Global Trading Platform Moomoo CA Rings the Opening Bell at Toronto Stock Exchange

TORONTO, CANADA - Media OutReach Newswire - 26 March 2024 - Moomoo Financial Canada Inc. (Moomoo CA), a leading next generation stock trading platform, rings the opening bell at the Toronto Stock Exchange to celebrate its approval as a TSX and TSXV non-trading member on March 26, 2024.

This occasion symbolizes moomoo's commitment to expanding its world class products and services in the Canadian market, empowering Canadians to be confident in themselves to invest and grow.

Justin Zacks, Vice President of Strategy at Moomoo said, "Having the privilege of ringing the opening bell at TSX with my fellow moomoo colleagues, friends and allies was truly an exciting moment. Moomoo CA is honored to be approved by TMX effective March 29th as a non-trading member of the TSX/TSXV. We look forward to incorporating this development into our business in the future. It's a new milestone for moomoo as we continue to expand our services and offerings in the Canadian market."

In September 2023, moomoo officially launched in Canada with the mission to empower Canadians to be confident in themselves to invest and grow, by providing them with advanced tools and comprehensive data essentials at low cost to trade. The moomoo app has rapidly gained popularity among Canadian users. Based on the data.ai's comparison in March 2024, moomoo is the #1 of Android finance app downloads ranking in Canada.

Unique Features and Tools that Empower Canadian Investors

To support Canadians taking control of their financial future with confidence, the moomoo app provides them with access to a wealth of features, including free access to Level 2 data for US stocks and Level 1 data for Canadian stocks, free 24/7 financial news from over 150 major financial publications, including Bloomberg & Dow Jones, and free detailed analyst ratings from over 4,000 Wall Street analysts.

Moomoo's vibrant community has over 21 million global investors sharing their experiences and stories and its Moo Learn feature has over 600 tailormade financial education courses make it a leading social-oriented investing platform that encourages self-learning in Canada.

Moomoo's user-friendly paper trading feature allows investors to begin their trading journey with a virtual portfolio worth $1,000,000, allowing them to practice and experiment without risking real money. Moomoo's paper trading feature gives investors the access of real-time market data to simulate trading conditions accurately and make informed investment decisions.

