MoneyHero Launches Free Credit Score-Checking MoneyHero App Set to Popularise Consumer- initiated Credit Enquiries

Revolutionising "soft" credit enquiries

Unbeknownst to many, "hard" enquiries initiated by credit providers upon receiving a credit application from an individual remain on the individual's credit report for up to two years and may negatively impact the individual's credit score if these enquiries are made on a frequent basis. Whereas an individual checking their own credit score and/or report through MoneyHero App is a "soft" enquiry, which has no impact on the individual's credit score. With its partnership with TransUnion, MoneyHero strives to empower Hong Kong consumers with clarity, control, and confidence over their financial decisions via its new app.

- a breakdown of credit score impact factors,

- credit usage summary, and

- credit alert services (an alert service to notify users of the possibility of identity theft), all of which aid in making smart financial decisions and maintaining credit health.

Popularising credit score checks

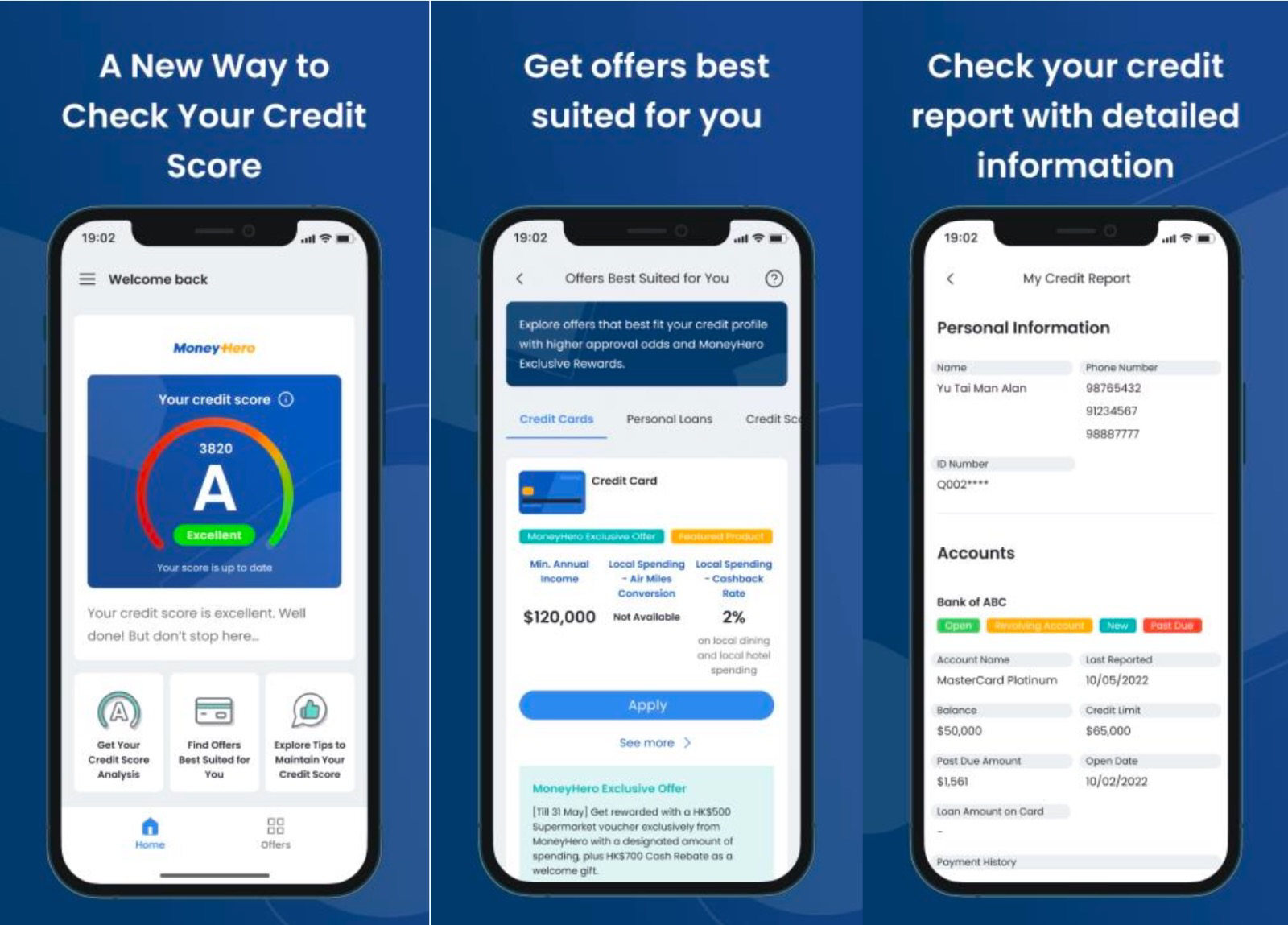

A credit score is a reflection of one's financial well-being, regardless of identity, profession, or wealth. However, credit checks have not been widespread in Hong Kong, with over 70% of respondents have never checked their credit scores, according to an online survey conducted with MoneyHero website users in 2021. In promulgating the importance of credit health and popularising personal credit checks, MoneyHero has created a one-stop credit check solution free of charge to the public via its new MoneyHero App, where detailed analysis of credit scores and reports as well as suggestions for improvement are just a few taps away.

Commitment to data privacy and security

As a user-centric company, MoneyHero emphasises privacy and information security and has been granted an ISO 27001 certification. All user data is kept strictly confidential and protected with the highest international encryption standards - using 256-bit encryption technology and Transport Layer Security (TLS) protocol.

App download link: http://bit.ly/3K05hET

The issuer is solely responsible for the content of this announcement.

About MoneyHero

MoneyHero is Hong Kong's largest and most popular digital personal finance platform, on a mission to empower and connect the Hong Kong public to a better financial future. We realise this mission by giving users more clarity, control, and confidence over their financial decisions through comprehensive comparison, insightful content, exclusive rewards, and personalised solutions to find and apply for the right personal finance product.

Launched in 2013, we are part of Hyphen Group, a leading fintech company operating in 5 markets, including Hong Kong, Malaysia, the Philippines, Singapore, and Taiwan.