Office Market Net Absorption Reached 183,000 Sq Ft in Q3, Driven by Pre-Committed Space in Hong Kong East

New “0+3” quarantine measure to help reignite business travel, although no immediate boost to tourism activities is anticipated

- Hong Kong's Grade A office market remained generally quiet in Q3, but pre-commitments at new project completions pushed up citywide net absorption to reach 183,000 sq ft

- Overall office rents fell by a further 2.3% q-o-q, although the decline is expected to narrow in Q4, with the full-year rental movement forecast now in a -3% to -5% range

- The retail market is recovering slowly, with retail sales in the first eight months down by 1.5% y-o-y; some retailers have held back on expansion plans in response to a still uncertain timeline for a full border reopening with mainland China

- The recently announced "0+3" quarantine measure will help stimulate outbound spending but may not immediately attract an influx of tourists to Hong Kong, weighing on the short-term retail recovery

HONG KONG SAR - Media OutReach - 6 October 2022 - Global real estate services firm Cushman & Wakefield today published its Hong Kong Office and Retail Leasing Markets Review and Outlook Q3 2022 report. Office and retail leasing activities were both relatively quiet in Q3. Overall office market net absorption returned to positive territory on the back of pre-commitments at new projects within the Hong Kong East district. Nevertheless, a rise in the availability rate saw rents trend downward at -2.3% q-o-q in Q3. The local retail market also remained weakened, with total retail sales for January to August 2022 recorded at HK$226.7 billion, down 1.5% y-o-y. While the latest "0+3" quarantine rule for inbound travelers may not immediately boost tourism to Hong Kong, it may instead spur locals towards outbound travel and hence impact short-term domestic retail sales.

Office market

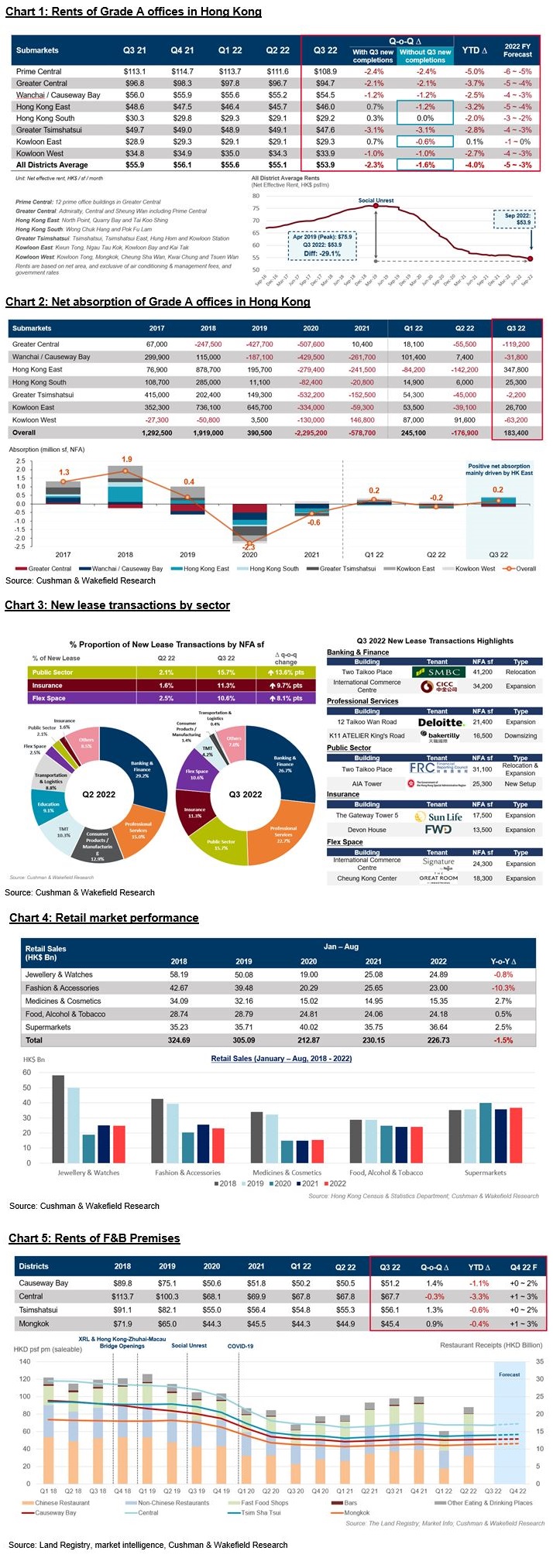

Office leasing activities remained quiet in Q3, against a backdrop of global economic instability, interest rate hikes, and continuing uncertainty over the Hong Kong-mainland China border reopening. The overall office rental level further trended further downwards, at -2.3% q-o-q and -4.0% YTD. By submarket, core districts such as Greater Tsimshatsui and Greater Central experienced more notable drops, down by 3.1% q-o-q and 2.4% q-o-q, respectively (Chart 1). Overall rents have now fallen by 29% since their peak in April 2019.