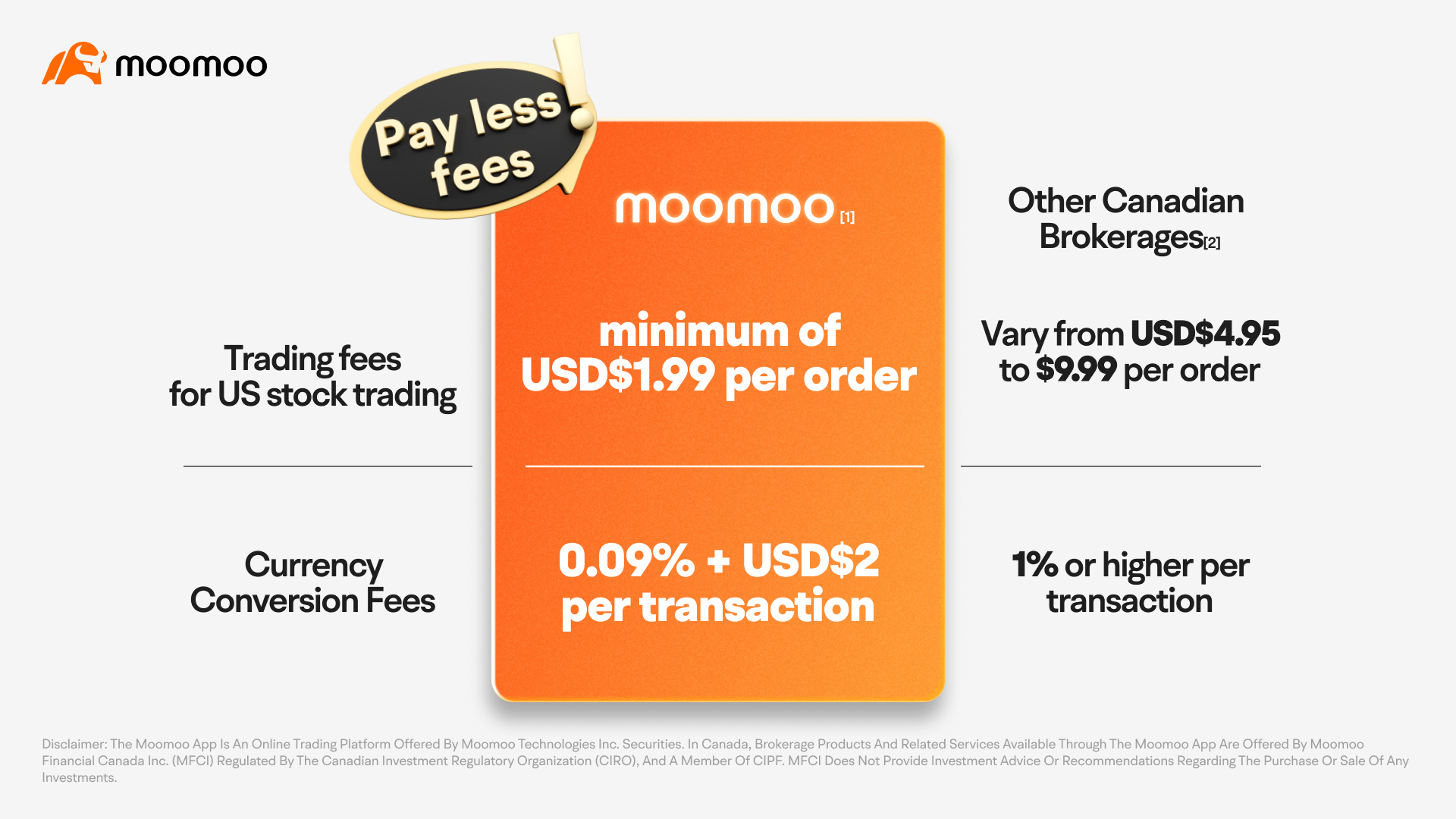

With a self-directed moomoo account, Canadian investors can invest in global markets with ease by trading in the U.S. and Canadian markets through one single moomoo account, with lower fees up to 92% cheaper than competitors. Opening an account on moomoo requires $0 capital threshold and $0 account management fees. Additionally, moomoo offers a competitive and transparent fee structure. The following table shows how moomoo's trading fees and currency conversion fees compare with other Canadian brokerages.

Built for the Canadian Investors

Moomoo brought its world-class trading platform to Canadian investors, offering a variety of account types to Canadian investors, including cash, margin, RRSP (Registered Retirement Savings Plan), and TFSA (Tax-Free Savings Account) accounts, all without any account management fees.

From March to April 2024, moomoo is running amazing promotions that eligible users can earn up to $2,400 in cash coupons. For more information regarding the promotional offer, please visit here.

[1] The rates provided are for informational purposes only and may not represent the complete range of available rates. It is possible that you may discover rates that are more favorable than those presented in this comparison. (For information on moomoo CA's Rates and Pricing, please visit: https://www.moomoo.com/ca/pricing)

[2] Other Brokerages include only certain brokerages that we compared and our data source is based on published fee schedules on their official websites. Official website of brokerages as of 8/26/2023. The brokers we refer to may have different rates for different tiers. Please visit their official websites to see details.

Click HERE to download high-resolution event photos.

Click HERE to view the bell ringing video.

Hashtag: #MoomooFinance

The issuer is solely responsible for the content of this announcement.

About moomoo

Moomoo is an investment and trading platform that empowers global investors with pro-grade, easy-to-use tools, data, and insights.

It provides users with the necessary information and technology to make more informed investment decisions. Investors have access to advanced charting tools, technical analytics, and Level 2 data. Moomoo grows with its users, cultivating a community where investors share, learn, and grow together in one place. Moomoo provides free access to investment courses, educational materials, and interactive events that any investor, at any level, can gain from. Users can join forum discussions, trading topics, and seminars to better their investment knowledge and insights.

Founded in the United States in 2018, moomoo has rapidly expanded globally, serving investors in countries such as the US, Australia, Japan, Singapore, Malaysia, and Canada. Globally, moomoo and its affiliates are trusted by over 21 million users. Moomoo takes pride in its role as a global strategic collaborator of the New York Stock Exchange (NYSE) and global collaborator of CBOE Global Markets, earning numerous international accolades from renowned industry leaders such as Best Day Trading Software 2023 awards from Benzinga, Best of the Best 2024 - Online Broker Rising Star from Money Australia and Best Retail Broker 2023 Award from the Securities Investors Association (Singapore).

About Moomoo Financial Canada Inc

In Canada, brokerage products and related services available through the moomoo app are offered by Moomoo Financial Canada Inc (MFCI). MFCI is a Canadian securities broker specializing in Order Execution Only (OEO) services and is registered with CIRO and a member of CIPF. MFCI does not provide investment advice or recommendations regarding the purchase or sale of any investments. Investors are responsible for their own investment decisions.