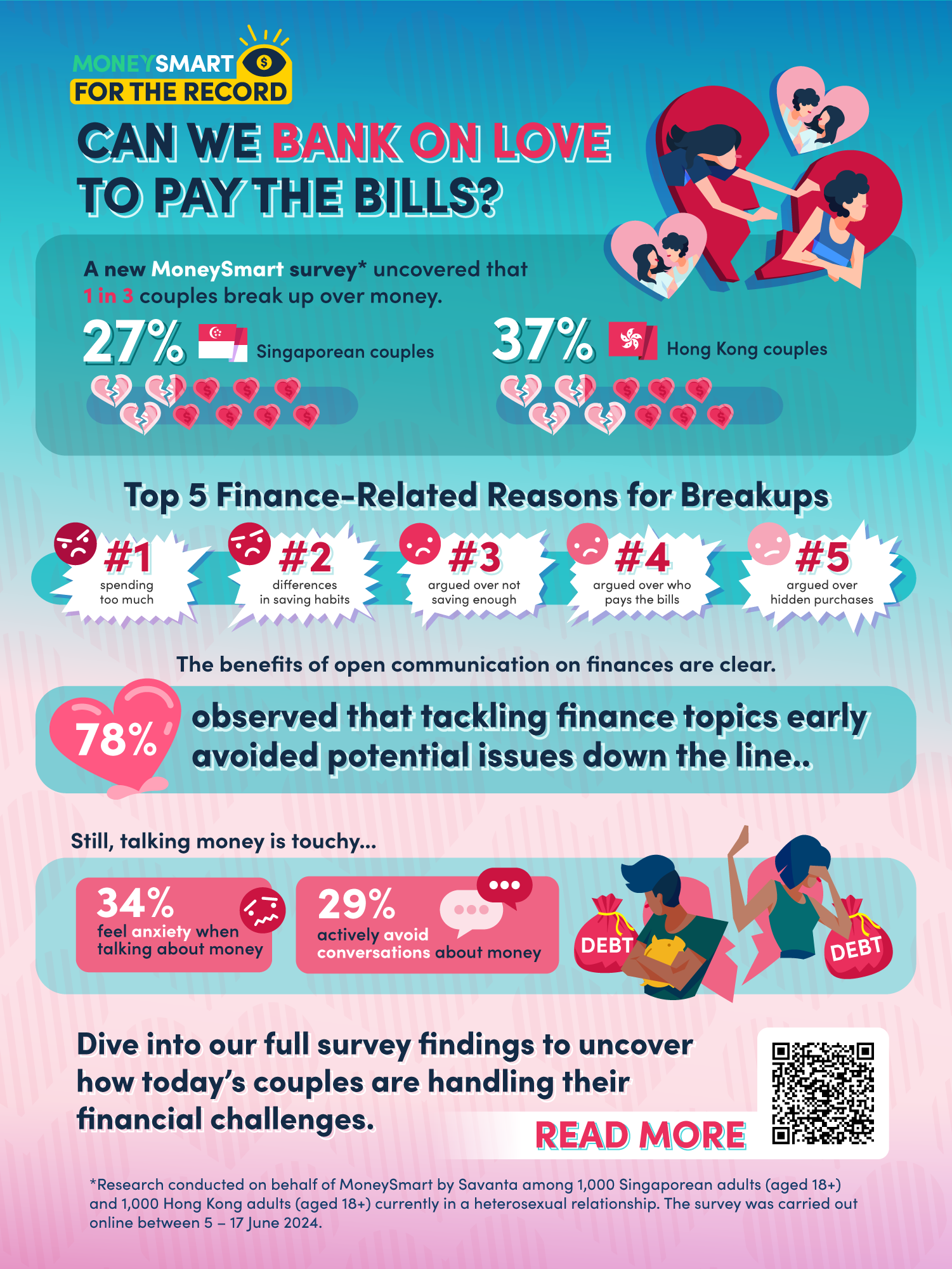

New MoneySmart Study Finds 1 in 3 Adults Experience Relationship Breakdowns Due to Money Disagreements

The study, which interviewed 2,000 adults in Hong Kong and Singapore who are currently in a heterosexual relationship, found that almost a third (32%) have had a relationship break down due to disagreements about money.

