Temu Named #1 iPhone App in Australia for 2024

- Written by The Times

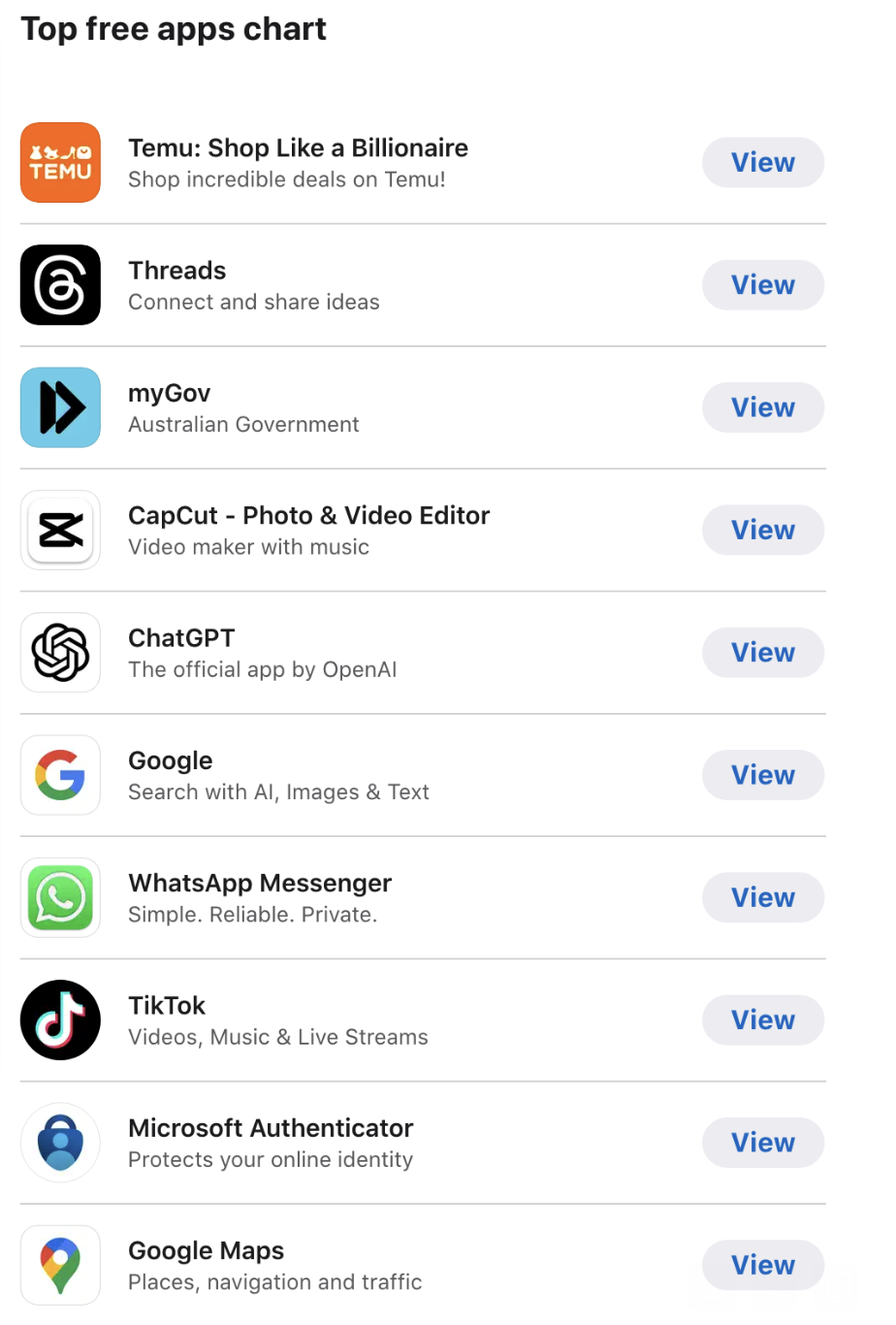

Apple’s newly released App Store data has revealed Temu is the #1 most downloaded iPhone app in Australia for 2024. Temu also is the only shopping app to make the top 10 free apps list in the Apple rankings.

Since launching in Australia in March 2023, Temu has quickly become a go-to platform for shoppers looking for unbeatable prices and a vast product range. Earlier this year, Temu empowered qualified sellers to manage logistics and ship products directly from local warehouses in Australia —a move that has significantly expanded product offerings and reduced delivery times for local customers.

Globally, Temu continues to dominate app charts. It was ranked #1 in 24 markets out of 30+ countries and regions with official Apple rankings, including the U.S., UK, Canada, Germany, and South Korea.

Temu also is available in more than 80 markets worldwide across the Americas, Europe, the Middle East, Africa, Asia, and Oceania.

Temu’s success is powered by its direct-from-factory model, connecting consumers directly with manufacturers to eliminate middlemen and associated costs. These savings are passed directly to customers through competitive pricing.