MariBank rewards Shopee Shoppers with 30% Shopee Cashback vouchers this shopping season

SINGAPORE - Media OutReach - 9 November 2023 - MariBank, a digital bank licensed by the Monetary Authority of Singapore and wholly owned by Sea Limited, has introduced a new payment method on Shopee, which allows customers to enjoy a seamless and secure direct checkout process on Shopee with Mari Savings Account.

In celebration of this launch, MariBank is offering up to 30% Cashback vouchers1 to Shopee buyers this shopping season when they pay with Mari Savings Account.

Seamless integration with the Shopee ecosystem

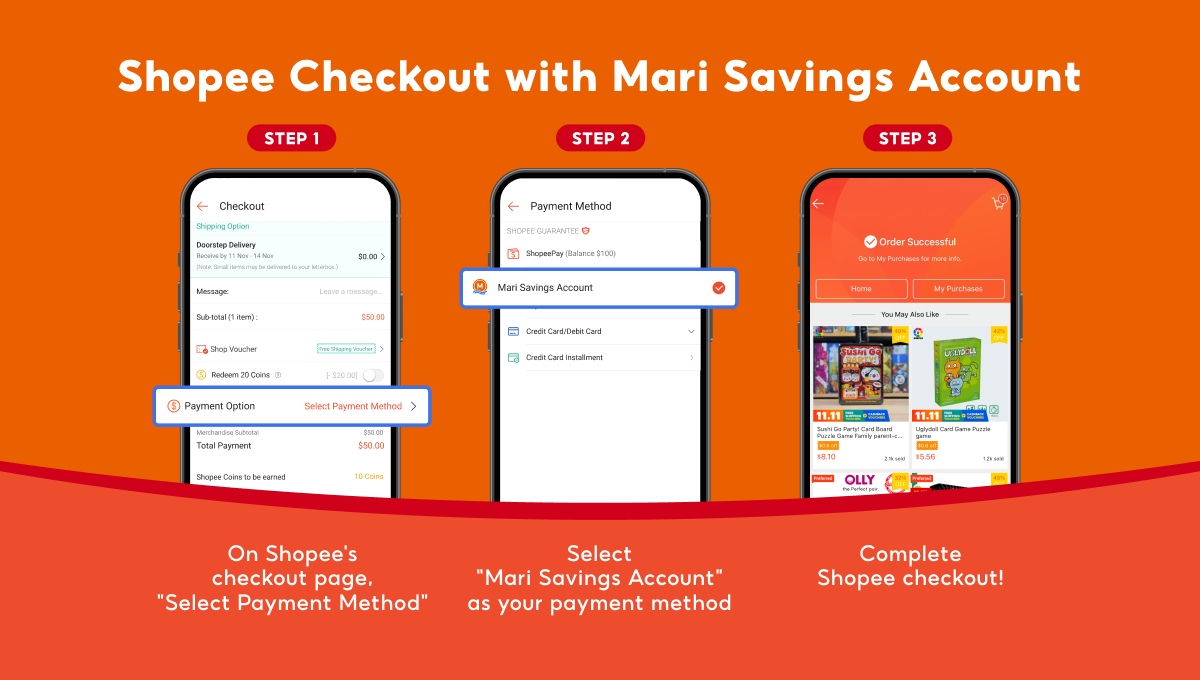

This feature makes shopping on Shopee even better by simplifying the payment process. With just a tap of a button, shoppers can easily pay for their purchases through funds that will be deducted directly from their Mari Savings Account.

