Reserve Bank Governor not for turning. No rate hike until unemployment near 4.5%

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

Reserve Bank governor Philip Lowe’s message to the nation today through the National Press Club is that he means it.

He isn’t intending to push up interest rates – he most probably isn’t intending to even think about pushing up interest rates – until 2024, at the earliest.

That’s a full three years from now, at a time when, maybe, inflation will be strong enough to be “sustainably within[1]” the Reserve Bank’s target band.

That’s the new benchmark, adopted by the bank in November[2].

It replaced an earlier loophole-ridden benchmark of “progress towards” an inflation rate of 2% to 3%, something that could have meant almost anything.

The bank will now need to see actual, sustainable, inflation of 2% to 3%, something those of us wanting some inflation haven’t seen for a decade.

Ultra-low rates til unemployment hits 4.5%

After the press club event I asked him what sort of unemployment rate we would need to see for that to happen. Was it still the 4.5%[3] the bank has nominated in the past, or had COVID pushed it up? Might less ambitious progress on unemployment do the trick?

He told he thought not. While it is impossible to be sure, something seemed to have changed around the world over the past ten years meaning it has become much harder to create inflation. He doubted whether an unemployment rate above 4.5% could do the trick.

Read more: The Reserve Bank might yet go negative[4]

Lowe told the press club that while unemployment had come down far more quickly than the bank expected when it produced its previous set of forecasts in November, its new forecasts had unemployment slipping only from 6.6% to 6% over the course of this year, and then taking another 18 months to reach 5.25%

An unemployment rate below 5% is beyond the bank’s forecasting horizon.

That’s why it has undertaken to buy as many government bonds as are needed to keep the three-year bond rate at the bank’s current cash rate[5] target of 0.10%, to make it clear that the cash rate will “be where it is for the next three years[6]”.

‘Creating money electronically’

And there’s another reason for buying government bonds – to restrain the Australian dollar. On Tuesday Lowe announced plans to use a separate program to buy an additional A$100 billion[7] of bonds between April and September.

Combined, the two bond-buying programs will depress Australian long-term interest rates and make foreigners less likely to buy Australian dollars to take advantage of higher rates here than overseas.

Asked directly whether the bank was printing money in order to buy government bonds, Lowe said it was, with the caveat that the modern way of doing things means the bank “creates the money electronically[8]”.

Read more: A little ray of sunshine as 2021 economic survey points to brighter times ahead[9]

While Lowe accepts that the JobKeeper wage subsidy will end at the end of March (“the government made it clear this was a temporary program”) he is extremely keen for governments at all levels to keep spending on infrastructure, saying if weren’t for public projects, non-mining investment would be bad indeed.

While the economy is recovering, and the bank is forecasting slightly stronger economic growth than The Conversation forecasting panel[10] of 3.5% this year and the next, the economy is unlikely to return to the trajectory it was on before the crisis, perhaps ever.

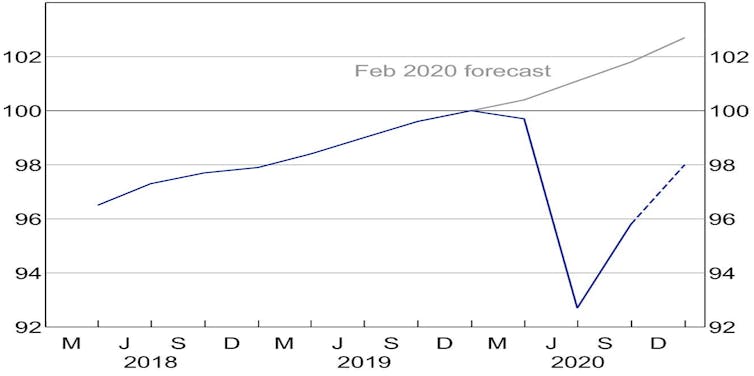

Reserve Bank GDP forecasts, February 2021 and February 2020

Index numbers, December 2019 = 100. RBA, ABS[11]

Index numbers, December 2019 = 100. RBA, ABS[11]

The bank is envisaging an economy 4% smaller than it would have been. As Lowe put it: “it’s a big number, there’s a big gap there”.

The governor isn’t worried by a likely “blip” in unemployment when JobKeeper comes off in March, but he is worried about what will happen to employment beyond that. The unemployment rate is “higher today than it has been for almost two decades and many people can’t get the hours of work they want”.

Even when the unemployment rate was low (in NSW it got “as it was in 1973” before the crisis) wage growth was weak.

JobSeeker a"fairness issue"

It would help to permanently lift the rate of the JobSeeker unemployment benefit on which a million Australians rely and which is due to return to the poverty-line level of $40 per day in April, although Lowe sees that not so much as an economic question but as a “fairness issue”.

“Different people legitimately have different views on the level of support stopping - my own view is that some increase is justifiable,” he told the press.

Read more: Vital Signs: Any talk about raising interest rates is a huge mistake[12]

The levers he can control, interest rates, will say low for as long as is necessary.

He isn’t “guaranteeing” to keep them low until 2024 or beyond, but he is guaranteeing to keep them low until inflation is sustainably near 3%, something he doesn’t think will happen until unemployment touches 4.5%, something he thinks is most unlikely to happen before 2024.

“I’m not pledging”, he told the national press, “but I am giving you my best guess”.

References

- ^ sustainably within (www.rba.gov.au)

- ^ in November (theconversation.com)

- ^ 4.5% (www.rba.gov.au)

- ^ The Reserve Bank might yet go negative (theconversation.com)

- ^ cash rate (theconversation.com)

- ^ be where it is for the next three years (www.tveeder.com)

- ^ additional A$100 billion (www.rba.gov.au)

- ^ creates the money electronically (www.tveeder.com)

- ^ A little ray of sunshine as 2021 economic survey points to brighter times ahead (theconversation.com)

- ^ The Conversation forecasting panel (theconversation.com)

- ^ RBA, ABS (www.rba.gov.au)

- ^ Vital Signs: Any talk about raising interest rates is a huge mistake (theconversation.com)

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University