A dedicated time to elevate awareness of cardiovascular wellbeing and support healthier lifestyles...

New evidence layer and UK acquisition expand Heidi’s role across the clinical workflow

Heidi, the...

Movement, mindfulness and hands-on rituals anchor a renewed wellness focus at OUTRIGGER Maldives Maa...

TasPorts will begin a major maintenance dredging campaign at the Port of Devonport next week, su...

At least 20,000[1] Australian women are diagnosed with breast cancer each year. And more than ...

An ACT Ombudsman report has found that Housing ACT tenants have been left waiting in unsafe and haza...

If you're looking for a reliable steam mop that can handle both everyday spills and stubborn stains ...

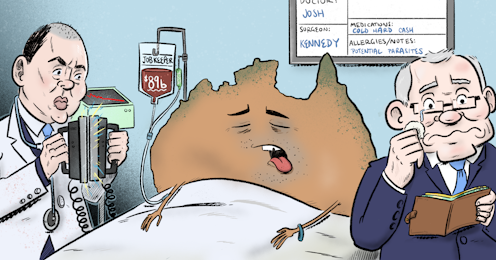

Inflation in Australia and globally has surged to multi-decade highs since 2021, driven by pande...

The war in the Middle East is not a distant geopolitical event for Australia. In an interconnect...