The top 5 tips leading experts are giving Aussies right now to crack the hot property market

- Written by CEO of Lending at Aussie Home Loans, David Smith

5 TIPS TO BUY IN A COMPETITIVE PROPERTY MARKET

The Australian property market is very hot right now, and this is making it hard for home buyers to navigate and find the right home.

New research from leading mortgage broker Aussie, shows more than 1 in 2 Australian property buyers feel stuck on how to take the next step to achieve their property goals. This is despite feeling more optimistic than they did nine months ago, with 4 in 5 believing 2021 is a good year for their property plans (March 2021 80%; cf. June 2020 49%).

According to the research, over half (53%) say that market conditions are making them feel stuck, with 35% identifying competition in the market and 31% identifying not finding the right property as the reason for holding them back from achieving their housing goals.

Now, although the competitive market conditions may be disheartening and even overwhelming, there are still significant opportunities for first home buyers, movers, upgraders, downsizers and investors, but it’s important to do your homework and get organised in advance, so you’ll be ready to make your move.

If you are an aspiring property buyer and feel like your progress has been paralysed by the current market conditions, David Smith, CEO Lending at Aussie, has 5 tips that could help you achieve your property goals this year.

Know what your end goal is.

Are you looking to buy a home to live in, or are you just keen to get on the property ladder with an investment property? Before you start to look into purchasing a property, it’s important to set a clear goal for why you are purchasing it so, you can direct your search efforts. If you are not sure, check out different kinds of properties and even research around your desired locations to give you some direction.

You need to make sure that you are doing the right thing for you and that you are not just following the pack. It can be easy to get swept up in the search for a property so be mindful of your goals and don’t forget what you’re really in it for.

Understand your necessities and where you can compromise.

Determining your wants versus your needs is crucial because you won’t always be able to find the perfect property. Consider what your necessities are for the property and the neighbourhood, what are the non-negotiables, and what you could compromise on. Things to consider include the number of bedrooms, school catchments, and public transport access. Also consider what you may need in the future if you plan on living in the property for a long time.

Creating this list will help you determine what type of properties you should be looking for and if you can compromise, you will be able to act quickly when you come cross a property that might be right for you.

Do your homework and consider widening your search.

Finding where you could buy a property or where you want to live can be challenging when trying to align it with your goals, necessities, and what you can afford. With the current housing boom, this has created even more confusion, with over half (54%) of Australian property buyers saying that they don’t know what suburbs they can afford to buy in, and 2 in 5 (39%) are confused about the current house prices in their desired suburb.

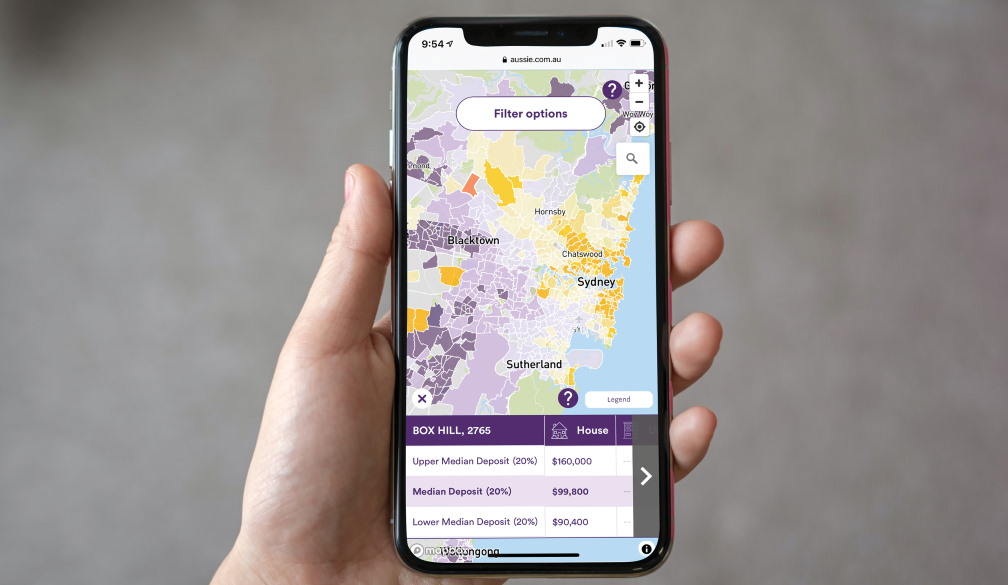

Researching the area that you want to buy in and inspecting as many properties as possible will help inform you with the values of properties in your preferred suburb or suburbs. If you are stuck, or not sure where to start Aussie’s Suburb Spotter Map can help you spot suburbs across Australia that you could buy in, based on the deposit amount. It is also worth considering widening your search because property prices may be more affordable a few suburbs out from your preferred location.

Find out how much you can borrow and afford.

Once you have done some research on your preferred suburbs and the ball park figure of the deposits required, the next step is to understand the amount you can borrow and more importantly can afford; as there are other costs to consider when purchasing a home like stamp duty, fees, and home loan repayments.

You can use an online home loan borrowing calculator as a guide, or you could ask your broker to help you assess your current situation and how much you could borrow. By knowing how much you can borrow and afford, you can tailor your search for a property accordingly, which could help avoid any disappointment or pressure.

Get pre-approval.

According to Aussie’s research, 2 in 3 (66%) buyers are missing out on properties because they were not ready and over half (52%) of Australian property buyers say they don’t know where to start when it comes to obtaining a pre-approval, despite a pre-approval providing an important head start in the current market, where houses are taking an average of just 36 days to sell.

As you begin to make some serious moves on your property search, you need to ensure you are ready to make offers when your dream property comes along. It takes time for lenders to assess home loan applications, so having pre-approval will allow you to confidently put in an offer or bid for a property. If you want to be on the front foot and are interested in getting pre-approval, an Aussie Broker can explain the process and help you obtain it.

About Aussie

Aussie was founded in 1992 and was widely credited for bringing competition to the Australian home lending industry. For nearly 30 years, Aussie Brokers have put progress within reach of more Australians, helping over 1.5 million customers with their home loan. Today, Aussie is part of the Lendi Group; and has the largest retail brokerage footprint across Australia. For more information about Aussie, please visit Aussie.com.au or call 13 13 33.

The research was commissioned by Aussie Home Loans and conducted by Lonergan Research in accordance with the ISO 20252 standard. Lonergan Research surveyed 2019 Australians 18+ who are planning to buy property in the next 18 months. Surveys were distributed throughout Australia including both capital city and non-capital city areas. The survey was conducted online amongst members of a permission-based panel, between 17 February and 10 March, 2021. After interviewing, data was weighted to the latest population estimates sourced from the Australian Bureau of Statistics.