Choosing the Wrong Agent Is the #1 Regret Among Aussie Property Sellers

- Written by The Times

Selling your home is often one of the largest financial transactions you’ll make, and for many Australians, it’s also one of the most emotional.

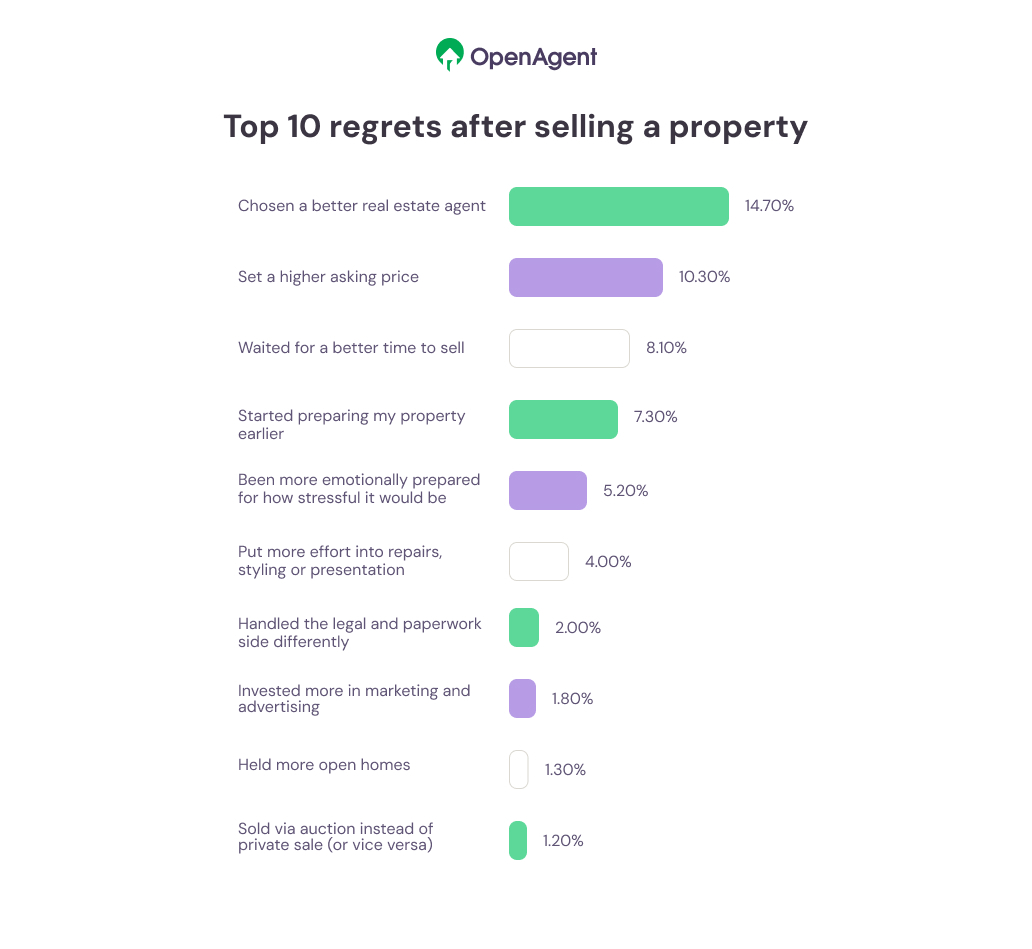

A new survey of Australian home sellers has revealed that their number one regret is having not selected a better real estate agent, a mistake made by 15% of respondents. And that figure only scratches the surface with how many sellers said they felt stressed, unsupported or out of their depth during the process.

The research is based on a nationwide survey commissioned by OpenAgent, a real estate marketplace which has helped nearly 400,000 Australians in comparing agents. The survey asked 344 Australians who sold a property within the last 24 months about the emotional cost of selling.

Selling is more stressful than you think

While buying a home or securing a loan often takes the spotlight in conversations around real estate stress, the survey results suggest that selling is just as intense, if not more so. More than 80% of respondents said selling was as stressful or more stressful than buying a home or getting a mortgage.

