What is an ETF? And why is it driving Bitcoin back to record high prices?

- Written by John Hawkins, Senior Lecturer, Canberra School of Politics, Economics and Society and NATSEM, University of Canberra

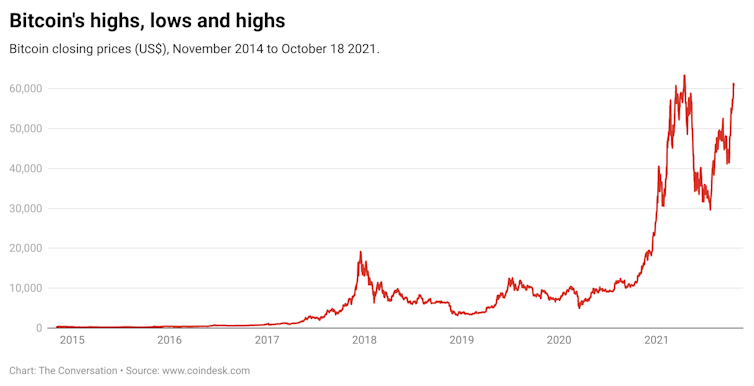

The Bitcoin bulls are racing again. A year ago the cryptocurrency was valued at less than US$12,000. Now it has passed the symbolic milestone of US$60,000, nudging the US$63,255 record it reached in mid-April, before its price fell to as low as US$30,000 in July.

Bitcoin’s rally over the past month is largely attributed[1] to speculation the US Securities and Exchange Commission is poised to approve[2] an exchange-traded fund, or ETF, based on Bitcoin futures.

So what is an ETF, and why does this matter to the value of Bitcoin?