Investment outlook 2023 made by OctaFX

KUALA LUMPUR, MALAYSIA - Media OutReach - 6 February 2023 - The year 2022 remains in the rear-view mirror. There was no shortage of buzz in the market last year: rising interest rates, an ongoing inflation shock, and, as a result, falling stock markets and a strengthening dollar.

Just imagine, at the end of the year the S&P500 was headed down 18%.

If we speak about the stock market, we should not be critical, as the decrease in the value of assets was mixed and there are even positive moments:

- The Energy sector is a striking example; it added 52% for the year and is, in fact, the only sector in the green zone.

- Utilities and Consumer Staples have proven to be defensive equities (and practically unchanged).

- Healthcare fell less than the entire market (8% drop in total).

- Other cyclical sectors (Basic Materials, Industrials, Financials) have recovered over the past two months, resulting in a decline of about 10%.

- The Telecommunications, Technology, Real Estate and Consumer Discretionary sectors, which are sensitive to rising interest rates, remain deep in the negative zone.

We have taken all these trends into review and provided you with the most probable scenario of the situation. The following research aims to let our clients know the 2023 trends in the assets they trade (currency pairs and stocks).

We've highlighted two sets of information. In the first part we look at trends in the macroeconomics of countries and forecast the value of the U.S. dollar, and in the second part we share a vision about key industries that we think will perform in 2023.

As we said, this outlook will be of primary interest to our clients, because they can use all the asset types and market situations discussed to execute trades on their accounts.

United States & US Dollar.

We expect the U.S. recession to continue in the first half of 2023, then recover and rebound, gaining strength by the end of 2023:

- The business cycle will outpace the economic cycle. Market players will be more optimistic, setting the stage for public equities valuation growth. Nevertheless, the full-year targets for U.S. economic growth and inflation may reflect a mostly recessionary outlook—we forecast that the inflation shock of the last 18 months has stopped—core inflation will slow from 5% now to 3% at the end of 2023. The unemployment rate will rise from 3.5% to 4.0% by year-end.

- We believe that in order to contain inflation (on the background of stronger real income growth), the U.S. Fed will raise the rate three more times in 25 bps increments to a peak of 5–5.25%. We also do not expect a rate cut in 2023.

- Based on the above, the US dollar's rise may slow and possibly reverse due to a slowdown in inflation and monetary policy easing by the US Federal Reserve starting in the second quarter (March–April) of 2023.

