Suburb compromise could be key to home ownership for many Australians in the current market

Leading mortgage broker Aussie has today revealed the top suburbs across Australia, where it’s possible to purchase a house or unit with a median deposit of $100,000 or less – helping to put home ownership within reach for more Australians.

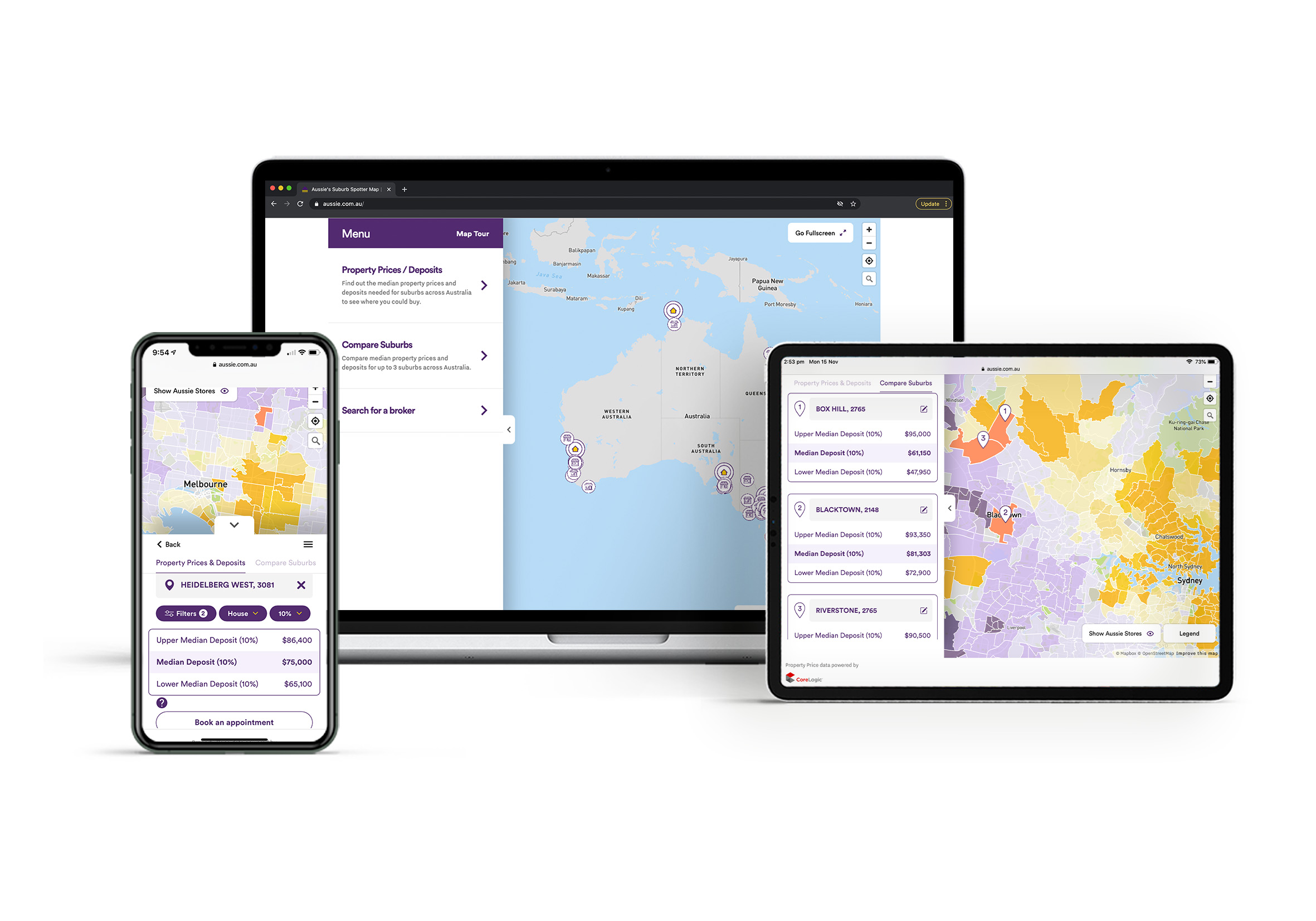

Over 3,960 suburbs across Australia where homebuyers could potentially purchase a house with a 10 or 20 per cent deposit of $100,000 or less were identified through Aussie’s Suburb Spotter Map, which is powered by CoreLogic Property Price data[1], while for units under $100,000 deposit, over 1,900 suburbs were identified.

Brad Cramb, CEO of Distribution at Aussie, said, “With rising property prices and recent changes to lending criteria from APRA creating some concerns around housing affordability, we wanted to show homebuyers that there are still opportunities to get into the property market if you expand your suburb search and adapt your thinking around how you might structure your home loan.”

“You don’t always need to have a 20 per cent deposit to buy a home. There are 5 per cent and 10 per cent home loan options where you can have a guarantor, access government support such as the First Home Loan Deposit Scheme, or pay Lenders’ Mortgage Insurance (LMI), which could form part of your home loan option.”

“According to our Aussie data, close to 1 in 5 (19%) borrowers have secured a home loan with LMI in the past 12 months[2], helping them get their foot on the property ladder sooner. Some banks and lenders even offer LMI discounts or special offers, and for some professions they can also waive LMI, so it’s worth speaking to a mortgage broker to see if this could be an option for you.”

On Aussie’s Suburb Spotter map the top three viewed suburbs for a median house deposit under $100,000 are the outer Melbourne suburb of Heidelberg West (10%: $75,000), followed by Box Hill (10%: $61,150) in Sydney’s west, and Footscray (10%: $94,075) in Melbourne’s inner west.

The top three viewed suburbs for units with a median deposit of under $100,000 are Melbourne (20%: $85,350) and Hawthorn (10%: $60,749.95) in Victoria, and Lakemba (20%: $76,500), south-west of Sydney.

“In a competitive market it’s important to do your homework, including considering where you might be willing to make compromises, researching suburbs where you could afford to buy a home in, and organising pre-approval,” added Cramb.

“If you need a guide to understand where property opportunities may be, Aussie’s Suburb Spotter Map allows you to easily spot suburbs across Australia that you could buy in based on median property prices or deposit amount. We have also launched a new comparison feature that allows you to compare up to three suburbs and then email the results to yourself to help you with your home hunt.”

“Having pre-approval is also important, so when the right property comes up on the market, you can make an offer with confidence. If you are not sure about the pre-approval process or don’t have time, that’s where a broker can help, and now you can also easily find brokers and book an appointment with them through the Aussie Suburb Spotter Map.”

The most viewed suburbs[3] for a house requiring $100,000 or less for a 10 per cent or 20 per cent deposit in each Australian state and territory are:

- New South Wales - Box Hill (10%: $61,150), and Wyee (20%: $83,000)

- Victoria - Heidelberg West (10%: $75,000) and Dallas (20%: $100,000)

- Queensland - Carina (10%: $75,050) and Acacia Ridge (20%: $90,500)

- South Australia - Adelaide (10%: $70,525) and Ascot Park (20%: $96,200)

- Western Australia - Scarborough (10%: $78,200) and Nollamara (20%: $79,000)

- Tasmania – Kingston (10%: $63,050) and Glenorchy (20%: $96,000)

- Northern Territory – Ludmilla (10%: $56,200) and Bakewell (20%: $93,200)

- Australian Capital Territory – Phillip (10%: $56,650)

Check out Aussie’s Suburb Spotter Map at Aussie.com.au/SuburbSpotter.