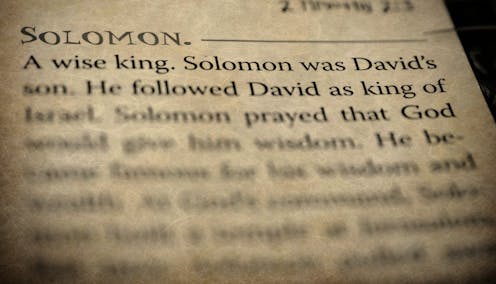

Borrowing from King Solomon, economists are getting closer to working out how good leaders can make good decisions

- Written by Richard Holden, Professor of Economics, UNSW

Here’s a story from the Bible. As far as I know, it’s the first reported instance of the branch of economics known as “implementation theory”.

It’s from the First Book of Kings, Chapter 3, starting at Verse 16[1].

Two women came before King Solomon with two babies, one dead and one alive.

Each claimed the live boy was her son, and the dead boy belonged to the other.

Then the king said, “Bring me a sword.” So they brought a sword for the king. He then gave an order: “Cut the living child in two and give half to one and half to the other.”

The woman whose son was alive was deeply moved out of love for him and said to the king, “Please, my lord, give her the living baby, don’t kill him!”

The other said, “neither I nor you shall have him, cut him in two!”