Zagga partners with Jamie Durie for Avalon Beach home

- Written by The Times

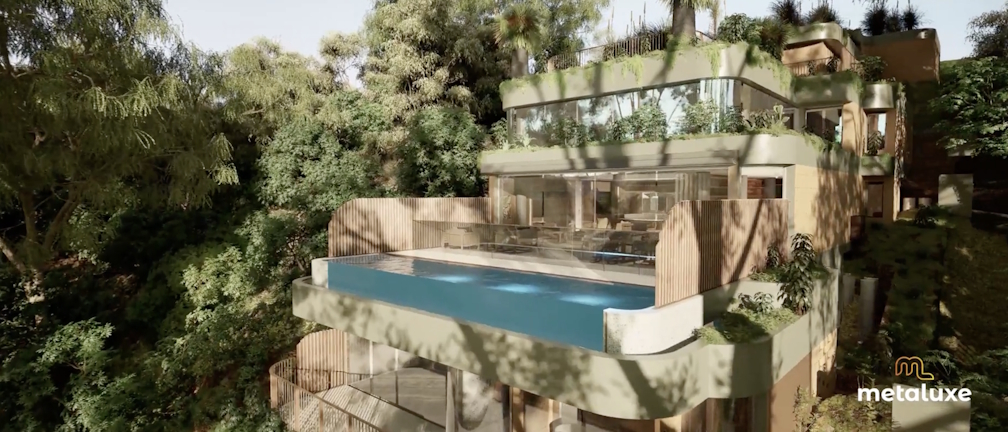

Leading boutique private credit investment manager, Zagga, has partnered with award-winning, celebrity landscape designer, Jamie Durie, on his latest project, a luxury home set to be one of Australia’s most sustainable builds.

The waterfront home is located in Sydney’s highly sought after Avalon Beach and is the feature of Channel 7’s new series, Growing Home with Jamie Durie. Based on comparable sales in the area, local experts estimate an on-completion value in excess of $40 million. The project is due to be completed by end of month.

Zagga is the senior lender on the project and expects to deliver investors returns comparable to its other investments, which average 9.80% per annum as at end October.

Commenting on the construction financing, Tom Cranfield, Director, Investment & Risk, at Zagga said the project reinforces the growing importance of private credit to deliver agility, commerciality, and flexibility in funding Australia’s future homes.

“This project is unlike any other in the market. We are thrilled to work with Jamie Durie, who is internationally renowned for his design acumen, to bring this sustainable-first design concept to life,” Mr Cranfield said.

“Jamie has designed the property as his dream home. It oYers ultra-luxury comforts, ample green space, and state-of-the-art sustainability features, which highlight the possibilities of sustainable design in everyday living.

“As a non-bank-lender, we could deliver agility and flexibility in funding and consider risks and returns based on the build’s unique attributes and characteristics. Working hand-in-glove with Jamie’s team ensured the best outcome for Jamie, as our borrower, alongside market-leading returns for our investors,” Mr Cranfield said.

The trophy-home comprises of five bedrooms, five bathrooms, multiple living rooms, a butler’s pantry, a full floor gym and wellness room with a sauna and steam room, infinity pool, a self contained nanny’s quarters with its own external access, and a self-contained boat shed. The property also benefits from its own deep-water birth, as well as a pontoon and private beach.

Commenting on working with Zagga to bring his dream home to life, Jamie Durie said Zagga’s specialist capabilities and dedicated team gave him the confidence to pursue his aspirations of building a healthier home for his family and the environment.

“I have a young family, and it was incredibly important to me to build a house without

compromise,” Mr Durie said. “This means a responsible, ethical build with best-in-class sustainability features that not only give my family the healthiest lifestyle, but also protect and preserve Australia’s spectacular natural environment.

“Working with Zagga has accelerated the project. It’s a mammoth build, going from an asbestos shack to a state-of-the-art, sustainable home, but the team has been with me for every step of

the journey, ensuring we get the best outcomes for all parties – on time and on budget.

“I met with at least nine traditional banks and non-bank lenders on this project and Zagga stood out because of its specialist capabilities and bespoke structuring of terms. For me, it has highlighted the importance of partnering with specialists who can really judge the project based on its individual merits rather than having to tick the boxes,”Mr Durie said.

Planting the seeds for a greener future

The Avalon Beach home is one of Australia’s first residential dwellings certified by independent sustainability ratings agency, Green Building Council of Australia.

The sustainable build saved 178 tonnes of CO2, which is the equivalent of taking 39 cars oY the road or planting 7000 trees.

A first-of-its-kind feature in Australia is the home’s geothermal heating and cooling system, which means the home is self-sustainable and can be run entirely oY grid without fossil-fuel energy. It also incorporates solar panels, rainwater tanks, and reduced carbon-concrete.

Sustainability has been central to every design element, with interior features including

carpeting made from recycled ocean plastics, VOC-free paint that can absorb carbon, and an 80 percent recycled kitchen with zero formaldehyde and carbon-free benchtops.

“Private and non-bank-lenders will play a crucial role in bringing more sustainable builds to the market,” Mr Cranfield said. “Strict lending criteria and increasing regulation mean traditional lenders, like banks, are finding it increasingly challenging to invest in unique, innovative projects like this one. This is providing private, nonbank lenders, like Zagga, access to A-grade

opportunities, which historically have been the domain of the Big 4.

“We expect this trend to continue as demand for sustainable living increases and the nation’s housing shortage puts more pressure on developers and the construction pipeline.

Commerciality, flexibility, and the ability to work closely with borrowers will be our point-of diYerence and competitive advantage,” Mr Cranfield said.

Greenspace was an important element to the build. This included Jamie’s unique design vision of a “growing home”. This includes an 85-tonne rooftop garden, extensive vertical gardens, and over 3000 native plant species. Jamie has also brought the outdoors in with more than 180 indoor plants.

“This home is the embodiment of years of research,” Mr Durie said. “It has allowed me to showcase my creativity and passion for landscape design, while also working with global leaders in sustainability and green technology to bring next-generation, sustainable living to Australia’s shores. I am humbled to be showing others what’s possible in sustainable residential design, while knowing I am building a brighter, healthier future for my family.”

You can see the home come to life on Channel 7’s Growing Home with Jamie Durie.