Gaw Capital Partners Announces Two Key Senior Appointments

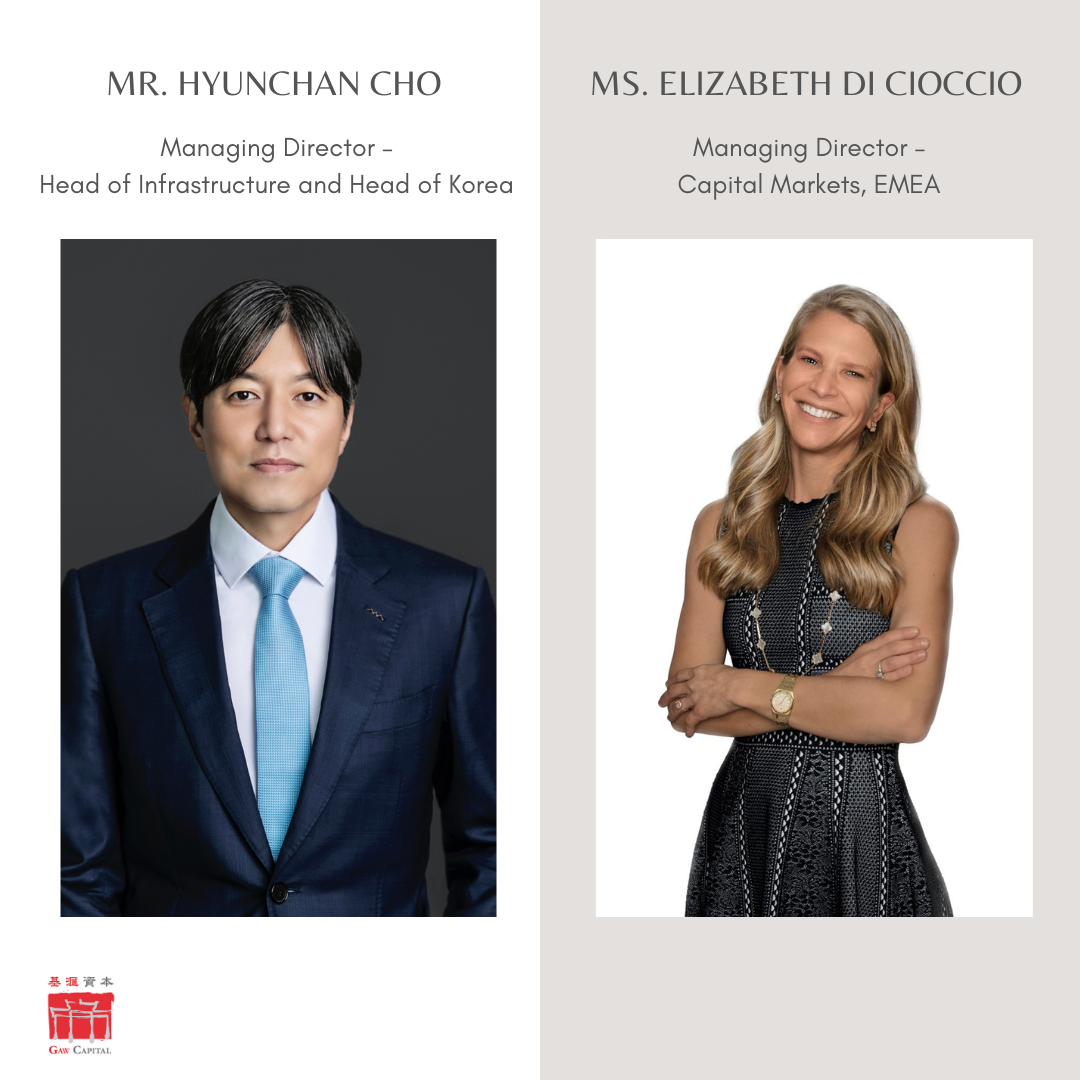

- HyunChan Cho joins as Managing Director – Head of Infrastructure and Head of Korea

- Elizabeth Di Cioccio joins as Managing Director – Capital Markets, EMEA

HONG KONG SAR - Media OutReach Newswire - 23 April 2024 - Private equity firm Gaw Capital Partners is pleased to announce the appointments of Mr. HyunChan Cho and Ms. Elizabeth Di Cioccio as key additions to its senior leadership team. These appointments bring a wealth of expertise and experience to the firm, positioning Gaw Capital for further success and fostering synergy across its investment and capital markets divisions.