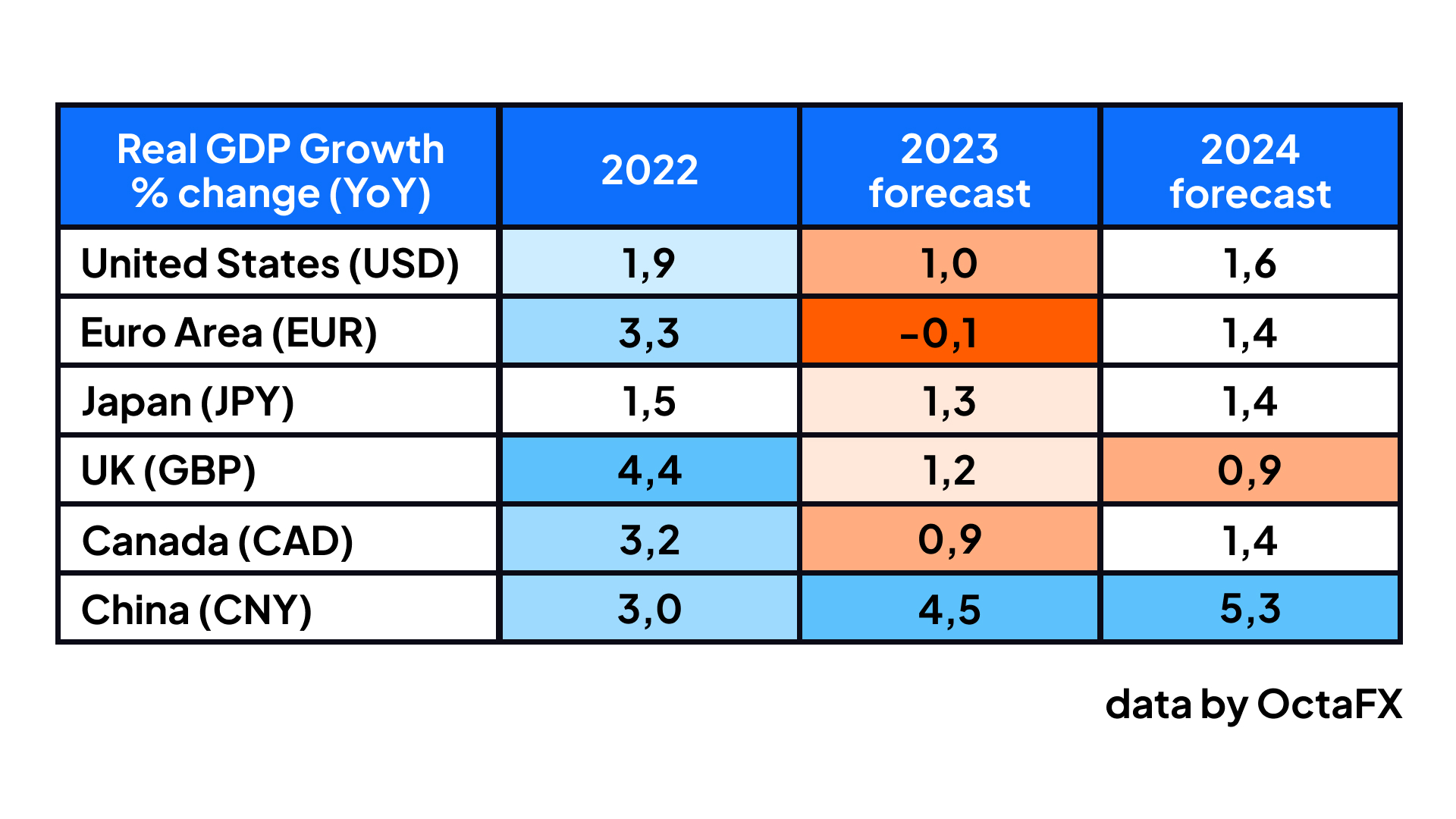

Global economies

US economic resilience is contrasted with a European recession and a boomy reopening in China. The energy supply shock resulting from the Russia-Ukraine war will contribute to weaker growth in the Eurozone. The situation in Asia-Pacific (APAC) mirrors that of China's reopening and their rejection of zero tolerance Covid in China

Commodity still looks attractive

- All commodities had a strong two-year run, and we expect this rally to continue, including Energy. The bullish super cycle that began in March 2020 continues. The lack of supply, which contributed to positive commodity returns in 2021 and 2022, will continue into 2023.

