4 in 5 Singapore residents prioritising savings, investments and insurance amongst others despite expectations of a tough year ahead: AIA Live Better Study

18-29 year olds significantly more optimistic and feel more financially prepared to confront the year compared to 40-49 year olds.

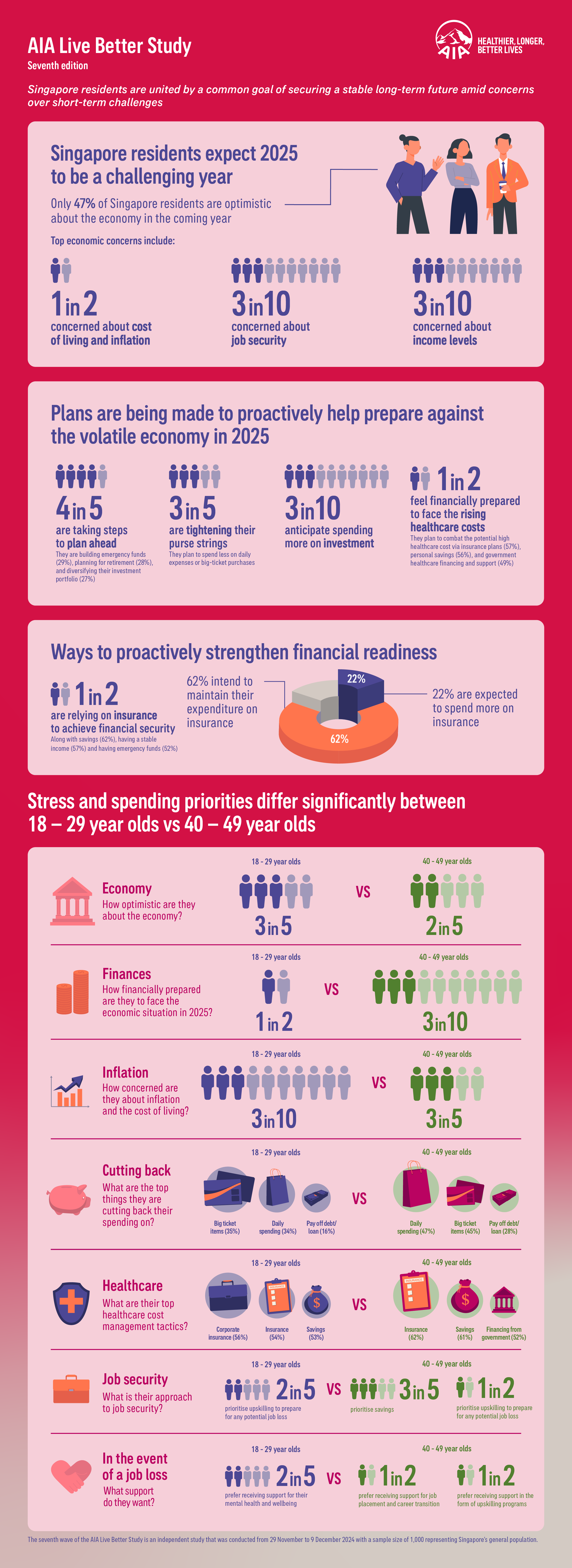

SINGAPORE - Media OutReach Newswire - 6 February 2025 - AIA Singapore today announced findings from the seventh edition of the AIA Live Better Study, which reflects the evolution of a society where more than 4 in 5 (83%) of Singapore residents plan to actively manage their finances amid concerns of a sluggish economy in 2025.The survey aims to uncover the aspirations and concerns of Singapore residents as they navigate these challenging times in the new year.

The study also found a stark contrast in the temperament and financial preparedness between two age groups. While more than half (54%) of those aged 18 – 29 feel financially prepared to tackle the challenging economic situation in 2025, only 34% of those aged 40 – 49, many of whom are taking care of their parents or kids, share similar sentiments.

Conducted in November 2024, the AIA Live Better Study[1] investigated the evolving financial, health, and wellness needs of Singapore consumers. Against expected muted economic growth in 2025[2], this year's study explores the mindset and actions of Singapore citizens and PRs as they navigate these challenging times.

Unsurprisingly, only 47% of Singapore residents are optimistic about the economy. Inflation and cost of living (50%) remain the top economic concern amongst the population, followed by worries over job security (35%) and income levels (34%).

"Despite the expectation of challenging times, the people of Singapore are showing remarkable resilience and proactiveness. This reflects a maturing society which has a better understanding and appreciation of the value of planning early and planning well for their future and that of their loved ones, which is especially noteworthy as we celebrate Singapore's 60th birthday this year," said Irma Hadikusuma, Chief Marketing and Healthcare Officer at AIA Singapore.

"AIA Singapore is committed to supporting the community with compelling solutions, tools and resources needed to overcome today's challenges and secure a prosperous future. Our mission is to help people live healthier, longer, better lives, ensuring financial and overall well-being," she added.

Securing financial resilience: Insurance and investments take centerstage in long-term financial plans

Rather than wringing their hands in despair, Singapore residents are taking on a positive mindset with more than 1 in 2 (54%) indicating that financial readiness in the long-run is more important to them in 2025 compared to the previous year.

The top three priorities Singapore residents believe will help them achieve financial security are savings (62%), a stable income (57%), and to have emergency funds (52%). Notably, 1 in 2 (48%) Singapore residents also cited insurance as an important way to ensure financial stability, a positive indication of an increased understanding about the importance of insurance as part of long-term financial planning.