Mr. HyunChan Cho joins Gaw Capital as the Managing Director - Head of Infrastructure and Head of Korea, bringing extensive expertise and a proven track record in infrastructure investment. With his deep industry knowledge and strategic acumen, Mr. Cho is the ideal candidate to drive Gaw Capital's infrastructure investment initiatives, and to lead and expand Gaw Capital's business in Korea. In addition, Mr. Cho's comprehensive knowledge of the Korean market will spearhead the firm's continued growth in the country. His successful leadership at IMM Investment, where he headed the infrastructure investment division, and his previous roles at the International Finance Corporation (IFC) have equipped him with a comprehensive understanding of alternative asset classes and portfolio management. Mr. Cho's appointment will synergize Gaw Capital's infrastructure investment strategies and contribute to the firm's expansion into new sectors.

Ms. Elizabeth Di Cioccio, joining as the Managing Director – Capital Markets, EMEA, brings nearly 20 years of experience and a proven track record of success in capital markets to Gaw Capital. Prior to joining Gaw Capital, Ms. Di Cioccio served as the Head of Middle East and Managing Director at KKR & Co. Inc (KKR), overseeing KKR's business in the Middle East with a focus on raising capital from GCC-based sovereign wealth funds (SWFs) and other government and institutional clients. With her expertise, Elizabeth will be responsible for Gaw Capital's capital markets division in the EMEA region, driving strategic initiatives and continue to foster our key relationships. Her appointment will enhance the firm's presence in the EMEA region and contribute to its overall growth.

Kenneth Gaw, President & Managing Principal at Gaw Capital Partners, said, "We are delighted to welcome Mr. HyunChan Cho to Gaw Capital Partners as our Head of Infrastructure and Head of Korea. Mr. Cho's deep industry knowledge and strategic acumen make him the ideal candidate to lead our infrastructure investment initiatives in all markets, as well as drive the firm's overall growth in the Korean market. With his expertise across alternative asset classes, including infrastructure, growth capital and venture capital, we are confident his joining will help us further achieve our corporate strategic goals."

Christina Gaw, Managing Principal, Global Head of Capital Markets, and Co-Chair of Alternative Investments at Gaw Capital Partners, said, "We would like to extend a big welcome to Elizabeth to our Capital Markets team. I have known Elizabeth personally for over a decade and have great respect for her work in our industry. We believe Ms. Di Cioccio's remarkable capital raising experience, coupled with her strong leadership skills, make her a valuable addition to Gaw Capital and will contribute to our continued growth in the EMEA region private markets, infrastructure sector and beyond. Leveraging Ms. Di Cioccio's extensive experience and industry acumen, we are poised to unlock exciting opportunities and deliver long-term value to our investors."

With a strong commitment to achieving sustainable growth, Gaw Capital Partners has been actively expanding its portfolio in the infrastructure sector and capitalizing on the growing opportunities in high-potential markets. The firm has robust plans to continue identifying and executing new investment opportunities, where Mr. Cho's and Ms. Di Cioccio's leadership will play a vital role in spearheading the firm's expansion efforts and cementing its position as a leading player in the market.

Hashtag: #GawCapitalPartners

The issuer is solely responsible for the content of this announcement.

About Gaw Capital Partners

Gaw Capital Partners is a uniquely positioned private equity fund management company focusing on real estate markets in Asia Pacific and other high barrier-to-entry markets globally.

Specializing in adding strategic value to under-utilized real estate through redesign and repositioning, Gaw Capital runs an integrated business model with its own in-house asset management operating platforms in commercial, hospitality, property development, logistics, IDC and Education. The firm's investments span the entire spectrum of real estate sectors, including residential development, offices, retail malls, serviced apartments, hotels, logistics warehouses and IDC projects.

Gaw Capital has raised seven commingled funds targeting the APAC region since 2005. The firm also manages value-add/opportunistic funds in the US, a Pan-Asia hospitality fund, a European hospitality fund, a Growth Equity Fund and it also provides services for credit investments and separate account direct investments globally.

Gaw Capital has raised equity of US$22.5 billion since 2005 with assets of US$35.9 billion under management as of Q4 2023.