It isn't right to say we are out of recession, as these six graphs demonstrate

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

It’d be wrong to say that we are out of recession, although that’s how the graph of Wednesday’s GDP numbers makes it look.

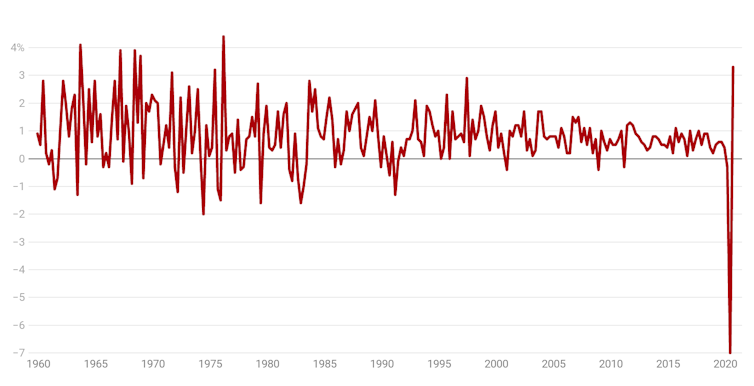

Gross domestic product (the measure of everything produced and earned and spent) fell 7% between the March and June quarters after slipping 0.3% between the December and March quarters, and then rebounded 3.3%[1] between the June and September quarters.

It was the biggest bounce since 1976, after the biggest fall on record.

Quarterly percentage change in gross domestic product

ABS National Accounts[2]

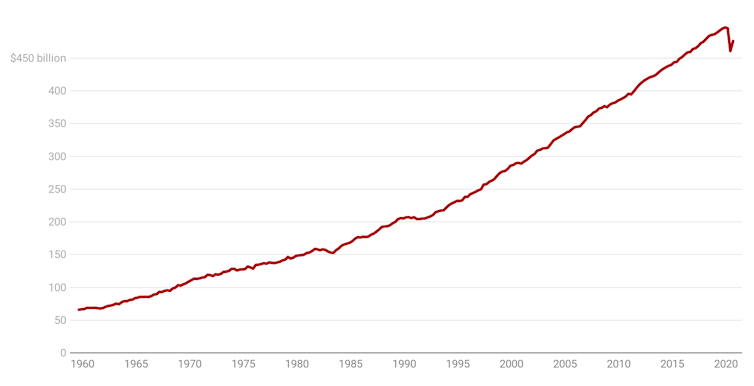

But it hasn’t anything like got us back to where we were.

When the levels rather than the changes in GDP are graphed, it is clear that, as Treasurer Josh Frydenberg put it, we have “a lot of ground to make up”.

Quarterly real gross domestic product

ABS National Accounts[2]

But it hasn’t anything like got us back to where we were.

When the levels rather than the changes in GDP are graphed, it is clear that, as Treasurer Josh Frydenberg put it, we have “a lot of ground to make up”.

Quarterly real gross domestic product

ABS National Accounts[3]

At first sight the graph of quarterly gross domestic product looks odd. Surely if GDP fell 7% and then rebounded by half that much it should have got back half its losses.

But 3.3% of a small number is much less than 7% of a bigger number. We’ve regained only two fifths of what we lost.

Read more:

6 things to watch for as Australia crawls out of recession[4]

And we’ve lost more than that. Had the economy grown as the Reserve Bank forecast before the coronavirus crisis[5], we would have spent and earned A$509 billion in the September quarter instead of $476 billion.

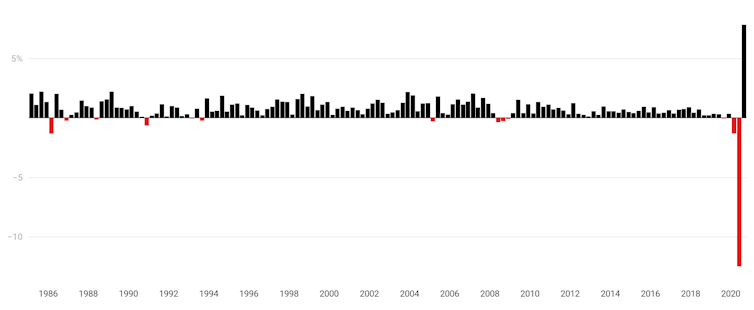

It’s consumer spending that’s bounced

What drove the bounce was a rebound in consumer spending after months in which we were confined to quarters, and here the news is better than it seems.

Quarterly change in household final consumption expenditure

ABS National Accounts[3]

At first sight the graph of quarterly gross domestic product looks odd. Surely if GDP fell 7% and then rebounded by half that much it should have got back half its losses.

But 3.3% of a small number is much less than 7% of a bigger number. We’ve regained only two fifths of what we lost.

Read more:

6 things to watch for as Australia crawls out of recession[4]

And we’ve lost more than that. Had the economy grown as the Reserve Bank forecast before the coronavirus crisis[5], we would have spent and earned A$509 billion in the September quarter instead of $476 billion.

