Interest rates are expected to drop but trying to out-think the market won’t guarantee getting a good deal

- Written by John Hawkins, Senior Lecturer, Canberra School of Politics, Economics and Society, University of Canberra

This article is part of The Conversation’s series examining the housing crisis. Read the other articles in the series here[1].

With most economists expecting interest rates to start falling later this year, prospective home buyers might be weighing up whether to buy now for fear of strong competition for stock, or waiting until repayments are lower.

The financial markets and private sector economists expect the Reserve Bank to start cutting interest rates later this year. But the average forecaster is expecting just one cut in the next 12 months, of 0.25%.

While rates have risen 13 times since May 2022, the drop won’t be so far nor so fast.

Even by the end of 2026 rates will probably only be around 1% lower than now.

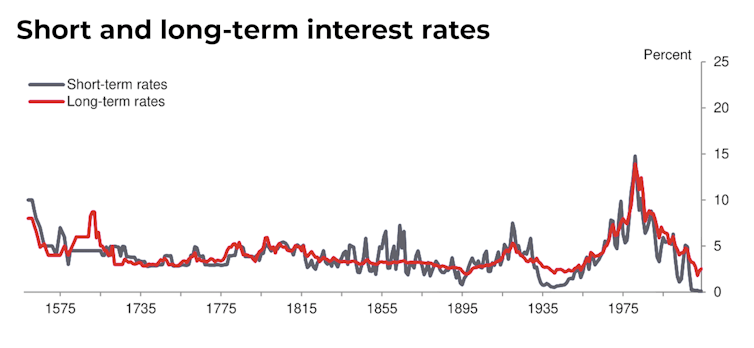

And this may be as low as interest rates go. The interest rates we saw during the COVID recession were arguably the lowest in human history[2].

We are highly unlikely to return to these lows.

This is also around the average value estimated in comparable countries[8]. In these days of global financial markets, it could be expected that there would be similar trends across countries. The decline in the global neutral real rate may be due to a reduction in the global economic growth rate associated with population ageing and higher global savings[9].

The Reserve Bank aims for inflation to average around the midpoint of its 2-3% target range[10]. So if the neutral real rate is around 1%, this would imply that the Reserve’s cash rate[11] (at which banks lend to each other overnight) would be around 3.5%.

This is about what the forecasters are expecting by the end of 2026.

Commercial banks set the interest rates[12] they charge on their loans by adding a margin to the Reserve Bank’s cash rate.

Read more: The government's Help to Buy scheme will help but it won't solve the housing crisis[13]

They set the interest they pay on deposits by subtracting a margin from the cash rate. The difference between the two (and any fee income) meets the costs of running the bank such as wages and premises, allows for some loans not being repaid and provides some profits. The margins will be smaller if the banking market is very competitive.

Banks generally move their mortgage interest rates in line with the cash rate. If by the end of 2026 the cash rate is 1% lower, it is likely home loan interest rates will also be around 1% lower. This would reduce the monthly repayment on a 30-year loan for $1 million by $700.

The impact of (somewhat) lower interest rates on house prices

If the housing market is reasonably efficient, these broadly expected decreases in interest rates should largely be already “priced in” by investors. This would suggest relatively little impact as the expected cuts materialise.

But some potential homebuyers will be able to borrow more once interest rates drop. And many of them will choose to do so. They may then bid house prices up.

This is why most economists are forecasting house prices to rise further[14] during 2024. The average expected increase is 5% in Sydney and 3% in Melbourne.

The increases are comparable to the expected rises in incomes so affordability will not significantly worsen. But buying a home will not be getting any easier.

A similar pattern of expected easing interest rates leading to higher house prices is being observed around the world[15].

Renters may be hoping landlords will pass on interest rate decreases to them. But they are likely to be disappointed. Rents have risen not due to interest rate rises but because the vacancy rate is low. With strong population growth, this is unlikely to change soon.

Read more: Urbanisation and tax have driven the housing crisis. It's hard to see a way back but COVID provides an important lesson[16]

What to do?

Trying to out-think the market is unlikely to work.

Not buying your dream home and instead waiting for a drop in interest rates may be a mistake. But so might panic-buying something that’s not what you want out of fear of further rises in house prices.

References

- ^ here (theconversation.com)

- ^ lowest in human history (www.bankofengland.co.uk)

- ^ Bank of England (www.bankofengland.co.uk)

- ^ CC BY-SA (creativecommons.org)

- ^ neutral real rate of interest (www.rba.gov.au)

- ^ nine different approaches (www.rba.gov.au)

- ^ RBA (www.rba.gov.au)

- ^ average value estimated in comparable countries (www.bis.org)

- ^ reduction in the global economic growth rate associated with population ageing and higher global savings (www.brookings.edu)

- ^ 2-3% target range (www.rba.gov.au)

- ^ cash rate (www.rba.gov.au)

- ^ set the interest rates (www.rba.gov.au)

- ^ The government's Help to Buy scheme will help but it won't solve the housing crisis (theconversation.com)

- ^ most economists are forecasting house prices to rise further (theconversation.com)

- ^ around the world (www.ft.com)

- ^ Urbanisation and tax have driven the housing crisis. It's hard to see a way back but COVID provides an important lesson (theconversation.com)

Authors: John Hawkins, Senior Lecturer, Canberra School of Politics, Economics and Society, University of Canberra