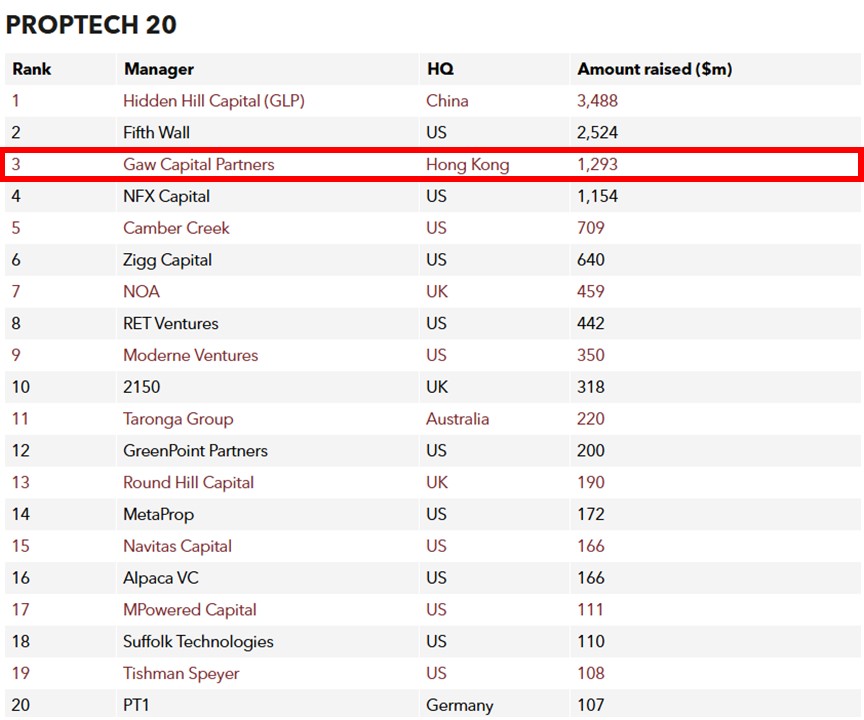

Gaw Capital Partners Ranks 3rd in PERE's 2024 Proptech 20

HONG KONG SAR - Media OutReach Newswire - 11 November 2024 - Gaw Capital Partners ranked third in the PERE's 2024 Proptech 20 among all fund managers globally, with US$1,293m raised over the past five-year period.

The Proptech 20 ranking, compiled annually by PERE, evaluates firms based on the amount of private direct investment capital raised between January 1, 2019, and December 31, 2023. According to PERE, the total capital raised by the firms in the Proptech 20 ranking reached $12.93 billion in 2024, marking a significant increase of over 14 percent from the previous year's total of $11.28 billion. This growth underscores the continued allure of proptech investments and the industry's drive to redefine traditional real estate practices through technological innovation.

Remaining at the top three of the Proptech 20 ranking is a testament to Gaw Capital's commitment to innovation and excellence in the real estate investment landscape. Despite challenging and ever-evolving market conditions, the firm has demonstrated remarkable resilience and foresight in navigating the proptech sector.

Christina Gaw, Managing Principal, Global Head of Capital Markets and Co-chair of Alternative Investments at Gaw Capital Partners, said, "Securing the third position in PERE's Proptech 20 ranking for consecutive 3 years not only testifies our team's dedication to leveraging technology for value creation in real estate but also highlights our prowess in fundraising and maneuvering capital markets. We are proud to be recognized for our efforts in shaping the future of the industry. As technology continues to disrupt and reshape the industry, Gaw Capital is poised to embrace new opportunities and drive innovation that will redefine the way we interact with built environments."

Humbert Pang, Managing Principal, Head of China, and Co-chair of Alternative Investments at Gaw Capital Partners, said, "The proptech landscape in Asia, particularly Middle East, is witnessing rapid evolution, driven by the increasing adoption of cutting-edge technologies and the robust growth of smart infrastructure. The region's dynamic market environment, coupled with the Chinese government's proactive stance on sustainable development, technological advancement and climate change mitigation, presents a wealth of opportunities for innovation and investment in the real estate related sector. Our dedication to harnessing technology and fostering sustainable practices reflects our commitment to driving positive change and delivering long-term value for our investors and stakeholders."

Being among the leading fundraisers in the last five years, Gaw Capital consistently showcases its expertise in recognizing and leveraging emergent trends within the proptech industry. The firm remains steadfast in its mission to pioneer transformative solutions and lead the way in proptech investments globally.

Hashtag: #GawCapitalPartners

The issuer is solely responsible for the content of this announcement.

About Gaw Capital Partners

Gaw Capital Partners is a uniquely positioned private equity fund management company focusing on real estate markets in Asia Pacific and other high barrier-to-entry markets globally.

Specializing in adding strategic value to under-utilized real estate through redesign and repositioning, Gaw Capital runs an integrated business model with its own in-house asset management operating platforms in commercial, hospitality, property development, logistics, IDC and Education. The firm's investments span the entire spectrum of real estate sectors, including residential development, offices, retail malls, serviced apartments, hotels, logistics warehouses and IDC projects.

Gaw Capital has raised seven commingled funds targeting the APAC region since 2005. The firm also manages value-add/opportunistic funds in the US, a Pan-Asia hospitality fund, a European hospitality fund, a Growth Equity Fund and it also provides services for credit investments and separate account direct investments globally.

Gaw Capital has raised equity of US$22.8 billion since 2005 with assets of US$35.2 billion under management as of Q2 2024.