It’s consumer spending that’s bounced

What drove the bounce was a rebound in consumer spending after months in which we were confined to quarters, and here the news is better than it seems.

Quarterly change in household final consumption expenditure

ABS Australian National Accounts[6]

Nationwide, household spending jumped 7.9% after falling 12.5%, but excluding locked-down Victoria (which will have its own delayed bounceback) household spending in the rest of the country rebounded 11% after falling 12%.

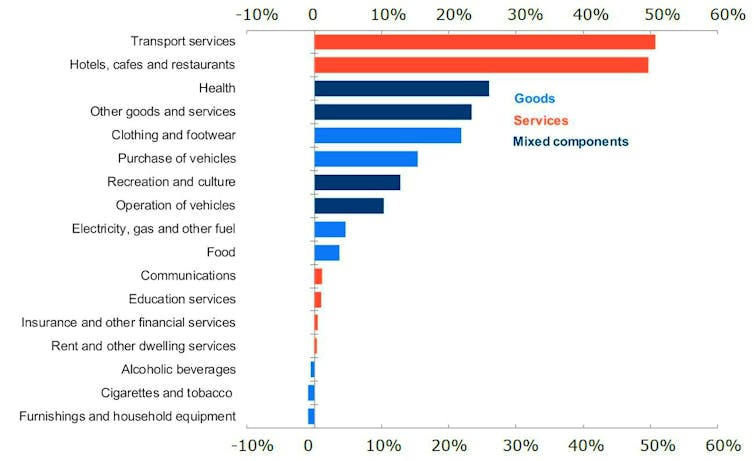

And it bounced back in exactly the places it collapsed while we were locked down; in services such as tourism and hospitality.

Household spending by category

ABS Australian National Accounts[6]

Nationwide, household spending jumped 7.9% after falling 12.5%, but excluding locked-down Victoria (which will have its own delayed bounceback) household spending in the rest of the country rebounded 11% after falling 12%.

And it bounced back in exactly the places it collapsed while we were locked down; in services such as tourism and hospitality.

Household spending by category

National, percentage change between June quarter and September quarter.

Australian Treasury

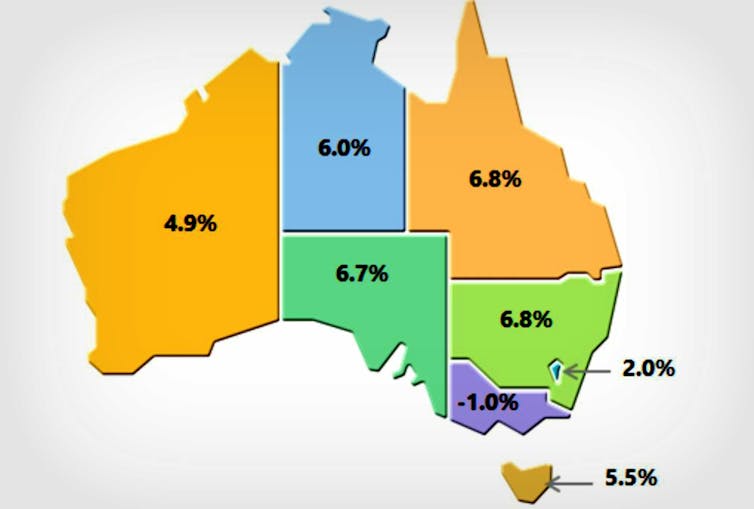

Victoria’s economy literally went backwards.

Spending in Victoria continued to fall while spending everywhere else bounced back.

In only one category, home alcohol consumption, did spending in Victoria advance while spending in other places retreated.

State and territory final demand, September quarter

National, percentage change between June quarter and September quarter.

Australian Treasury

Victoria’s economy literally went backwards.

Spending in Victoria continued to fall while spending everywhere else bounced back.

In only one category, home alcohol consumption, did spending in Victoria advance while spending in other places retreated.

State and territory final demand, September quarter

ABS Australian National Accounts[7]

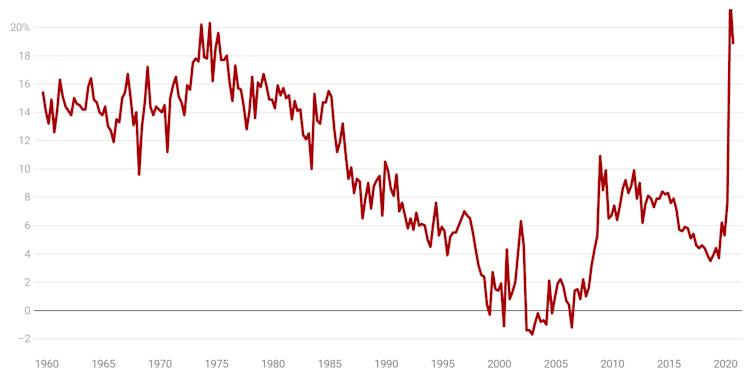

Consumers financed the extra spending by saving less, but even so, Australia’s household saving ratio remained alarmingly high.

