The US has invaded countries and deposed leaders before. Its military action against Venezuela feels different

- Written by Juan Zahir Naranjo Cáceres, PhD Candidate, Political Science, International Relations and Constitutional Law, University of the Sunshine Coast

In the early hours of Saturday morning, US special forces captured Venezuelan President Nicolás Maduro[1] from his home in Caracas and flew him out of the country. US President Donald Trump announced that Maduro and his wife, Cilia Flores, would face federal narco-terrorism charges in New York.

For anyone familiar with the history of US interventions in Latin America and the Caribbean, the basic pattern is grimly familiar: a small state in Washington’s “backyard”, a leader deemed unacceptable, military force applied with overwhelming effect, and a government removed overnight.

Yet what makes Venezuela’s case different – and profoundly alarming – is the brazen nature of the months-long US military operations against the country based on shifting and shaky justifications[2], with little evidence.

This moment is also significant, with many scholars already warning[3] that international law is in deep crisis.

A long tradition of removing ‘unacceptable’ leaders

Venezuela is not the first country in the region to see its leader overthrown or seized with direct US involvement or acquiescence.

In 1953, the British government suspended the constitution of its colony British Guiana (now Guyana) and removed the democratically elected government[4] of Cheddi Jagan after just 133 days. The British believed Jagan’s social and economic reforms would threaten its business interests.

A decade later, the CIA conducted a sustained covert operation[5] to destabilise Jagan’s later administration, culminating in rigged 1964 elections that ensured his rival, Forbes Burnham, would win.

In 1965, US President Lyndon Johnson sent more than 22,000 US troops[6] to the Dominican Republic to prevent the return of former President Juan Bosch, overthrown in a 1963 coup, and another communist regime forming in the region.

Following the violent overthrow and execution of Prime Minister Maurice Bishop of Grenada in 1983, President Ronald Reagan ordered an invasion[7]. His administration justified the action by citing the need to protect US medical students and prevent the island from becoming a “Soviet-Cuban colony”.

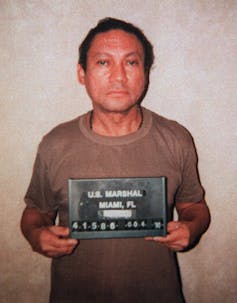

In December 1989, President George H.W. Bush launched a full-scale invasion of Panama[8] involving about 24,000 US troops to remove General Manuel Noriega, who had been indicted on drug-trafficking charges (like Maduro). He was subsequently flown to the United States, tried and imprisoned[9].

And in 2004, Haitian President Jean-Bertrand Aristide was removed from power and flown to Africa in what he described as a US-orchestrated coup and “kidnapping”[10]. In 2022, French and Haitian officials told The New York Times[11] that France and the US had collaborated to remove him.

Why Maduro’s case is different

In all of these cases, Washington asserted control over what it has long considered its sphere of influence, intervening when governments threatened its interests through ideology, alliances or defiance.

But Venezuela in 2026 is not Grenada in 1983 or Panama in 1989. It is a much larger country with some 30 million people and significant armed forces, which has spent years preparing for a possible US invasion[12]. More importantly, the operation unfolded in an entirely different global context.

During the Cold War, US interventions were often condemned but rarely threatened the legitimacy of the international order itself.

Today, by contrast, the Maduro operation has been met with swift and sharp condemnation[13] from across the political spectrum.

Colombian President Gustavo Petro called[14] the strikes an “assault on the sovereignty” of Latin America, while Brazilian President Luiz Inácio Lula da Silva said[15] the attack “crossed an unacceptable line” and set an “extremely dangerous precedent”. Mexican President Claudia Sheinbaum said[16] the strikes were in “clear violation” of the UN Charter.

Even traditional US allies expressed discomfort. France’s foreign minister said[17] the operation contravened the “principle of non-use of force that underpins international law” and that lasting political solutions cannot be “imposed by the outside”.