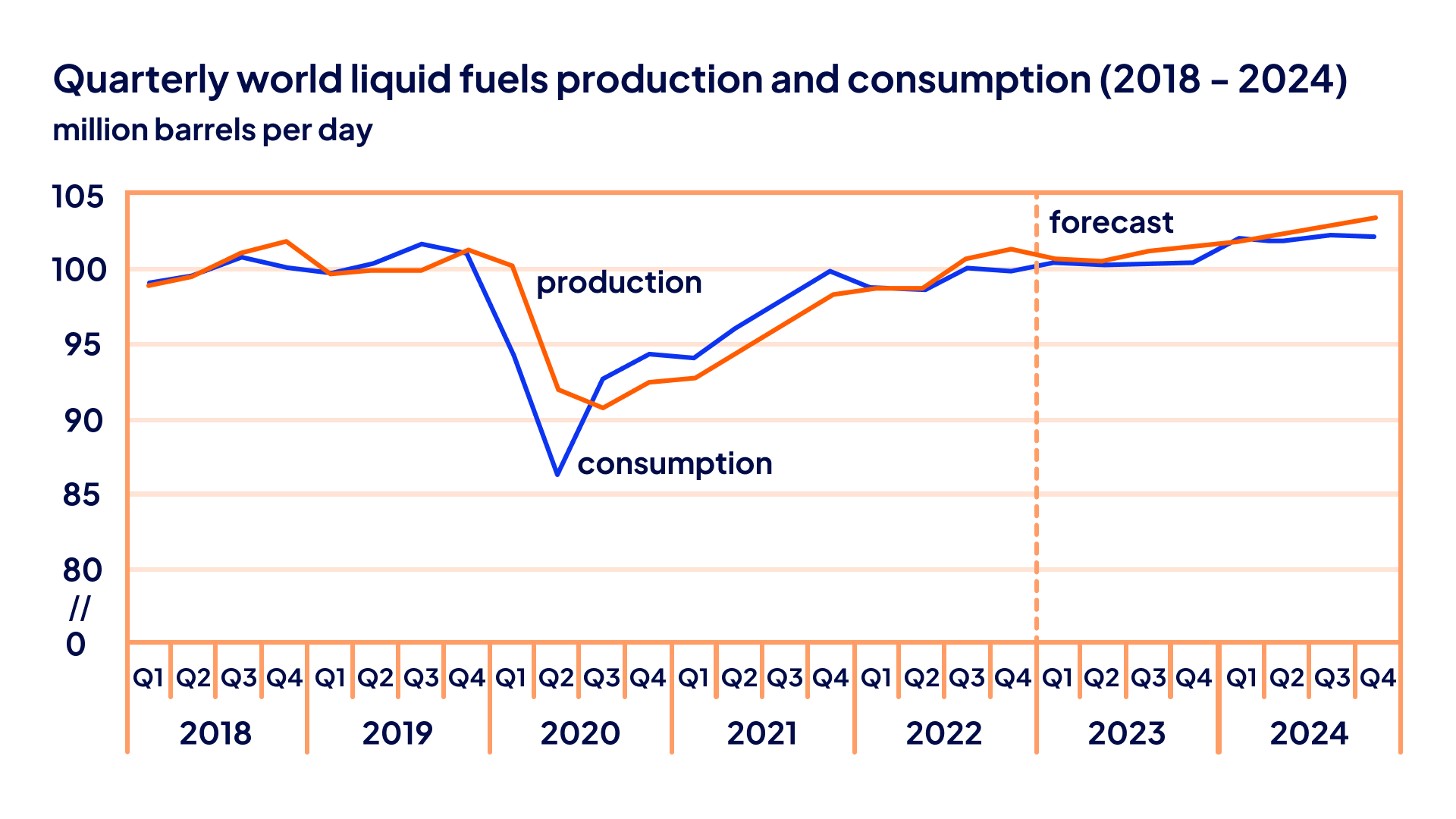

- OPEC+ has taken key strategic steps to minimise supply while maximising the price. U.S. preferences are increasingly shifting toward renewable energy, while Russian oil is subject to restraining sanctions. The implication is that falling global oil production will contribute to higher prices over the next few years. Thus, the International Energy Association (EIA) forecasts production growth of 1% in 2023, which with the average assumed growth of global GDP of 1.8%, creates these prerequisites (see fig.).

- However, in 2023, commodity prices may reverse as we expect a recession in the first half of the year. Once recession fears subside in the second half and demand starts to pick up, we expect commodity prices to start rising. Our year-end forecast is $95 for Brent and $91 for WTI.

In the stock market, we identify two sectors that, for different reasons, have growth potential and could be attractive in 2023, but at the same time do not rule out separate market stories with other stocks:

Big Techs have big trends

After the technology crash of 2022, some companies are still struggling to recover, and investors may think that the best days of technology companies have passed.

Ambitious plans can definitely be pushed aside. For the technology sector, 2023 is a year of uncertainty and skills shortages. This puts a strain on all activities in 2023.

Companies are focused on optimising business processes and reducing budgets, which, in our opinion, will have a negative impact on growth stocks.

However, we see the negative market sentiment as a great opportunity for the "Big Techs" (Apple, Microsoft, Nvidia, Visa, etc.), as their businesses have become well-established.

We believe that rising interest rates and macroeconomic and geopolitical concerns have simply distracted investors from long-term trends that create growth opportunities for companies in Semiconductors, Cloud technologies and 5G.

(Our clients can trade 22 shares in this sector)

Healthcare—good fundamentals creating upside opportunity

In the first half of 2022, we saw a massive selloff across the entire spectrum of the market, and the Healthcare sector is no exception. But with so much negative sentiment already factored into stock prices, the fundamentals become quite interesting and speak to the undervaluation of this category of stocks. If confirmed by investors' willingness to buy, the healthcare sector could rise in 2023.

Another tailwind is worth highlighting: The US Inflation Reduction Act, which was signed into law in August 2022, included a 3-year extension of enhanced subsidies for consumers who purchase health coverage on the Affordable Care Act marketplaces. This is a benefit to health insurers offering Medicare and/or Medicaid plans.

Regardless of where the U.S. markets go next, the Healthcare sector may offer a combination of protective and growth characteristics that could be attractive in a variety of scenarios.

(Our clients can trade 22 shares in this sector).

The Bottom Line

Due to the fact that business cycles outpace economic cycles, we believe that cyclical stocks have growth potential first and foremost.

We believe that the themes described in this review are the key ones that will drive the world economy. We deliberately divided the forecasts into America and non-America, understanding that the U.S. dollar is the main measure of the state of the world economy. And within 2023, the U.S. dollar tends to decline, which is a leading positive signal for the global economy and all categories of public equities.

Hashtag: #OctaFX

The issuer is solely responsible for the content of this announcement.

About OctaFX

OctaFX is a global broker providing online trading services worldwide since 2011. It offers commission-free access to financial markets and a variety of services already utilised by clients from 150 countries with more than 12 million trading accounts. Free educational webinars, articles, and analytical tools they provide help clients reach their investment goals.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities and small to medium enterprises.

On a side note, OctaFX has also won more than 50 awards since its foundation, including the 2021 ‘Best ECN Broker’ award from World Finance and the 2022 ‘Best Global Broker Asia’ award from International Business Magazine.