What's the charitable deduction? An economist explains

- Written by Patrick Rooney, Executive Associate Dean for Academic Programs, Glenn Family Chair, and Professor of Economics and Philanthropic Studies, IUPUI

The charitable deduction[1] is a dollar-for-dollar reduction in taxable income that lowers what someone owes the Internal Revenue Service[2]. Only donations to tax-exempt charities[3] count.

This giving incentive is available only for the 10% of American taxpayers who itemize their tax returns[4]. Taxpayers who itemize can sum up certain expenses, such as the interest they pay to for a home mortgage, and then subtract that money from their taxable income.

Here’s a hypothetical example: Clara Doe, a veterinarian, pays a 32% marginal tax rate[5] on her US$200,000 income as a single filer. Because she itemizes, her $100 annual donation to a local food pantry costs her $68 after taxes. Uncle Sam essentially pays the rest by giving her a tax break.

Most Americans instead use the standard deduction[6], a set amount of money based on how you file your taxes. As as of 2021, the standard deduction was $12,550 for single taxpayers. People claiming it subtract that amount from their income to see how much of it is subject to the income tax. The standard deduction usually saves more money than itemizing.

With the standard deduction, giving $100 costs, well, $100.

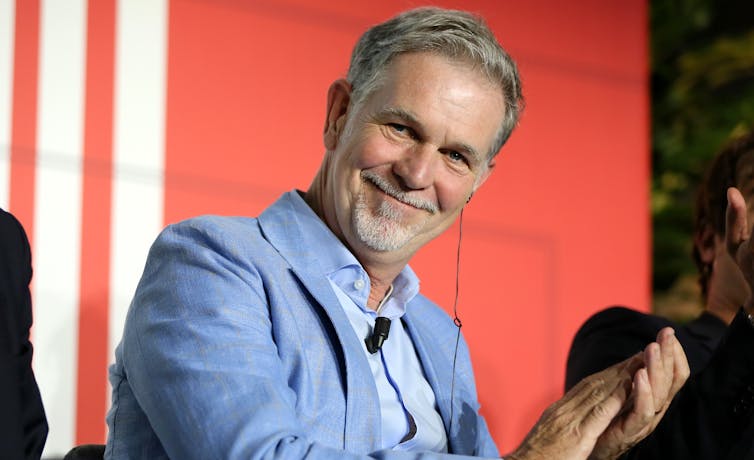

Most people who donate extensively to charity, such as Netflix founder Reed Hastings, use this tax break.

Ernesto S. Ruscio/Getty Images via Netflix[7]

Most people who donate extensively to charity, such as Netflix founder Reed Hastings, use this tax break.

Ernesto S. Ruscio/Getty Images via Netflix[7]

Why the charitable deduction matters

People give to charities for many reasons[8]. Tax breaks cannot be the main one because giving money away doesn’t make you better off financially.

As is true elsewhere[9], Americans tend to donate more with government incentives. Similarly, donors usually give away smaller shares of their income when Uncle Sam scales back those advantages.

Consider what happened once the 2017 tax reform package[10] took effect. Many economists predicted beforehand[11] that its reduction in giving incentives would prompt American taxpayers to give less to charity. And that did happen in 2018[12].

Although charitable giving has since rebounded, reaching new records[13], I believe the total could have been higher[14] if more Americans could deduct charitable contributions from their taxable income.

How many Americans claim the charitable deduction?

In 2019, only an estimated 8.5% of taxpayers[15] took advantage of this century-old tax break[16]. Nearly three times as many Americans[17] were claiming this deduction before the 2017 tax reforms.

There’s a simple explanation for this decline: The tax package nearly doubled the standard deduction. Most people who were itemizing until 2018 are now better off if they take the standard deduction instead.

That could change after 2025[18], when many of the 2017 tax reforms will expire.

The Conversation U.S. publishes short, accessible explanations of newsworthy subjects by academics in their areas of expertise.

References

- ^ charitable deduction (www.investopedia.com)

- ^ Internal Revenue Service (www.irs.gov)

- ^ tax-exempt charities (www.irs.gov)

- ^ 10% of American taxpayers who itemize their tax returns (par.nsf.gov)

- ^ marginal tax rate (www.investopedia.com)

- ^ standard deduction (www.investopedia.com)

- ^ Ernesto S. Ruscio/Getty Images via Netflix (www.gettyimages.com)

- ^ give to charities for many reasons (theconversation.com)

- ^ As is true elsewhere (doi.org)

- ^ 2017 tax reform package (www.investopedia.com)

- ^ economists predicted beforehand (www.aei.org)

- ^ did happen in 2018 (theconversation.com)

- ^ rebounded, reaching new records (theconversation.com)

- ^ total could have been higher (doi.org)

- ^ estimated 8.5% of taxpayers (par.nsf.gov)

- ^ century-old tax break (www.everycrsreport.com)

- ^ three times as many Americans (www.taxpolicycenter.org)

- ^ could change after 2025 (www.mlrpc.com)

Read more https://theconversation.com/whats-the-charitable-deduction-an-economist-explains-162647