Looking ahead, Singapore residents have plans to uptake a myriad of long-term financial solutions to prepare against the volatile economy in 2025:

- Approximately 3 in 5 (59%) Singapore residents are tightening their purse strings and planning to spend less on daily expenses or big-ticket purchases.

- Singapore residents are making plans to build emergency funds (29%), plan for retirement (28%), and diversify investments (27%) to strengthen their long-term financial readiness.

- Singapore residents are likely to see an increased uptake in endowment and investment plans as over a fifth of respondents intend to boost their expenditure towards insurance (22%) and investments (27%) in the coming year.

Balancing the budget in preparation for rising healthcare expenses

A substantial subset when it comes to Singapore's cost of living is healthcare costs. Aligned with Health Minister Ong Ye Kung[3], the study noted that the increasing cost of healthcare is a key economic concern that must be addressed. Key insights include:

- More than half (53%) of Singapore residents perceive healthcare costs to be expensive.

- Yet, less than half (47%) feel financially prepared to manage these costs, calling for more support, financial and non-financial, by both the government and private sectors.

- Singapore residents are taking matters into their own hands, planning to combat the potential high healthcare costs via insurance plans (57%), personal savings (56%) and government healthcare financing and support (49%).

Many in their 40s are feeling the pressures of being in the sandwiched generation, and they are the most pessimistic about their outlook for 2025 across all demographics. This is in comparison to the more optimistic demographic of 18 – 29 year olds in Singapore.

Financial Priorities Shift with Age: From Experiences to Stability

Despite the nation's overall sentiment, the younger generation (aged 18 - 29) are less stressed about the economy and are less likely to take steps towards financial preparedness. This is in contrast to Singapore residents in their 40s.

- The younger generation is more optimistic (56%) about the economy than those in their 40s (38%),

- They are less concerned about inflation and cost of living (34% compared to 63%).

- Fewer 18-29 year olds strive to be debt and loan free (16%) compared to their older counterparts (28%).

- Less than 2 in 5 (34%) younger adults foresee themselves cutting back on daily expenses and only 35% planning to reduce their budgets for big-ticket items.

- In contrast, approximately 1 in 2 (47%) of those in their 40s will be cutting their daily spending and 45% will be reducing purchases of big-ticket items.

Stresses on the Job Market

Having stable employment is important to all Singapore residents regardless of age. Approximately 1 in 2 (47%) of those aged between 18 and 29 years old, and approximately 3 in 5 (61%) of those in their 40s cited it as an increasingly important aspect of their overall wellness in 2025.

However, their likely approach to pre-empting a potential loss of job differs:

- While the younger ones prioritise upskilling (40%) more than the older generation (28%),

- The latter will focus on building their savings (55%) and setting aside emergency funds (46%).

- While 18 – 29 year olds find mental health and well-being support (40%) to be more important,

- 40 – 49 year olds would prefer more practical support in the form of job placements, career transition services (52%) and access to online training and upskilling programmes (47%).

[1] The seventh wave of the AIA Live Better Study is an independent study that was conducted from 29 November to 9 December 2024 with a sample size of 1,000 representing Singapore's general population.

[2] 'Economic trends to watch for Singapore in 2025' (Jan 1, 2025) The Straits Times. Available at: https://www.straitstimes.com/business/economic-trends-to-watch-for-singapore-in-2025

[3] 'Healthcare costs are rising in Singapore. Is there really nothing we can do about it?' (Nov 23, 2024) CNA. Available at: https://www.channelnewsasia.com/cna-insider/healthcare-costs-rising-singapore-hospitals-government-subsidies-moh-4764391

[4] 'The Big Read: Understanding why millennials and Gen Zers feel the way they do about work' (Jul 30, 2022) CNA. Available at: https://www.todayonline.com/big-read/big-read-understanding-why-millennials-and-gen-zers-feel-way-they-do-about-work-1956641

Hashtag: #AIASingapore

The issuer is solely responsible for the content of this announcement.

About AIA

AIA Group Limited and its subsidiaries (collectively "AIA" or the "Group") comprise the largest independent publicly listed pan-Asian life insurance group. It has a presence in 18 markets – wholly-owned branches and subsidiaries in Mainland China, Hong Kong SAR[1], Thailand, Singapore, Malaysia, Australia, Cambodia, Indonesia, Myanmar, New Zealand, the Philippines, South Korea, Sri Lanka, Taiwan (China), Vietnam, Brunei and Macau SAR[2], and a 49 per cent joint venture in India. In addition, AIA has a 24.99 per cent shareholding in China Post Life Insurance Co., Ltd.

The business that is now AIA was first established in Shanghai more than a century ago in 1919. It is a market leader in Asia (ex-Japan) based on life insurance premiums and holds leading positions across the majority of its markets. It had total assets of US$289 billion as of 30 June 2024.

AIA meets the long-term savings and protection needs of individuals by offering a range of products and services including life insurance, accident and health insurance and savings plans. The Group also provides employee benefits, credit life and pension services to corporate clients. Through an extensive network of agents, partners and employees across Asia, AIA serves the holders of more than 42 million individual policies and 16 million participating members of group insurance schemes.

AIA Group Limited is listed on the Main Board of The Stock Exchange of Hong Kong Limited under the stock codes "1299" for HKD counter and "81299" for RMB counter with American Depositary Receipts (Level 1) traded on the over-the-counter market under the ticker symbol "AAGIY".