In the June quarter Australian households saved a record (upwardly revised) 22.1% of what they earned. In the September quarter that fell to 18.9%, which is still far too high.

In good times, less-worried Australians save less than half that.

Household saving ratio

ABS Australian National Accounts[7]

Consumers financed the extra spending by saving less, but even so, Australia’s household saving ratio remained alarmingly high.

In the June quarter Australian households saved a record (upwardly revised) 22.1% of what they earned. In the September quarter that fell to 18.9%, which is still far too high.

In good times, less-worried Australians save less than half that.

Household saving ratio

ABS Australian National Accounts[8]

Frydenberg put the best spin he could on the extraordinarily high amount of saving by saying it would provide “ongoing support for the economic recovery in the new year as confidence continues to build”.

Australia was as well positioned to recover as “any nation on earth”. Over the past year its economy has contracted less than Britain, France, Germany and Japan.

Exports, business investment continue to fall

Much of that success is due to Australia’s achievement in getting on top of the virus and the success of JobKeeper[9] in keeping Australians in work until conditions improved. The Reserve Bank believes it saved 700,000 jobs[10].

Working against that has been the forth consecutive quarterly fall in export income (something set to worsen[11] unless relations with China improve) and the sixth consecutive fall in business investment.

In a quarter when consumer spending recovered, non-mining business investment fell a further 3% on top of a fall of 8.6% in the previous quarter.

The US National Bureau of Economic Research[12] defines a recession as

a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales

On that basis Australia is still in one. Employment, income and production remain well down on where they were a year ago. GDP is down 3.8%[13] on where it was a year ago.

ABS Australian National Accounts[8]

Frydenberg put the best spin he could on the extraordinarily high amount of saving by saying it would provide “ongoing support for the economic recovery in the new year as confidence continues to build”.

Australia was as well positioned to recover as “any nation on earth”. Over the past year its economy has contracted less than Britain, France, Germany and Japan.

Exports, business investment continue to fall

Much of that success is due to Australia’s achievement in getting on top of the virus and the success of JobKeeper[9] in keeping Australians in work until conditions improved. The Reserve Bank believes it saved 700,000 jobs[10].

Working against that has been the forth consecutive quarterly fall in export income (something set to worsen[11] unless relations with China improve) and the sixth consecutive fall in business investment.

In a quarter when consumer spending recovered, non-mining business investment fell a further 3% on top of a fall of 8.6% in the previous quarter.

The US National Bureau of Economic Research[12] defines a recession as

a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales

On that basis Australia is still in one. Employment, income and production remain well down on where they were a year ago. GDP is down 3.8%[13] on where it was a year ago.

Reserve Bank Governor Philip Lowe.

MICK TSIKAS/AAP

Speaking as the national accounts were being released, Reserve Bank Governor Philip Lowe said he expected Australia’s unemployment rate to remain above 6% for the next two years.

Annual wage growth would remain less than 2%[14]

It was possible the economy could do better.

His forecasts assume no widespread vaccination against coronavirus until late next year. They also assume international travel restrictions until 2022.

But it was also possible things could be worse.

Just three months ago that many were hailing a robust bounce-back in Europe.

Now, Europe’s economy is expected to sink again in the December quarter as member states struggle to contain the virus.

Australia was on a different path, but there was “no guarantee we will remain so”.

Reserve Bank Governor Philip Lowe.

MICK TSIKAS/AAP

Speaking as the national accounts were being released, Reserve Bank Governor Philip Lowe said he expected Australia’s unemployment rate to remain above 6% for the next two years.

Annual wage growth would remain less than 2%[14]

It was possible the economy could do better.

His forecasts assume no widespread vaccination against coronavirus until late next year. They also assume international travel restrictions until 2022.

But it was also possible things could be worse.

Just three months ago that many were hailing a robust bounce-back in Europe.

Now, Europe’s economy is expected to sink again in the December quarter as member states struggle to contain the virus.

Australia was on a different path, but there was “no guarantee we will remain so”.

References

- ^ 3.3% (www.abs.gov.au)

- ^ ABS National Accounts (www.abs.gov.au)

- ^ ABS National Accounts (www.abs.gov.au)

- ^ 6 things to watch for as Australia crawls out of recession (theconversation.com)

- ^ forecast before the coronavirus crisis (www.rba.gov.au)

- ^ ABS Australian National Accounts (www.abs.gov.au)

- ^ ABS Australian National Accounts (www.abs.gov.au)

- ^ ABS Australian National Accounts (www.abs.gov.au)

- ^ JobKeeper (theconversation.com)

- ^ 700,000 jobs (www.rba.gov.au)

- ^ worsen (theconversation.com)

- ^ National Bureau of Economic Research (theconversation.com)

- ^ 3.8% (www.abs.gov.au)

- ^ less than 2% (www.rba.gov.au)

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University