.