More than banking done right, consumer data rights are set to transform our lives

- Written by Ross Buckley, Professor, Faculty of Law, UNSW

There’s a revolution under way in commerce. Within five years, the consumer data right will have transformed competition and simplified the way we live.

Yet most of us know little about it, or think it is restricted to banking.

It’s the brainchild of former Productivity Commission chief Peter Harris[1] and Scott Morrison when he was treasurer.

Read more: How open banking could transform financial services[2]

The Productivity Commission was asked to inquire into the use of big data.

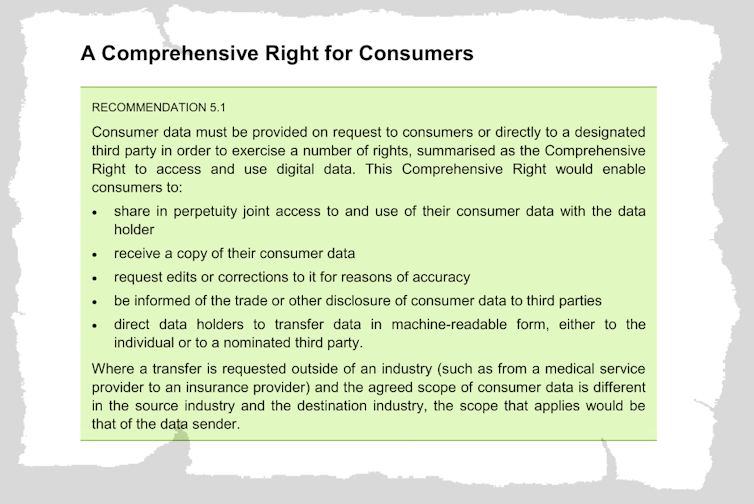

It made all sorts of recommendations about how the government could use data better, but only after first delivering an overarching recommendation[3] that would deliver ownership of consumer data to the consumers who provided it.

Productivity Commission, Data Availability and Use, Final Report 2017

The recommendation would give consumers and businesses not just theoretical ownership of the data they gave to other businesses, but also practical access in the form of machine-readable code[4] that they could take to a competitor or a firm that would help them pick a better service provider.

Productivity Commission, Data Availability and Use, Final Report 2017

The recommendation would give consumers and businesses not just theoretical ownership of the data they gave to other businesses, but also practical access in the form of machine-readable code[4] that they could take to a competitor or a firm that would help them pick a better service provider.

On request, firms such as Spotify would have to hand over your history to competitors.

It’s easy to see how it will work for music streaming.

A customer might want to switch to another service, but would find it hard because the one they were with had years of their data — favourites, playlists etc.

Under the legislation that flowed from the report, the old provider would have to provide the information in machine-readable code to the new one to make the transition effortless.

Or the consumer could take their data to a service which would analyse their listening history and determine the right provider for them.

The right has first been rolled out to banking, where it is called Open Banking[5].

Since July 2020 bank customers have been able to give permission to accredited third parties to access their savings and credit card data.

Since November customers have also been able to give permission to accredited third parties to access mortgage, personal loan and joint bank account data.

It’ll help customers search for better deals and keep track of their finances.

Firms will no longer own customers data

Historically, banks thought of this information as their data, inside knowledge about their customers that gave them an edge on the competition.

Progress has been slow for two reasons, both of them good ones.

One is that the government is insisting that industry determines the standards on which the regime will run. This will help. Government-mandated standards don’t often work well.

The other reason, learnt the hard way from the less than perfect introduction of My Health Record[6] is that data reforms need to be done right, the first time. If there are data leaks, from one provider to another, trust will evaporate.

Read more:

Soft terms like 'open' and 'sharing' don't tell the true story of your data[7]

The choice of banking to start the rollout has clouded the message.

It has meant that where people know about the new right at all, many think it is limited to banking. But in time it will apply almost everywhere — to energy, communications, superannuation among other services.