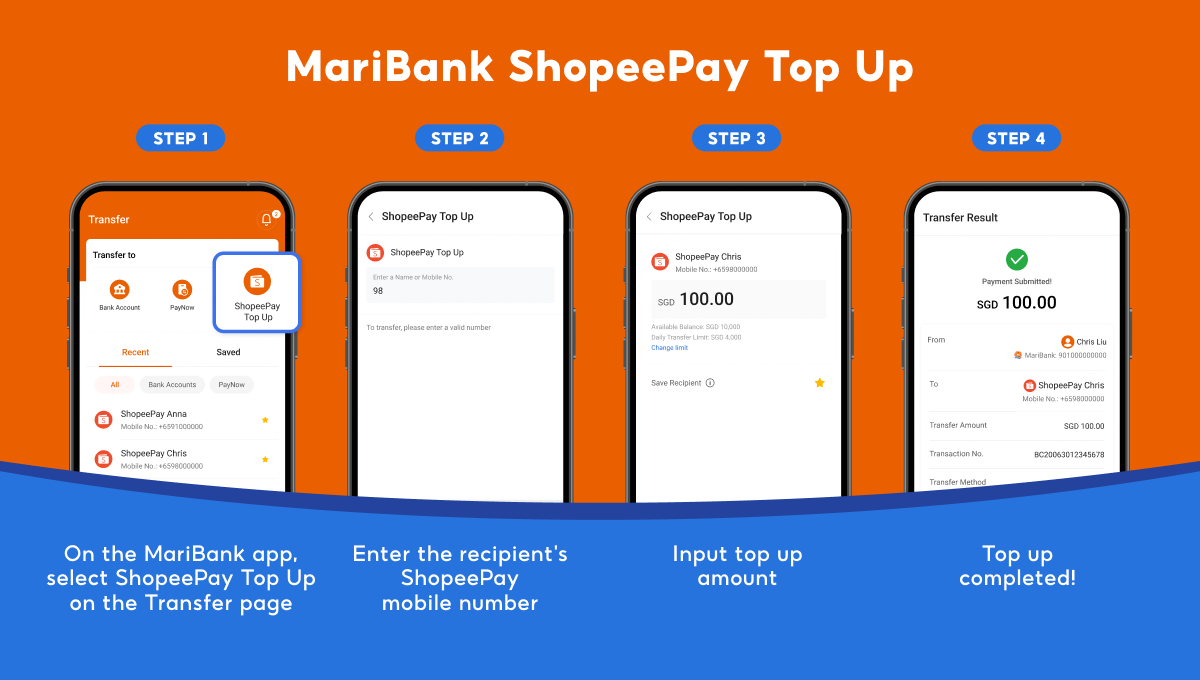

Shopee users can also easily top up their ShopeePay wallets via the Shopee or MariBank app without having to switch apps or whip out their cards.

Shopee Checkout with Mari Savings Account:

MariBank ShopeePay Top Up:

To do so, users will only need to open a Mari Savings Account with MariBank and do a one-time link of their MariBank and Shopee accounts.

In the months to come, Shopee users can expect to see more integrated services with MariBank, further value-adding to their shopping experience.

Exclusive Cashback vouchers for the shopping season

Just in time for the November shopping season, MariBank users can get up to 30% Shopee Cashback vouchers1 between 11 - 13 Nov 2023.

Shoppers just need to claim the vouchers on the Shopee app and pay with Mari Savings Account to enjoy the Cashback voucher.

Mari Savings Account is MariBank's flagship savings account offering 2.88% p.a. interest2 with no conditions required. Account holders can deposit up to S$75,000 in the savings account and earn interest credited daily.

For more information on the promotion, download the MariBank app from official app stores or visit https://shopee.sg/m/MariSavings.

Disclaimer

130% cashback vouchers are applicable with a min spend of S$20, capped at 3000 Shopee coins and are subjected to Shopee voucher terms and conditions.

2Rates are accurate as at the point of publishing. All rates are for information only and subject to change without prior notice. Promotional interest rate of 2.88% p.a. is effective till 31 December 2023. Prevailing base rate of 2.50% p.a. shall apply thereafter. Mari Savings Account has a maximum deposit capped at S$75k. T&Cs Apply.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Hashtag: #MariBank #Shopee #ShopeePay #ecommerce #banking

The issuer is solely responsible for the content of this announcement.

MariBank

MariBank is a digital bank wholly owned by Sea Limited and licensed by the Monetary Authority of Singapore (MAS). MariBank aims to support the banking needs of digital natives and small businesses in Singapore, through the provision of simple and purpose-built banking products.