Be careful what you claim for when working from home. There are capital gains tax risks

- Written by Dale Boccabella, Associate Professor of Taxation Law, UNSW

Nearly all of the income tax focus in the context of “working from home” during COVID-19 has been on claiming “running expenses[1]” – things like electricity, heating and internet/broadband fees.

These are pretty straightforward.

The Australian Tax Office released a temporary shortcut[2] for claiming running expenses to make it easier: it’s 80 cents for each hour you work from home between March and July.

At the same time, it has made the brief comment that employees generally cannot claim “occupancy expenses[3]” as deductions. Occupancy expenses are things like interest on housing loans, rent, council rates, building insurance and similar things.

These would be deductible if you were running a business from home, but generally should not be if you are merely working from home for an employer that normally provides you with a place to work.

Claim running expenses, not occupancy expenses

Occupancy expenses are usually far bigger than running expenses and their deductibility assumes considerable importance to government revenue, and to people who claim them.

And there’s something else about them.

The capital gains tax exemption for the gain on sale of the family home (the main residence) is linked to them; in particular to the deductibility of interest expenses[4].

If a taxpayer is entitled to deductions for interest on the home loan, she can lose a portion of her capital gains tax exemption.

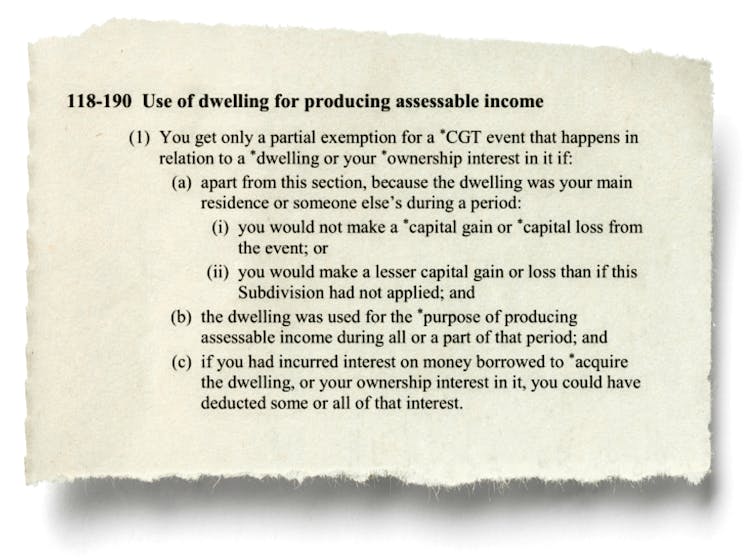

Section 118.190 Commonwealth Income Tax Assessment Act[5]

In effect, the tax benefit from deductibility is offset or clawed back through denial of the full capital gains tax exemption later on.

Of course, if there is no immediate prospect of the sale of the home, then to many people the loss of the full capital gains tax exemption won’t be of much concern.

Try not to put capital gains into play

An interesting, perhaps strange[6], aspect of this part of the rules is a homeowner can lose part of their capital gains tax exemption even when they don’t have interest to deduct (such as when they have paid off their home loan).

The relevant rule poses the question: would you have got interest deductions if you still had a loan on the home? If the answer is yes, the homeowner loses part of the capital gains tax exemption, even though the home owner did not in fact obtain tax deductions for interest.

There is a perception among some taxpayers, and perhaps some tax practitioners, that taxpayers have choices in this area, that it will help to say: “I will not claim my deductions, and therefore I get to keep my capital gains tax exemption.”

In short, there is no choice given to taxpayers in the relevant substantive tax rules. If the tax office knows you have used your home to earn an income, it has every right to deny you some capital gains tax benefits if and when you sell later on.

Not claiming deductions might not help

Of course, how taxpayers (possibly with help of tax agent) fill in their tax returns is their choice; they can decide to depart from the law, assuming they know how it applies in their situation. In turn, whether ATO audit coverage is sufficient to pick up incorrect tax returns depends on a range of factors.

What could be a disastrous outcome for a taxpayer would be to forgo a deduction (when entitled to it), but later on sale, have the ATO apply the capital gains tax rule correctly and withdraw part of the capital gains tax exemption.

If the taxpayer was out of time to amend (or make) their deduction claim, they would suffer both ways.

The other issue with occupancy expense deductions is that if there is “financial union” in the finances of spouses, the spouse entitled to occupancy expenses may only be entitled to 50% of the relevant expenses because the other 50% is incurred by the other spouse.

Regrettably, legal cases and the tax office itself have not dealt with this issue in a meaningful way.

