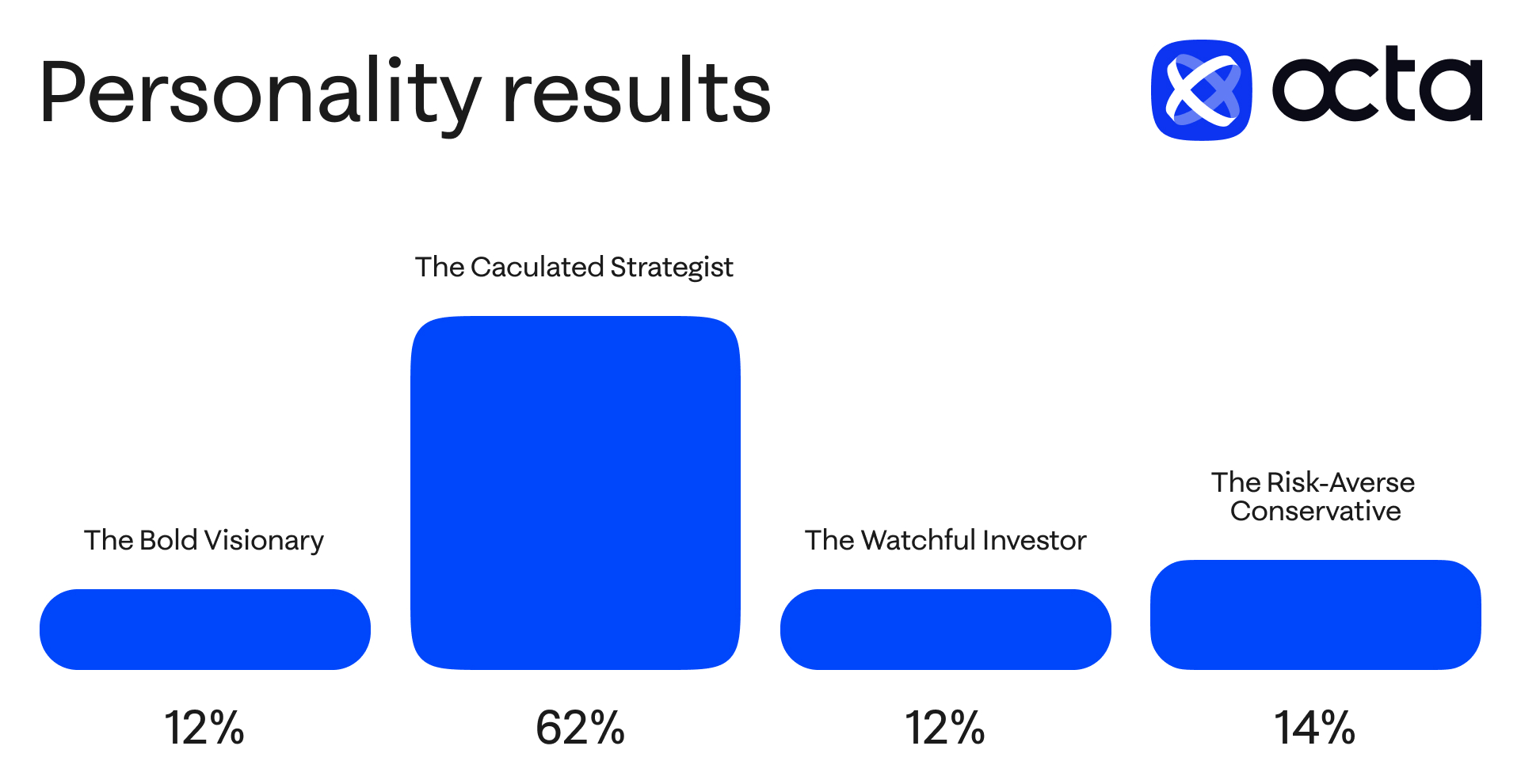

The Rise of the Calculated Strategist: 62% of Malaysian Traders Choose a Rational Investment Approach

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 10 April 2025 - A recent quiz conducted by global broker Octa and World of Buzz media discovered that 62% of Malaysian traders are 'calculated strategists'—investors who base their decisions on information, risk management, and long-term stability rather than emotional fluctuations.

This change in trading behaviour makes rational, strategic investing the new norm. In this article, Octa Broker, a broker with globally recognised licenses, shares the drivers of this rise of a more systematic approach among Malaysian traders.

Phenomenon of the ‘Calculated Strategists’

A calculated strategist is a trader who:

- Thinks about risk before making an investment decision.

- Relies on market analysis and facts, not emotions or guesses.

- Uses a systematic trading plan to attain long-term growth.

- Avoids making impulsive decisions in response to market fluctuations.

This distribution shows a clear shift towards analytical, strategic investment, with traders opting for stability over speculation. It indicates a budding investment mindset, where traders become more analytical and make decisions based on expert recommendations and market sentiments rather than impulses.

Drivers Behind the Rise of the Calculated Strategist

Several key reasons explain why Malaysian traders are turning towards a more analytical and rational trading approach.

1. Economic Uncertainty and Market Volatility

Global financial markets have been subject to greater uncertainty, ranging from inflation fears to geopolitical tensions. In such a climate, traders are more risk-averse, with risk management being preferred over speculation. The era of 'all-in' trading strategies ends as stability becomes the focus.

2. Access to Educational Resources

The availability of financial education has expanded through brokerage webinars, online courses, and expert commentary. Traders equipped with knowledge in risk management are more likely to build robust portfolios and avoid common trading pitfalls. This increased understanding leads to more thoughtful investment decisions.

The Driving Force of Preferring Strategy To Speculation in Malaysia

One of the biggest myths about trading is that it's a matter of luck or rampant speculation. But Malaysian traders are flipping that on its head, using a systematic approach grounded in market savvy rather than gut reaction.

Instead of seeking rapid gains, traders base their decisions on expert analysis, financial information, and trends. Most traders follow a 'trend-based strategy'—using market signals not as triggers for reckless trades but as opportunities to refine their long-term strategy.

The rise of trading communities and learning forums has further cemented this phenomenon. Traders no longer rely on gut feel; instead, they are combining systematic methods, risk assessment, and expert-backed opinions to trade volatile markets with confidence. This move towards intelligent, calculated decision-making is a move away from risk-taking speculation and towards intelligent, sustainable investing.

Checklist of a Calculated Strategist

Use this checklist to learn if you follow the basics of the rising trading philosophy.

- Open a Demo Account. Assess trade execution velocities and market situations without jeopardising real capital.

- Evaluate Withdrawal Times. Investigate how quickly brokers process fund withdrawals. According to surveys, over a third of traders rank fast withdrawals high when choosing a broker.

- Trader Ratings and Community Sentiment. Join veteran traders, follow expert commentary, and review feedback on broker performance and market strategy.

- Investigate Trading Conditions. Check for minimum deposits, spreads, commissions, and hidden fees to avoid surprise costs.

- Diversify Across Asset Classes. Avoid over-reliance on a single market by trading indices, commodities, and other financial products to diversify risk and returns.

- Use Risk Management Tools. Set stop-loss and take-profit orders to protect capital and manage market volatility effectively.

- Stay Current with Market Analysis. Monitor economic calendars, central bank releases, and market news to predict potential price action and adjust strategies accordingly.

___

Disclaimer: This press release does not contain or constitute investment advice or recommendations and does not consider your investment objectives, financial situation, or needs. Any actions taken based on this content are at your sole discretion and risk, and we and Octa do not accept any liability for any resulting losses or consequences.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.