2024 China Corporate Payment Survey: Payment delays continued to shorten, but corporates increasingly cautious

- Coface’ survey shows that more firms expressed willingness to grant payment terms in 2023 but they tightened payment terms to 70 days from 81 days in 2022.

HONG KONG SAR - Media OutReach Newswire - 19 March 2024 - Junyu Tan, North Asia Economist at Coface, said: "2023 was the year when economic activities generally normalised from the pandemic. The same went for corporate business practices regarding payment terms. As market competition and practices returned to normal, more companies took the initiative to grant payment terms.

But corporates have become more cautious and offered tighter payment terms. Coface's 2024 China Corporate Payment Survey showed that average payment terms decreased in 2023. The use of risk management tools was also more prevalent in businesses.

Tighter payment terms led to an increased incidence of payment delays. But that does not necessarily mean a worsening of companies' cash flow position. If payment delays are added to payment terms, the total average waiting time between purchasing a product and paying an invoice - known as days sales outstanding (DSO) - decreased from 140 days in 2022 to 136 days in 2023. That may indicate an improvement in corporates' cash flow cycle.

Looking ahead to 2024, 53% of our respondents expected the economic outlook to improve as policy support increases, market competition eases, and inventory burdens reduce. Slowing demand in 2024 should prompt more government spending to stabilise growth."

Payment delays1: More delays reported, but duration shortened

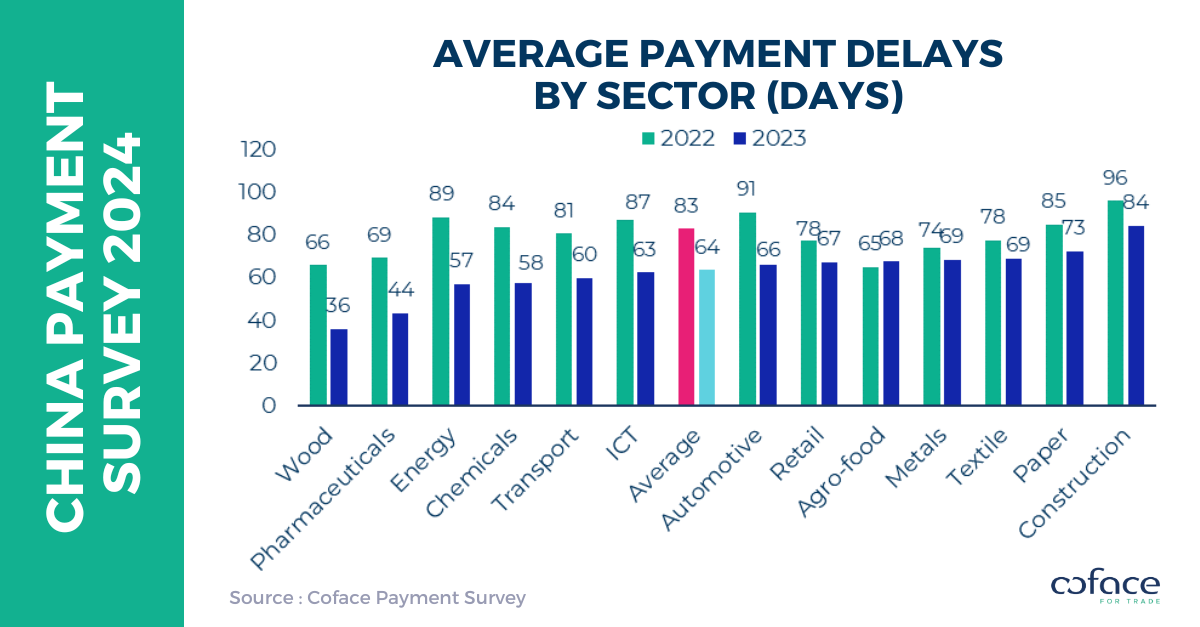

62% of our respondents reported payment delays in 2023, up from 40% in 2022. But an increase in the frequency of payment delays may not necessarily equate to a deterioration in companies' cash flow position. In 2023, payment delays shortened significantly, from 83 days in 2022 to 64 days.

The survey also showed a continuous downtrend of ultra-long payment delays (ULPDs, above 180 days) exceeding 2% of annual turnover, a threshold for high non-payment risk – 80% of such delays were never paid based on Coface's experience. Only 33% of respondents reported such delays, the second-lowest level since 2014.

Construction continued to see the longest payment delays (84 days) as property developers remained under severe financial stress with persistent weakness in new home sales. Textile appeared to have the highest non-payment risks (ULPDs exceeding 2% of turnover) when overdue occurred. But the situation is unlikely to improve in 2024 as pent-up demand recedes and labour cost rises.

Intense competition was cited as a major reason for customers' financial difficulties, which may be partly due to the excessive capacity in some industries. However, cost pressure did not appear to be a significant burden for Chinese companies, which was consistent with China's relatively weak inflationary environment.

Economic expectations: Competition to moderate, but demand outlook unfavorable

Looking ahead, increased policy support may bring some confidence to corporates as 53% of our respondents remained optimistic about the economic prospects in 2024. Pharmaceuticals emerged as the most optimistic on the back of the structural demand arising from an ageing population. Automobile and construction also outperformed as policy support for electric vehicles and infrastructure investments should continue to roll out. Textile was most pessimistic as pent-up demand is likely to recede in 2024 and labour costs to rise.

Fierce competition was still regarded as the biggest risk facing corporate operations in 2024. But with many companies offering deep discounts to boost sales in 2023, competition should ease in 2024 as inventory burdens reduce. But slowdown in demand was expected to be more severe as reopening demand fades while household incomes and business profits have yet to provide new dry powder. In this regard, government may have to step up spending to stabilize overall demand.

The issuer is solely responsible for the content of this announcement.

COFACE: FOR TRADE

With over 75 years of experience and the most extensive international network, Coface is a leader in trade credit insurance & risk management, and a recognized provider of Factoring, Debt Collection, Single Risk insurance, Bonding, and Information Services. Coface's experts work to the beat of the global economy, helping ~50,000 clients in 100 countries build successful, growing, and dynamic businesses. With Coface's insight and advice, these companies can make informed decisions. The Group' solutions strengthen their ability to sell by providing them with reliable information on their commercial partners and protecting them against non-payment risks, both domestically and for export. In 2023, Coface employed ~4,970 people and registered a turnover of €1.87 billion.

For more information, visit coface.com