Australia’s tax system is being weaponised against victims of domestic abuse. Here’s how

- Written by Ann Kayis-Kumar, Founding Director of UNSW Tax and Business Advisory Clinic, UNSW Sydney

When women seeking financial help from the government-funded UNSW Tax and Business Advisory Clinic[1] are asked whether they have ever been affected by family or domestic violence, most say they have.

In the past year this number has grown from 65%[2] to over 80%.

And about 14%[3] of the clinic’s clients say their tax debts are a result of intimate partner violence. These debts often arise from business debts, bankruptcy, corporate directorships and director penalty notices.

We know that economic abuse is a red flag for other forms of domestic violence. Economic abuse occurs in nearly all Australian domestic and family violence cases, affecting more than 2.4 million Australians[4] and costing the economy an estimated A$10.9 billion[5] a year.

Unfortunately, existing laws fall well short of protecting abuse victim-survivors from financial loss.

How violent partners weaponise tax

The perpetrators of violence can effectively weaponise the tax system by placing tax debts solely in the names of former partners, often because they have made them directors of companies or through family businesses operating through partnerships or trusts.

There is a policy assumption that family members benefit from family partnerships.

But this does not always hold in practice and can be problematic when there is economic abuse because Australian tax law requires victims report and pay tax on their “share” of the family partnership’s income.

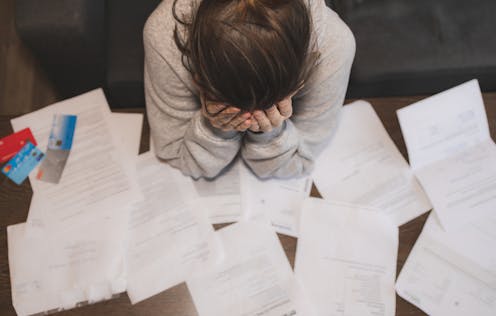

The average tax debt at the tax clinic is about $90,000. This can result in debilitating financial burdens, exhausted savings, insecure housing and prolonged economic instability, well after abusive relationships end.

Change is needed

Australia has no specific strategy for relief of tax debts caused by financial abuse. There are “serious hardship” provisions in Australian taxation law, but these are outdated and in need of reform[6].

Usually people do not have the funds up front so the only way the Australian Taxation Office can collect debts from the abused partner is through (generally two-year) payment plans, offsetting future tax refunds, engaging external debt collectors and initiating bankruptcy proceedings.

To that end, the decision announced in this year’s budget to give the Tax Commissioner discretion not to offset[8] against tax returns debts previously placed “on hold” is welcome.

It will provide short-term relief by enabling abuse victims to get their refunds instead of having it used by the Tax Office to reduce their debt.

Colleagues Christine Speidel, Leslie Book and I want this power extended to all forms of tax debts[9] not just for tax debts that have been placed “on hold” especially where the taxpayer is known to have experienced financial abuse.

But this wouldn’t go far enough – the victim-survivors would still have the perpetrator’s tax debt hanging over them.

Where this happens, financial instability can drive women back[10] into abusive relationships.

The US shows what can be done

Legislative reform to shift tax liability from abuse survivors to perpetrators is the key to helping solve the problem.

The United States has offered some form of “innocent spouse relief[12]” since 1971. In 2011 it widened eligibility and removed a two-year time limit[13] for requesting relief.

It is important to understand the US provisions apply because the country offers jointly filed “married” tax returns. In Australia tax returns are filed by individuals.

Australia’s laws would need to change to ensure abused women do not find themselves jointly liable. Any changes should also include debts incurred in the name of partnerships and company directors.

The US is the first and only country to do this, largely because of the advocacy of US low-income tax clinics over decades. Australia now has such clinics, funded as part of the Tax Office National Tax Clinic Program[14].

Australia’s adoption of US-style rules could provide a model for other jurisdictions, increase tax debt collection (as perpetrators are likely to have better capacity to pay than victims) and foster greater confidence in the Tax Office.

Most importantly, it would acknowledge that victim-survivors with tax debts should not bear responsibility for debts incurred by perpetrators.

For information and advice about family and intimate partner violence contact 1800 RESPECT (1800 737 732[15]). If you or someone you know is in immediate danger, contact 000. The Men’s Referral Service (1300 766 491)[16] offers advice and counselling to men looking to change their behaviour.

References

- ^ Tax and Business Advisory Clinic (www.unsw.edu.au)

- ^ 65% (cdn.theconversation.com)

- ^ 14% (ssrn.com)

- ^ 2.4 million Australians (www.abs.gov.au)

- ^ A$10.9 billion (www.commbank.com.au)

- ^ reform (theconversation.com)

- ^ fizkes/Shutterstock (www.shutterstock.com)

- ^ not to offset (www.ato.gov.au)

- ^ forms of tax debts (papers.ssrn.com)

- ^ drive women back (www.commbank.com.au)

- ^ IRS (www.irs.gov)

- ^ innocent spouse relief (www.irs.gov)

- ^ removed a two-year time limit (www.irs.gov)

- ^ National Tax Clinic Program (www.ato.gov.au)

- ^ 1800 737 732 (www.1800respect.org.au)

- ^ 1300 766 491) (ntv.org.au)