Would you use AI to break writer’s block? We asked 5 experts

- Written by Nicola Redhouse, Lecturer, Publishing and Editing, The University of Melbourne

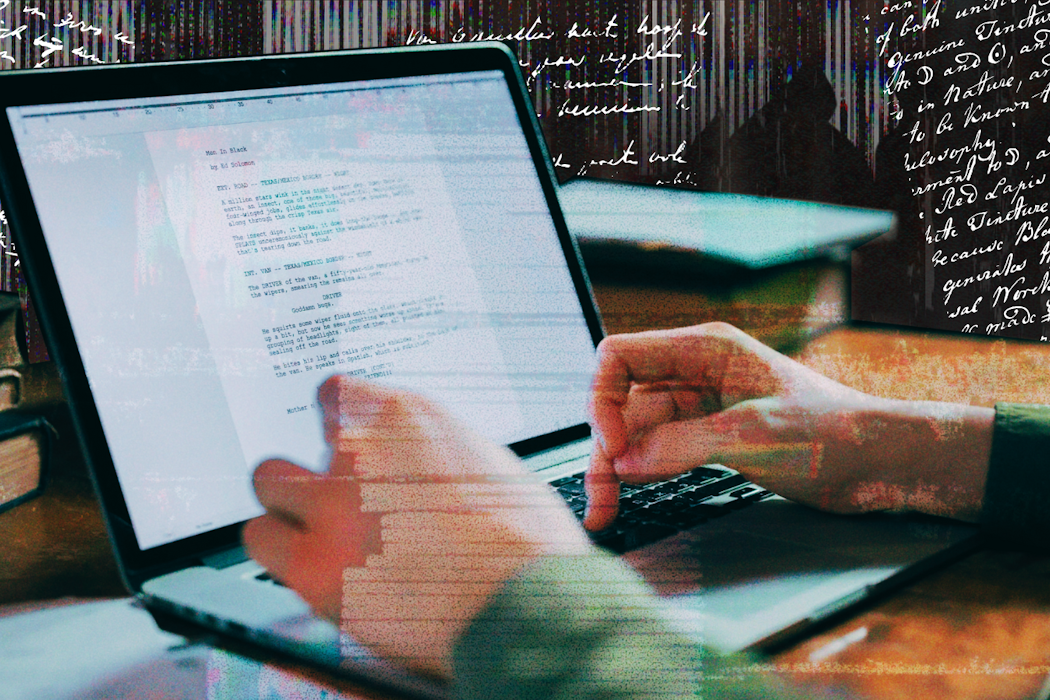

Pexels, The Conversation, CC BY-NC

Pexels, The Conversation, CC BY-NCThe founder and chief executive of Bloomsbury Publishing, responsible for blockbuster romantasy author Sarah J. Maas and literary heavyweights like George Saunders, has suggested AI “will probably help creativity” – including by helping authors defeat writer’s block.

“AI gets them...

Read more: Would you use AI to break writer’s block? We asked 5 experts