Wednesday's GDP numbers are impressive, but they are for the December quarter, when we were bouncing back from Delta

- Written by John Hawkins, Senior Lecturer, Canberra School of Politics, Economics and Society and NATSEM, University of Canberra

Australia’s economy bounced back a welcome 3.4% in the December quarter of 2021, more than reversing the 1.9% lockdown-related decline in the September quarter. It was the sixth-biggest increase in the 60 years the figures have been compiled.

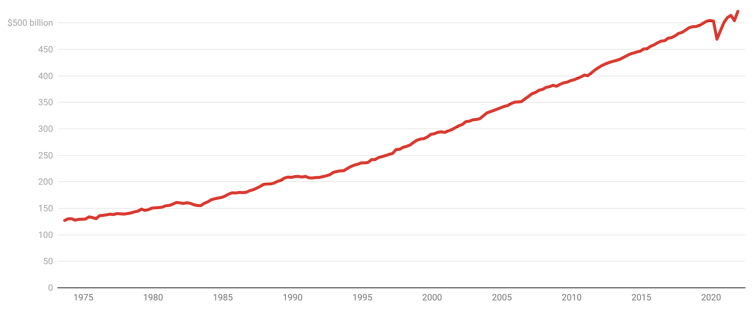

Australian quarterly gross domestic product

The economy grew by 4.2% over the year to December, making it 3.4% bigger than it was two years earlier, before COVID.

This is similar[2] to what happened in the United States, but better than what happened in the European Union and South Korea. The economies of the UK and Japan are still smaller than they were before COVID.

While it is impressive in the circumstances, had there been no pandemic, real GDP was set to climb 6% rather than 3.4% over those years. That’s what the Reserve Bank[3] had been forecasting.

The South East versus the rest

It depended very much on where you lived. NSW, Victoria and the ACT were constrained by lockdowns in the September quarter.

Those states bounced back most strongly in the December quarter.

It is notable, and concerning, that in the other states, the best measure of total spending, state final demand, barely grew at all or went backwards.

State final demand, December quarter

Household spending was the main driver of the stronger GDP.

It bounced back in the December quarter as unemployment fell, vaccination rates rose and consumer confidence climbed ahead of Omicron in the belief COVID was coming under control.

Household final consumption expenditure

Spending on services surged. Personal and other services, the category that includes hairdressing, climbed by a record 15%.

There were also some big increases in spending on non-essential goods. Purchases of clothing and footwear jumped by more than 40%.

Components of household final consumption expenditure

Households have been saving an unusually high proportion of their income during the pandemic.

The saving ratio soared to a record high early in the pandemic, fell during the 2020 recovery, soared again during the 2021 lockdowns, and fell in the December quarter.

But it remains, as the Treasurer said in his press conference, around three times what it would have otherwise been without the pandemic.

Household saving ratio

Much of the saving is the result of caution, but much also reflects government support programs that maintained incomes at times when people were limited in their ability to spend on travel, restaurants, cinemas, gyms and other services.

Some of the frustrated services spending was diverted to goods, exacerbating supply bottlenecks and contributing to inflation.

Inventories climbed $1.5 billion after a fall of $2.9 billion in the September quarter as wholesalers restocked, also contributing to GDP growth.

Read more: Australia cut unemployment faster than predicted – why stop now?[8]

Export volumes fell as the reduction in coal exports (reflecting heavy rain and labour constraints) outweighed the increase in agricultural exports (reflecting a record grain harvest).

Housing construction also detracted from growth as shortages of workers and materials caused delays in building.

Sharing the cake

How were the proceeds of this higher GDP shared among Australians?

Treasurer Josh Frydenberg was keen to point out the wages bill climbed by more than 5% through the year as more workers found jobs, higher bonuses were paid and workers switched to better jobs and got promotions, a form of wage growth not captured in the official wage price index[9].

The wages share of national income remained near an all-time low. Wage growth is lagging price growth, meaning workers are getting a smaller share of the pie than they have been used to.

Wages share of total factor income

Looking forward

The December quarter was between the bulk of Delta and the bulk of Omicron.

After the outbreak of Omicron in late December, hours worked slid 9%[11] in January as workers became sick, isolated and caring for friends and family who were sick.

Consumer sentiment[12] deteriorated in both January and February as petrol prices rose and attention turned to interest rate rises.

Russia’s invasion of Ukraine, and the subsequent further surge in petrol prices, is likely to depress sentiment further.

Read more: Inflation hits 3.5%, but it won't budge the Reserve Bank on interest rates[13]

This means the next GDP release, covering the March quarter, will quite likely go backwards, taking GDP growth down with it.

Fortunately for the government, it isn’t due for release until Wednesday June 1[14], safely after the election which must be held by Saturday May 21[15] to avoid a separate half-Senate election.

References

- ^ ABS National Accounts (www.abs.gov.au)

- ^ similar (www.abs.gov.au)

- ^ Reserve Bank (www.rba.gov.au)

- ^ ABS National Accounts (www.abs.gov.au)

- ^ ABS National Accounts (www.abs.gov.au)

- ^ ABS National Accounts (www.abs.gov.au)

- ^ ABS National Accounts (www.abs.gov.au)

- ^ Australia cut unemployment faster than predicted – why stop now? (theconversation.com)

- ^ wage price index (www.abs.gov.au)

- ^ ABS National Accounts (www.abs.gov.au)

- ^ 9% (www.abs.gov.au)

- ^ Consumer sentiment (www.westpac.com.au)

- ^ Inflation hits 3.5%, but it won't budge the Reserve Bank on interest rates (theconversation.com)

- ^ June 1 (www.abs.gov.au)

- ^ May 21 (antonygreen.com.au)