To my mind energy provides an even better example of the power of the reform than banking. I pay too much for my electricity, yet every time someone rings to offer me a better energy plan, I say no. I am usually too busy and it would take time to compare the offers.

Switching providers might be as simple as a click

But once the consumer data right is in place, I won’t have to do that maths. I will be able to simply click on a button on a website or email to direct my data to the other supplier. That supplier will be able to set out what I am paying today against what I would be paying if I switched. The same with mobile phone plans.

I won’t even need to contact my old provider to switch. This will deny my old provider the opportunity to reclaim me by offering a better deal when I call to cancel my contract. It will be too late. My current provider will be forced to treat me fairly upfront – or risk losing me.

Firms might have treat their customers well

Banks today routinely offer new customers better terms than existing customers.

Thirty years ago most Australian businesses thought charging existing customers more than new customers was unfair. Those standards have fallen away.

In many contexts, the consumer data right will bring them back.

It’s a work in progress, but it is set to improve our lives and the services we use for decades to come.

On request, firms such as Spotify would have to hand over your history to competitors.

It’s easy to see how it will work for music streaming.

A customer might want to switch to another service, but would find it hard because the one they were with had years of their data — favourites, playlists etc.

Under the legislation that flowed from the report, the old provider would have to provide the information in machine-readable code to the new one to make the transition effortless.

Or the consumer could take their data to a service which would analyse their listening history and determine the right provider for them.

The right has first been rolled out to banking, where it is called Open Banking[5].

Since July 2020 bank customers have been able to give permission to accredited third parties to access their savings and credit card data.

Since November customers have also been able to give permission to accredited third parties to access mortgage, personal loan and joint bank account data.

It’ll help customers search for better deals and keep track of their finances.

Firms will no longer own customers data

Historically, banks thought of this information as their data, inside knowledge about their customers that gave them an edge on the competition.

Progress has been slow for two reasons, both of them good ones.

One is that the government is insisting that industry determines the standards on which the regime will run. This will help. Government-mandated standards don’t often work well.

The other reason, learnt the hard way from the less than perfect introduction of My Health Record[6] is that data reforms need to be done right, the first time. If there are data leaks, from one provider to another, trust will evaporate.

Read more:

Soft terms like 'open' and 'sharing' don't tell the true story of your data[7]

The choice of banking to start the rollout has clouded the message.

It has meant that where people know about the new right at all, many think it is limited to banking. But in time it will apply almost everywhere — to energy, communications, superannuation among other services.

To my mind energy provides an even better example of the power of the reform than banking. I pay too much for my electricity, yet every time someone rings to offer me a better energy plan, I say no. I am usually too busy and it would take time to compare the offers.

Switching providers might be as simple as a click

But once the consumer data right is in place, I won’t have to do that maths. I will be able to simply click on a button on a website or email to direct my data to the other supplier. That supplier will be able to set out what I am paying today against what I would be paying if I switched. The same with mobile phone plans.

I won’t even need to contact my old provider to switch. This will deny my old provider the opportunity to reclaim me by offering a better deal when I call to cancel my contract. It will be too late. My current provider will be forced to treat me fairly upfront – or risk losing me.

Firms might have treat their customers well

Banks today routinely offer new customers better terms than existing customers.

Thirty years ago most Australian businesses thought charging existing customers more than new customers was unfair. Those standards have fallen away.

In many contexts, the consumer data right will bring them back.

It’s a work in progress, but it is set to improve our lives and the services we use for decades to come.

References

- ^ Peter Harris (www.smh.com.au)

- ^ How open banking could transform financial services (theconversation.com)

- ^ overarching recommendation (www.pc.gov.au)

- ^ machine-readable code (www.cdr.gov.au)

- ^ Open Banking (www.ausbanking.org.au)

- ^ My Health Record (www.theguardian.com)

- ^ Soft terms like 'open' and 'sharing' don't tell the true story of your data (theconversation.com)