There’s a high bar for occupancy expenses

The central question therefore becomes whether a worker’s situation of working at home could be sufficient to attract deductions for occupancy expenses.

The courts and the Administrative Appeals Tribunal (AAT) have set the bar very high. Let’s put aside for the moment the situation of the mere contemplative worker[7] who needs little equipment to work, other than perhaps a laptop computer.

There are two requirements; both must be satisfied.

First, the room claimed for occupancy expenses must be used extensively and systematically for taxpayer’s work. Some cases have put this requirement in terms of near exclusive use for work such that the taxpayer and family have forgone domestic use of that room and/or that the room is not readily adaptable back to domestic use. Minimal domestic use (such as storing some clothes in room, thoroughfare to rest of home) will not preclude satisfying the usage requirement.

This usage requirement will be enough to deny deductions to many COVID-19 at-home workers because many are working in bedrooms, lounge rooms, dining rooms and so on.

Read more:

Mortgage deferral, rent relief and bankruptcy: what you need to know if you have coronavirus money problems[8]

Those who choose to “run the risk” of satisfying deductibility for occupancy expenses and thereby losing part of the capital gains tax exemption might consider retaining a significant degree of domestic use of the relevant room.

(Renters, not being owners, have no capital gains tax cost down the track so obtaining deductions for occupancy expenses would be a win with no accompanying loss.)

Assuming the usage requirement is met, the second criterion is the requirement that the home office is not just a mere convenient place to work. This has come to mean that the home office is needed as a place of necessity because the worker does not have anywhere else to carry out their work and/or the employer does not provide a work location.

A worker who has been lawfully directed, due to COVID-19, that they cannot work at the normal employer-provided premises must be taken to satisfy this second criterion; that working at home is a necessity and not for the mere convenience of the taxpayer.

It’s hard to claim a place for contemplation

What about the mere contemplative worker, the one who needs very little equipment or items to carry out their work, perhaps just a laptop computer and a range of hard-copy documents.

There is little to no guidance in the cases on this. However, it’s likely if a worker is a mere contemplative worker, that person cannot deduct occupancy expenses even if there is extensive use of a room.

The reasoning is likely to be that the worker could work in many places (such as a lounge room, public library, café) without compromising their quality of work.

Read more:

About that spare room: employers requisitioned our homes and our time[9]

The room in the home they are working in does not have that degree of necessity about it and/or working in that room might have a high degree of mere convenience. It is also likely that aspects of the “usage criterion” will be drawn on to help deny the deduction (such as that the room has not lost its domestic character).

In the end, a court or the Administrative Appeals Tribunal will have to rule on at least one COVID-19 case. It is hoped that the case(s) are roughly representative of workers more generally so serve as guidance.

As well, some authoritative ruling on the mere contemplative worker would be very welcome, even for a post-COVID-19 world.

The commentary in this article is largely based on two articles by Dale Boccabella and Kathrin Bain, namely, The age of the home worker - part 1: deductibility of home occupancy expenses[10] (2018) and The age of the home worker - part 2: calculation of home occupancy expense deductions, deduction apportionment and partial loss of CGT main residence exemption[11] (2019), both in Australian Tax Forum.

Section 118.190 Commonwealth Income Tax Assessment Act[5]

In effect, the tax benefit from deductibility is offset or clawed back through denial of the full capital gains tax exemption later on.

Of course, if there is no immediate prospect of the sale of the home, then to many people the loss of the full capital gains tax exemption won’t be of much concern.

Try not to put capital gains into play

An interesting, perhaps strange[6], aspect of this part of the rules is a homeowner can lose part of their capital gains tax exemption even when they don’t have interest to deduct (such as when they have paid off their home loan).

The relevant rule poses the question: would you have got interest deductions if you still had a loan on the home? If the answer is yes, the homeowner loses part of the capital gains tax exemption, even though the home owner did not in fact obtain tax deductions for interest.

There is a perception among some taxpayers, and perhaps some tax practitioners, that taxpayers have choices in this area, that it will help to say: “I will not claim my deductions, and therefore I get to keep my capital gains tax exemption.”

In short, there is no choice given to taxpayers in the relevant substantive tax rules. If the tax office knows you have used your home to earn an income, it has every right to deny you some capital gains tax benefits if and when you sell later on.

Not claiming deductions might not help

Of course, how taxpayers (possibly with help of tax agent) fill in their tax returns is their choice; they can decide to depart from the law, assuming they know how it applies in their situation. In turn, whether ATO audit coverage is sufficient to pick up incorrect tax returns depends on a range of factors.

What could be a disastrous outcome for a taxpayer would be to forgo a deduction (when entitled to it), but later on sale, have the ATO apply the capital gains tax rule correctly and withdraw part of the capital gains tax exemption.

