why these budget numbers will get worse

- Written by Warren Hogan, Industry Professor, University of Technology Sydney

Thursday’s economic statement is the government’s first attempt to quantify the impact of the coronavirus pandemic on government finances and should be treated with caution.

The near A$300 billion[1] hit to government finances over two years is, as the treasurer says “eye-watering”, but that forecast is as good as it’s going to get.

In all likelihood the impact of the virus on the economy and government finances will be much worse. The health crisis will most likely take longer than assumed to get on top of and the economic recovery will take more government policy than assumed to get out of.

We should be prepared for much bigger deficits than predicted this financial year and potentially a very large deficit once again in 2021-22.

Read more: Five things you need to know about today’s economic statement[2]

This is fine. With government debt projected to rise to 45% of GDP over the year ahead, we’ve still plenty of “fiscal space”; that is, room for the government to spend more in order to ensure a recovery.

The average debt level across members of the Organisation for Economic Co-operation and Development is 100% of GDP.

Optimistic about both health and the economy

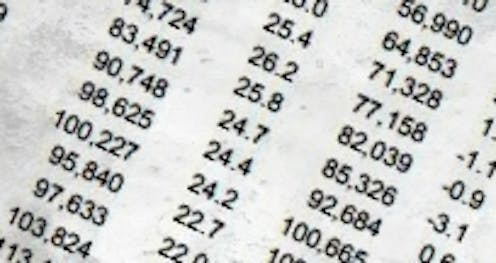

The statement reveals the pandemic knocked $33 billion off budget revenues last financial year and should knock $56 billion off this financial year.

The cost of the emergency measures is even bigger, $58 billion last financial year and $118 billion this financial year. The result is a $90 billion budget deterioration in 2019-20 followed by a $190 billion deterioration in 2020-21, a total of about $300 billion.

That’s the relatively good news. The bad news is these numbers are based on something close to a best-case scenario. If they change, there is very little chance it will be for the better. We would need to see something like a near-immediate discovery of a vaccine and its distribution within months.

Read more: These budget numbers are shocking, and there are worse ones in store[3]

The list of things that could go wrong is much longer, chief among them continued outbreaks and lockdowns like the one in Melbourne and worse news from overseas.

Treasury’s assumptions include:

an end to all domestic restrictions including the four square metre rule by the end of the year

an end to Melbourne’s lockdown after six weeks followed by a staged re-opening

no reimposed restrictions in other states

international borders gradually opened from January and fully opened by next July.

Given these assumptions, the short-term economic forecasts are reasonable and not too far out of line with what would be the consensus of economists.

They include a 7% drop in GDP in the three months to June followed by a 1.5% rebound in the three months to September and gradual improvements after that. The unemployment rate is expected to peak at (only) 9.25% within months.

Read more: Budget deficit to hit $184.5B this financial year, unemployment to peak at 9.25% in December: economic statement[4]

But unemployment typically peaks at about 11% in a recession, and the government itself has said that taking hidden employment into account the rate is probably closer to 13%.

With the virus running riot across the Americas and surging in Africa the downside risks outweigh the others. The treasury forecasts eschew the traditional approach of charting a middle path through upside and downside risks.

But finances aren’t a problem

The update is telling us the pandemic will cost the government about $300 billion over the two years.

The eventual number is likely to be much higher, by 2022 probably closer to half a trillion dollars. It is a perfectly reasonable sum.

Read more: Frydenberg's three-stage economic recovery is abominably hard to get right[5]

Even if the deficits and debt associated with the pandemic end up being twice what the government is projecting our government debt will still be just over 60% of GDP, a level that would be the envy of most other countries, many of which don’t have the potential to grow and recover that Australia does.

For our government, the investment is well worth the money.

References

- ^ A$300 billion (budget.gov.au)

- ^ Five things you need to know about today’s economic statement (theconversation.com)

- ^ These budget numbers are shocking, and there are worse ones in store (theconversation.com)

- ^ Budget deficit to hit $184.5B this financial year, unemployment to peak at 9.25% in December: economic statement (theconversation.com)

- ^ Frydenberg's three-stage economic recovery is abominably hard to get right (theconversation.com)

Authors: Warren Hogan, Industry Professor, University of Technology Sydney