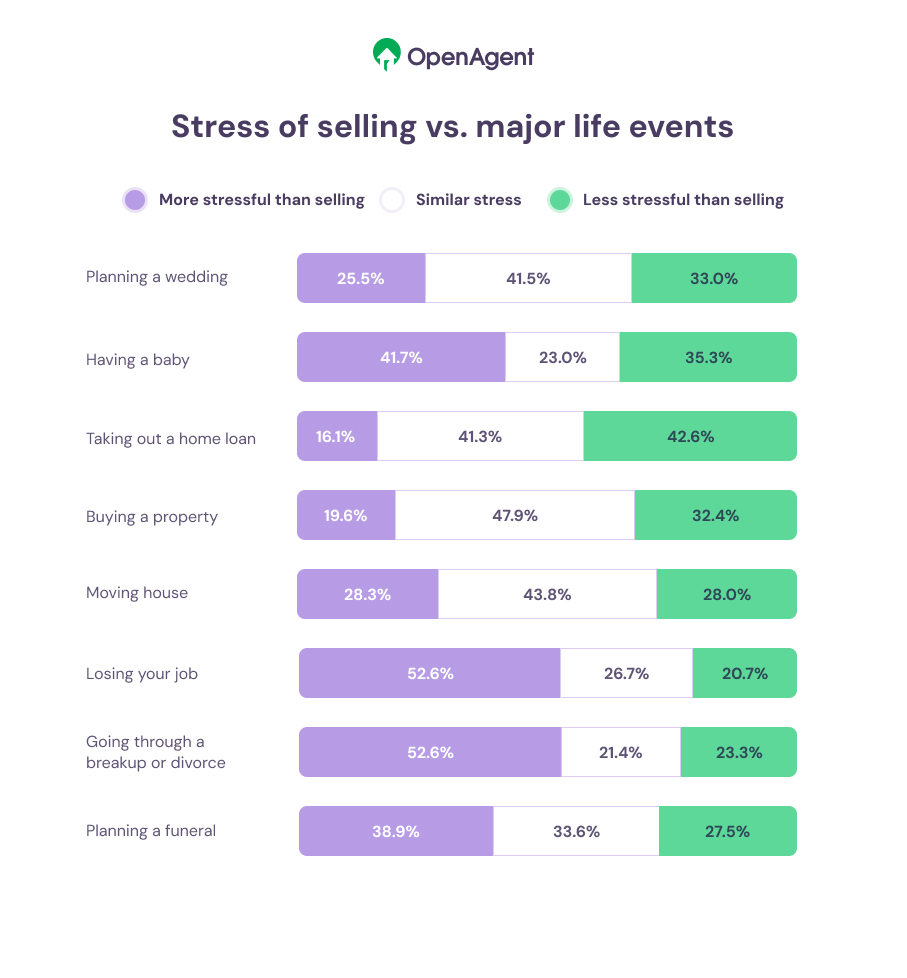

When compared to other major life events, the picture gets even more dramatic:

• Almost half compared it to the stress of a breakup or job loss

• Three in four said it was on par with the stress of planning a wedding

And in a finding that might surprise some people, one in three Australians admitted they cried during the process of selling their property, whether from pressure, exhaustion, or sheer relief.

Bridget Dijkmans-Hadley, a recent seller who used OpenAgent to compare agents, said the emotion hit her the moment the first offer came in.

“I burst out crying because this is our home our little ones have grown up in, but also so relieved that we'd had that help and that it was over,” she said.

What sellers regret most

While every selling journey is unique, the survey revealed common pain points. The biggest? Choosing the wrong agent.

Other frequently cited regrets included not setting a higher asking price and wishing they had waited for better market conditions. But it was agent choice that stood out as the most impactful. Many sellers felt that a different agent could have helped them navigate negotiations better, market more strategically, or avoid unnecessary delays.

OpenAgent Co-CEO Johanna Urrutia says it’s no surprise that agent selection comes up again and again.

“The top concerns we hear from sellers are around pricing the property correctly, making sure it’s presented well, and choosing the right agent,” she said.

“While choosing the right agent can alleviate stress throughout the process, selling a home can still come with a lot of ups and downs, especially for those who have an attachment to the home they're selling.”

Why the right agent makes a difference

An experienced agent can ease the stress of selling in multiple ways:

• They bring local market knowledge that can help with pricing and positioning• They handle tough negotiations and buyer communications

• They know how to present your home to maximise interest with everything from listing strategy to photography and open inspections

While some sellers are tempted to go it alone or choose an agent based solely on fees or a referral, the data suggests this may be a costly decision, emotionally and financially.

OpenAgent’s platform helps sellers compare agents based on criteria such as recent sales, suburb experience and historical track record. You can also check your property value with OpenEstimates and see the average agent commission in your suburb. This helps homeowners make more confident decisions at a time when uncertainty runs high.

Because while tears may be part of the process, the goal is to make sure they come from relief, not regret.

Methodology:

OpenAgent surveyed 344 Australians who sold a property in the past 24 months via a combination of online panel and email invitations during February–May 2025. Questions explored the stress, emotions and potential regrets involved in selling a home. The study was designed and analysed in‑house by OpenAgent.

About OpenAgent:

OpenAgent has been helping Australians buy, sell and own property since 2012. Best known for our agent comparison tools and property insights, the free resources on our website were used by over 2.1 million Australians in the past year.