If the taxpayer was out of time to amend (or make) their deduction claim, they would suffer both ways.

The other issue with occupancy expense deductions is that if there is “financial union” in the finances of spouses, the spouse entitled to occupancy expenses may only be entitled to 50% of the relevant expenses because the other 50% is incurred by the other spouse.

Regrettably, legal cases and the tax office itself have not dealt with this issue in a meaningful way.

There’s a high bar for occupancy expenses

The central question therefore becomes whether a worker’s situation of working at home could be sufficient to attract deductions for occupancy expenses.

The courts and the Administrative Appeals Tribunal (AAT) have set the bar very high. Let’s put aside for the moment the situation of the mere contemplative worker[7] who needs little equipment to work, other than perhaps a laptop computer.

There are two requirements; both must be satisfied.

First, the room claimed for occupancy expenses must be used extensively and systematically for taxpayer’s work. Some cases have put this requirement in terms of near exclusive use for work such that the taxpayer and family have forgone domestic use of that room and/or that the room is not readily adaptable back to domestic use. Minimal domestic use (such as storing some clothes in room, thoroughfare to rest of home) will not preclude satisfying the usage requirement.

This usage requirement will be enough to deny deductions to many COVID-19 at-home workers because many are working in bedrooms, lounge rooms, dining rooms and so on.

Read more:

Mortgage deferral, rent relief and bankruptcy: what you need to know if you have coronavirus money problems[8]

Those who choose to “run the risk” of satisfying deductibility for occupancy expenses and thereby losing part of the capital gains tax exemption might consider retaining a significant degree of domestic use of the relevant room.

(Renters, not being owners, have no capital gains tax cost down the track so obtaining deductions for occupancy expenses would be a win with no accompanying loss.)

Assuming the usage requirement is met, the second criterion is the requirement that the home office is not just a mere convenient place to work. This has come to mean that the home office is needed as a place of necessity because the worker does not have anywhere else to carry out their work and/or the employer does not provide a work location.

A worker who has been lawfully directed, due to COVID-19, that they cannot work at the normal employer-provided premises must be taken to satisfy this second criterion; that working at home is a necessity and not for the mere convenience of the taxpayer.

It’s hard to claim a place for contemplation

What about the mere contemplative worker, the one who needs very little equipment or items to carry out their work, perhaps just a laptop computer and a range of hard-copy documents.

There is little to no guidance in the cases on this. However, it’s likely if a worker is a mere contemplative worker, that person cannot deduct occupancy expenses even if there is extensive use of a room.

The reasoning is likely to be that the worker could work in many places (such as a lounge room, public library, café) without compromising their quality of work.

Read more:

About that spare room: employers requisitioned our homes and our time[9]

The room in the home they are working in does not have that degree of necessity about it and/or working in that room might have a high degree of mere convenience. It is also likely that aspects of the “usage criterion” will be drawn on to help deny the deduction (such as that the room has not lost its domestic character).

In the end, a court or the Administrative Appeals Tribunal will have to rule on at least one COVID-19 case. It is hoped that the case(s) are roughly representative of workers more generally so serve as guidance.

As well, some authoritative ruling on the mere contemplative worker would be very welcome, even for a post-COVID-19 world.

The commentary in this article is largely based on two articles by Dale Boccabella and Kathrin Bain, namely, The age of the home worker - part 1: deductibility of home occupancy expenses[10] (2018) and The age of the home worker - part 2: calculation of home occupancy expense deductions, deduction apportionment and partial loss of CGT main residence exemption[11] (2019), both in Australian Tax Forum.

References

- ^ running expenses (www.smh.com.au)

- ^ shortcut (www.ato.gov.au)

- ^ occupancy expenses (www.ato.gov.au)

- ^ deductibility of interest expenses (www5.austlii.edu.au)

- ^ Section 118.190 Commonwealth Income Tax Assessment Act (www5.austlii.edu.au)

- ^ perhaps strange (www.taxinstitute.com.au)

- ^ contemplative worker (papers.ssrn.com)

- ^ Mortgage deferral, rent relief and bankruptcy: what you need to know if you have coronavirus money problems (theconversation.com)

- ^ About that spare room: employers requisitioned our homes and our time (theconversation.com)

- ^ The age of the home worker - part 1: deductibility of home occupancy expenses (www.taxinstitute.com.au)

- ^ The age of the home worker - part 2: calculation of home occupancy expense deductions, deduction apportionment and partial loss of CGT main residence exemption (www.taxinstitute.com.au)

Authors: Dale Boccabella, Associate Professor of Taxation Law, UNSW