Is your neighbourhood underinsured? Search our map to find out

- Written by Kate Isabel Booth, Senior Lecturer in Human Geography and Planning, University of Tasmania

Underinsurance is more common than many[1] realise. And if you live in an area where most people don’t have enough home and/or contents insurance, the financial and social catastrophe that follows a disaster can be community-wide.

Even if you’re well covered, your neighbourhood may struggle long after the dust has settled, as houses lie derelict, people struggle to bounce back and social cohesion frays.

So, do you live in one of these “pockets of underinsurance”?

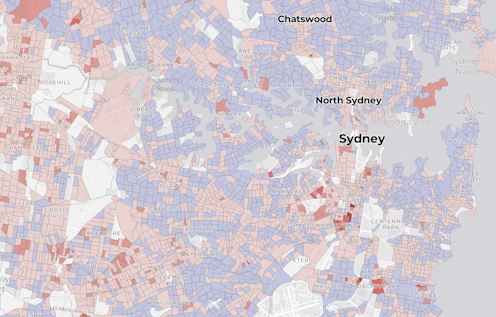

Search our interactive map below by suburb name or by postcode to find out:

The map is based on data reported in our study[2] published in the journal Environment and Planning A: Economy and Space[3].

Suburb-by-suburb data on actual rates of underinsurance doesn’t exist (yet). But we combined data from the 2015 Australian Survey of Social Attitudes (AuSSA) and the Australian Bureau of Statistics to map predicted rates of underinsurance for each suburb in Australia.

In other words, the map shows whether you live in an area where underinsurance is likely to be more prevalent.

The darker the red, the more likely it is many in your neighbourhood do not have enough house and/or contents insurance.

Underinsurance can compound disadvantage. This dynamic is expected to worsen as home ownership drives more people into long-term renting and climate change makes disasters and extreme weather events more frequent – and more severe.

Read more: Insurance is unaffordable for some, but it's middle Australia that is underinsured[4]

Renters often don’t have contents insurance

The data show that a poorer suburb with a high rate of rental properties will likely be the most underinsured. But, perhaps counter-intuitively, some wealthier suburbs are showing up as likely having high rates of underinsurance.

That’s because it is housing tenure (whether someone owns or rents) that contributes most significantly to the patterns seen in the map.

Areas with high levels of renting[5] are more likely to be a “pocket of underinsurance” because while a landlord may buy home insurance, renters often don’t have contents insurance. In fact, around 40% of renting households don’t have insurance[6].

Many suburbs mapped as having higher rates of underinsurance have a high proportion of rental properties. This includes wealthier suburbs.

In fact, poorer suburbs with high rates of home ownership are more likely to appear as adequately insured.

For example, zooming in on the municipalities of Hobart and Glenorchy in Tasmania, reveals the more well-heeled Hobart area contains significant areas of underinsurance, similar to that in the more disadvantaged Glenorchy.

The take home message is that while income remains a significant indicator of underinsurance risk, renters (both poor or rich) are much more likely to be underinsured than home owners due to a lack of contents insurance.

What’s driving these trends?

As property values have climbed, many Australians have been priced out of home ownership and driven into long-term renting[7]. And as rents go up, more of the household budget is spent on rental payments. When households are under financial stress, they are more likely to drop insurance[8].

The end result is a lot of renters don’t have contents insurance.

Climate-exacerbated disasters are also driving changes in the affordability and availability of house and/or contents insurance.

Together, these trends in housing, renting, climate change and insurance could potentially create new pockets of entrenched disadvantage.

I’m well insured, so how does this affect me?

Without sufficient home and/or contents insurance, both renters and homeowners can struggle to recover from a disaster.

Repairs or rebuilds may be delayed (or too expensive) for homeowners and landlords. Renters may be unable to replace their stuff, or face eviction from a damaged property, and possible homelessness[9].

In a disaster like a massive bushfire, demand for emergency housing skyrockets. So even if a household can afford insurance and alternative accommodation, demand for housing may outpace supply.

An area dominated by damaged and uninhabitable properties can lose a sense of community. Those who are well insured may find rebuilding in an otherwise derelict area can be tough.

In contributing to homelessness and a loss of community, underinsurance can lead to loss of social connections and cohesion. It can fragment the collective responses so important for recovery.

In other words, people struggle to bounce back[10]. Some may never get back on their feet.

What needs to be done?

There are many different types of insurance aimed at building individual and collective capacity to recover after disaster.

Some of these, like Flood Re in the United Kingdom and the National Flood Insurance Program in the United States, use the market to set premium prices and manage risk[11]. The idea is if insurance prices are set according to a particular area’s level of risk, this will encourage people to take action to reduce their risk.

Others, for example in Europe, focus on enabling the collective good[12] through insurance affordability and availability. These approaches, which aim to make insurance an option for everyone, better reflect the collective predicament underinsurance represents.

If Australia is to build resilience, then our dependence of individual insurance policies must end. Governments must shift their efforts to equitable, social insurance schemes.

Read more: Underinsurance is entrenching poverty as the vulnerable are hit hardest by disasters[13]

References

- ^ many (www.abc.net.au)

- ^ study (journals.sagepub.com)

- ^ Environment and Planning A: Economy and Space (journals.sagepub.com)

- ^ Insurance is unaffordable for some, but it's middle Australia that is underinsured (theconversation.com)

- ^ high levels of renting (journals.sagepub.com)

- ^ don’t have insurance (www.sciencedirect.com)

- ^ long-term renting (www.aihw.gov.au)

- ^ more likely to drop insurance (melbourneinstitute.unimelb.edu.au)

- ^ possible homelessness (theconversation.com)

- ^ struggle to bounce back (journals.sagepub.com)

- ^ manage risk (www.tandfonline.com)

- ^ collective good (www.sciencedirect.com)

- ^ Underinsurance is entrenching poverty as the vulnerable are hit hardest by disasters (theconversation.com)

Read more https://theconversation.com/is-your-neighbourhood-underinsured-search-our-map-to-find-out-168836