The most common causes of disagreements were found to be someone in the couple spending too much (43%), differences in saving habits (37%), and not saving enough (32%). Almost one in five (18%) said that they and their partner argue more about money than anything else.

The study also found that many couples are not fully transparent about their finances. While 29% admitted to holding savings accounts that their partner was unaware of, 23% admitted to having debt their partner didn't know about. This is despite nearly half (49%) saying that they would consider their partner dishonest if they lied about their finances, income or debts, and 35% going as far as to say that they would never forgive their partner for doing so.

Many couples find talking about money challenging

For many couples in Hong Kong and Singapore, being able to talk about money openly was found to be challenging. A third (33%) stated that they find it difficult to discuss finances with their partner, while over a quarter (29%) actively avoided such conversations. Additionally, 34% experience anxiety when discussing money with their partner, highlighting that financial discussions can be a significant source of stress for many couples.

Despite these challenges, the importance of being able to discuss finances freely as a couple is clear. 78% believe that open discussions about money strengthen their relationship, and 56% found that frequent money talks improved their relationship quality.

How to talk about money with your partner

Opening up conversations around money can be challenging. But it is something that can be worked on, according to relationship coach, Iwa Hensarling:

"Although sometimes tricky, improving communication around finances is entirely possible. By addressing money matters proactively and collaboratively, couples can strengthen their partnership, minimise stress, and build a more transparent and supportive financial relationship."

Five tips for talking about money as a couple, from Iwa Hensarling:

1. Start early: Begin discussions about finances early in the relationship, ideally before making any significant commitments or financial decisions together.

2. Create a safe space: Ensure that conversations about money are held in a non-judgmental, open, and honest environment. Acknowledge that it can be a sensitive topic and approach it with care and understanding.

3. Be transparent: Share your financial situation transparently, including incomes, debts, savings, financial obligations, and credit scores. This honesty will help both partners understand the complete financial picture and plan accordingly.

4. Set mutual goals: Discuss and align on your short-term and long-term financial goals. Whether it's saving for a vacation, buying a home, or planning for retirement, having shared goals can motivate you and strengthen your bond.

5. Plan regular check-ins: Money management should be an ongoing discussion. Set regular check-ins to review your financial status, update your goals, and adjust your plans as necessary.

For more advice on how to manage and talk about money as a couple, information on savings accounts, credit cards, and loans for couples, or to view the full findings of the research, please see below:

Hong Kong (EN): https://www.moneysmart.hk/en/credit-cards/the-cost-of-money-disputes-on-relationships-ms

Hong Kong (ZH): https://www.moneysmart.hk/zh-hk/credit-cards/the-cost-of-money-disputes-on-relationships-ms

Singapore: https://www.moneysmart.sg/credit-cards/the-cost-of-money-disputes-on-relationships-ms

Survey Methodology

Research conducted on behalf of MoneySmart by Savanta among 2,000 Hong Kong and Singaporean adults (aged 18+) currently in a heterosexual relationship. The survey was carried out online between 5 – 17 June 2024. Please see a breakdown of the marital status of participants below:

Marital Status:

● Married: 90.9%

● Dating: 4.3%

● Cohabiting: 4.8%

Hashtag: #MoneySmart

The issuer is solely responsible for the content of this announcement.

About MoneySmart Group

MoneySmart Group is a leading personal finance group in Southeast Asia, encompassing two dynamic brands: MoneySmart and Bubblegum. Bringing together these brands to offer a comprehensive range of financial products, knowledge and advice, MoneySmart Group is dedicated to empowering consumers with clarity, confidence and control over their financial future.

MoneySmart provides a financial marketplace, comparison and content platform for consumers to make informed product choices across various banking, insurance and investment products. We do the hard work of compiling the information and facts to make it easy for you to compare and choose what's best for you.

Under our Bubblegum brand, we create desirable insurance products and experiences and aim to become the winning digital insurance brand of the future.

For more information, please visit www.moneysmart.com.