And a statement from UN Secretary-General Antonio Guterres said[18] he was “deeply alarmed” about the “dangerous precedent” the United States was setting and the rules of international law not being respected.

The UN Charter prohibits the use of force against the territorial integrity or political independence of any state under Article 2(4)[19].

For years, scholars have warned that repeated violations[20] of the UN Charter by the United States were steadily eroding the basic rules governing the use of force.

Venezuela may represent the moment that erosion becomes collapse. When a permanent Security Council member not only bombs another state but abducts its head of state[21], the precedent is indeed profound.

Read more: A predawn op in Latin America? The US has been here before, but the seizure of Venezuela's Maduro is still unprecedented[22]

Regional consequences

The immediate consequences for Latin America are already being felt. Colombia has moved troops[23] to its border with Venezuela, while neighbouring Guyana has activated[24] its own security plans.

It’s unclear at this point if further US military operations are planned. Trump has said the US will “run” Venezuela[25] until a “safe transition” is complete, but analysts question whether Washington has the appetite for such an open-ended commitment. Venezuela’s defence minister has also pledged[26] to continue to fight against what he called “criminal aggression”.

The operation has also deepened divisions that already existed in Latin America over Venezuela. After Maduro’s 2024 election[27], the results were immediately contested: Maduro’s government claimed victory, while the opposition said it won based on voting tallies[28] it published online.

Regional governments split over which narrative to accept, with some recognising Maduro’s government and others backing the opposition[29]. These fault lines have made a coordinated regional response to the Trump administration’s actions impossible.

The broader risk is that Venezuela becomes a precedent not only for great powers, but for regional actors. If Washington can seize a head of state without legal sanction, what stops others from doing the same?

A dangerous new normal

Maduro’s removal may or may not bring the political change Trump desires. But the manner of his removal – brazen, unilateral, defended in the language of US exceptionalism – has already done serious damage to the fragile architecture of international law.

If sovereignty can be set aside when inconvenient, heads of state can be abducted without UN approval, and the most powerful decide which governments may exist, then we have returned to a world governed by force – not the law. And in that world, no state can consider itself truly secure.

References

- ^ captured Venezuelan President Nicolás Maduro (www.cbsnews.com)

- ^ shifting and shaky justifications (abcnews.go.com)

- ^ many scholars already warning (www.jurist.org)

- ^ removed the democratically elected government (www.declassifieduk.org)

- ^ conducted a sustained covert operation (nsarchive.gwu.edu)

- ^ sent more than 22,000 US troops (www.ebsco.com)

- ^ President Ronald Reagan ordered an invasion (www.britannica.com)

- ^ launched a full-scale invasion of Panama (www.army.mil)

- ^ tried and imprisoned (www.nytimes.com)

- ^ US-orchestrated coup and “kidnapping” (www.latimes.com)

- ^ told The New York Times (www.nytimes.com)

- ^ preparing for a possible US invasion (www.aljazeera.com)

- ^ swift and sharp condemnation (www.nytimes.com)

- ^ called (www.bbc.com)

- ^ said (www.wxxinews.org)

- ^ said (mexiconewsdaily.com)

- ^ said (www.aa.com.tr)

- ^ said (news.un.org)

- ^ Article 2(4) (www.un.org)

- ^ warned that repeated violations (www.jurist.org)

- ^ abducts its head of state (www.nytimes.com)

- ^ A predawn op in Latin America? The US has been here before, but the seizure of Venezuela's Maduro is still unprecedented (theconversation.com)

- ^ Colombia has moved troops (colombiaone.com)

- ^ activated (demerarawaves.com)

- ^ said the US will “run” Venezuela (www.bbc.com)

- ^ pledged (news.cgtn.com)

- ^ 2024 election (www.bbc.com)

- ^ said it won based on voting tallies (apnews.com)

- ^ backing the opposition (www.as-coa.org)