John Siu, Managing Director, Head of Project and Occupier Services, Hong Kong, Cushman & Wakefield stated: "As office availability remains high, some landlords have adopted more flexible leasing plans, such as providing rent-free periods and capital expenditure subsidies to attract tenants. Having said that, since office rents have dropped almost 30% from the last peak in 2019, a further major rental correction is unlikely. The recent "0+3" measure and the gradually relaxed quarantine arrangements will likely help to bring a positive spin by improving capital flow and business travel. We expect the overall office market rental decline will narrow in Q4, with the full year rental forecast now in the -3% to -5% range."

In terms of net absorption, the positive figure of 183,000 sq ft in Q3 was mainly driven by pre-commitments at newly completed offices (Chart 2). Submarkets with new office completions, such as Hong Kong East, Hong Kong South, and Kowloon East, all saw rebounds in net absorption in Q3. However, overall new leasing demand in the market remained sluggish, with some companies returning space to the market upon lease expiry for cost-saving purposes. Combined with the impact of the 2 million sq ft of newly completed office space in Q3, the overall availability rate climbed to 16.1%, up from 13.8% in Q2.

John Siu further stated, "There were quite a few notable office completions this quarter, including Two Taikoo Place in Hong Kong East, which had witnessed relatively strong pre-commitment, pushing the submarket's quarterly net absorption to 348,000 sq ft. In terms of new leasing transactions by floor area, the banking and finance (26.7%) and professional services (22.7%) sectors remained the key drivers, while we also saw new lettings from government entities, insurance firms and flex space operators pick up notably, accounting for 15.7%, 11.3% and 10.6% by share, respectively (Chart 3). Core submarkets recorded several leases via flex space expansions in recent months, with more businesses looking for flexible lease terms and lower capital expenditure amid a market facing economic uncertainty and interest rate hikes. We expect to see this trend remain in 2023."

Retail market

The retail market remained subdued in Q3, with stock market volatility and interest rate hikes leading to more conservative local spending. Total retail sales decreased by 1.5% y-o-y for the first eight months from January to August 2022, although the medicines & cosmetics, supermarket, F&B, and daily necessities sectors performed relatively well (Chart 4). Sales in the month of August 2022 fell 0.1% y-o-y from the high base of last year, reflecting a more cautious spending attitude from the general market.

In terms of high street store vacancy rates, submarket performance varied, with Hong Kong Island performing better than Kowloon. Vacancy rates in Causeway Bay (5.3%) and Central (8.5%) have fallen to their lowest levels since the pandemic, despite some being short-term leases, while vacancy in Tsimshatsui (16.7%) and Mongkok (12.5%) in Kowloon rose slightly. In Tsimshatsui, vacant stores have become more evident in traditional tourist streets such as Canton Road, while some large retailers in Mongkok have also downsized or are undertaking consolidation.

Kevin Lam, Executive Director, Head of Retail Services, Agency & Management, Hong Kong, Cushman & Wakefield stated, "Although the government has gradually eased quarantine measures, Hong Kong and mainland China have yet to achieve a full border opening, making it difficult for retailers to deploy expansion plans. As a result, leasing activities remained quiet in Q3. However, vacancy rates in Central and Causeway Bay have dropped significantly compared with the beginning of the year. Although Causeway Bay is traditionally supported by tourist activities, the district is transforming and has become more appealing for local consumers. Meanwhile, consumption activities are still focused on local office workers and high-spending groups, as Central will continue to display resilience despite dampened tourism activities."

In terms of high street rents, suburban submarkets such as Yuen Long and Tuen Mun were relatively stable, but the core submarkets' rents continued to come under pressure. Rents at traditional tourist districts such as Causeway Bay and Tsimshatsui fell more significantly, by 1.9% q-o-q (-7.6% YTD) and 1.2% q-o-q (-5.1% YTD), respectively. In contrast, rents at local consumer-heavy districts such as Central, Yuen Long and Tuen Mun were relatively stable. Rents in the F&B sector were also relatively resilient, with the exception of Central, with the other submarkets' rental levels rising slightly at 0.9% q-o-q to 1.4% q-o-q in Q3 (Chart 5).

Kevin Lam added, "The government's latest announcement of the "0+3" quarantine measure may not immediately attract an influx of tourists to Hong Kong, yet it could encourage locals to travel abroad, as they have been frustrated by stringent quarantine measures since the beginning of the pandemic. In the short term, outbound travel by locals could weaken local consumption and hence weigh on rental levels in Q4. However, the recently announced relaxation of restaurant dine-in rules, to allow 12 people per table, should lend support to F&B performance. As we enter the year-end holiday season, short-term leases will likely be more popular and we expect vacancy rates to reduce further towards the end of the year. Meanwhile, unless the government introduces more favorable policies for the retail market, high street retail rents are not expected to see significant rises until the second half of next year."

Please click here to download photos.

Photo caption:

Picture: John Siu, Managing Director, Head of Project and Occupier Services, Hong Kong, Cushman & Wakefield (left); Kevin Lam, Executive Director, Head of Retail Services, Agency & Management, Hong Kong, Cushman & Wakefield (right)

Hashtag: #CushmanWakefield

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms in the world, with approximately 50,000 employees in over 400 offices and 60 countries. In Greater China, a network of 23 offices serves local markets across the region, earning recognition and winning multiple awards for industry-leading performance. In 2021, the firm had revenue of $9.4 billion across core services including valuation, consulting, project & development services, capital markets, project & occupier services, industrial & logistics, retail and others. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.