Not perfect, but much to like

- Written by Peter Davidson, Adjunct Senior Lecturer, UNSW

There’s a lot to like about the JobMaker Hiring Credit[1] announced in the budget.

As lockdowns ease, it’s logical to cautiously move from protecting jobs in struggling sectors to generating new jobs in growing ones.

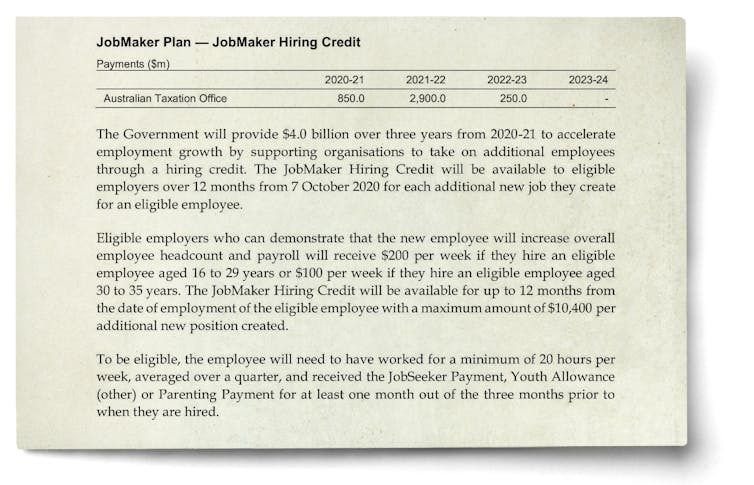

For the next year, employers who take on a new worker who has been on JobSeeker or a related benefit will receive A$200 per week for up to 12 months if the worker is aged 16 to 29 years, or $100 per week if aged 30 to 35 years.

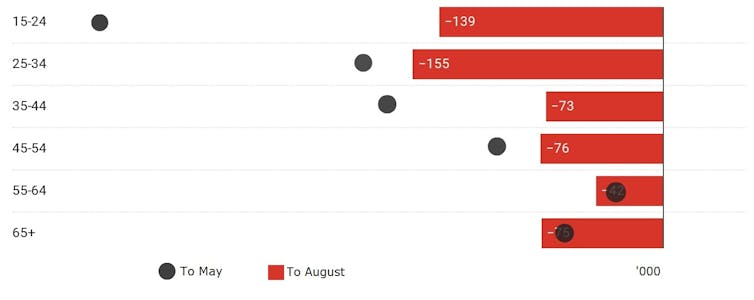

The employer will have to demonstrate that the new worker will increase overall headcount and payroll, and the payment will top out at $10,400 per position. The budget says it will support 450,000 jobs[2]. Many will simply be brought forward, created earlier than they would have been; but this itself should be helpful, contributing to a virtuous cycle of employment, confidence, and consumer demand. Past experience suggests that about 10%[3] will be truly additional – jobs that wouldn’t have been created without the subsidy. Cheaper per job than tax cuts But even then, unlike the personal tax cuts, which the Australian Council of Social Service believes will cost $475,000[4] per job created, the cost per job would be a more modest $80,000. More importantly, the hiring credit could prompt employers to take on people they might not otherwise have considered - those facing prolonged unemployment. It is likely that by next year, more than a million people will be on unemployment payments for over a year - three times the peak in long-term unemployment after the early-90s recession. Young people – those under 35 – have been targeted because they lost far more jobs[5] in this recession than older people. Employment by age, change since February 2020

The employer will have to demonstrate that the new worker will increase overall headcount and payroll, and the payment will top out at $10,400 per position. The budget says it will support 450,000 jobs[2]. Many will simply be brought forward, created earlier than they would have been; but this itself should be helpful, contributing to a virtuous cycle of employment, confidence, and consumer demand. Past experience suggests that about 10%[3] will be truly additional – jobs that wouldn’t have been created without the subsidy. Cheaper per job than tax cuts But even then, unlike the personal tax cuts, which the Australian Council of Social Service believes will cost $475,000[4] per job created, the cost per job would be a more modest $80,000. More importantly, the hiring credit could prompt employers to take on people they might not otherwise have considered - those facing prolonged unemployment. It is likely that by next year, more than a million people will be on unemployment payments for over a year - three times the peak in long-term unemployment after the early-90s recession. Young people – those under 35 – have been targeted because they lost far more jobs[5] in this recession than older people. Employment by age, change since February 2020  Source: ABS, RBA[6] Limited work experience and qualifications means many young people will find themselves out of paid work for a long time. But they’re not the only ones. There are already over 600,000 people long-term unemployed on benefits for more than a year, most of whom are over 40. Older unemployed people are right to be concerned the wage subsidy might encourage employers to overlook them for younger applicants. Room for improvement It’d be better to also target the subsidy to the duration of unemployment[7]; for example to young people unemployed for six months, and others out of paid work for at least a year. Otherwise a large and diverse set of talents might be wasted. The subsidies might also be too low. $200 per week is around a quarter of the full-time minimum wage, enough to encourage employers to expand entry-level jobs of around 20 hours a week but perhaps not enough to encourage employers to expand full-time jobs. Read more: Budget 2020: promising tax breaks, but relying on hope[8] This could hasten the shift already under way from fulltime to part-time employment in entry-level jobs in retail, hospitality and other industries. That might reduce unemployment in the short-term, but at the expense of entrenching higher levels of under-employment (people lacking the paid working hours they need). Another issue is administration. An employment service on the ground would be better at matching the needs of workers and employers and organising pre-vocational training than workers and employers left to their own devices. It’ll be important to avoid abuses That could also help ensure the integrity of the scheme. Wage subsidy schemes give rise to concerns that existing workers may be displaced, or that people could be laid off when the subsidy ends regardless of their performance. Guaranteeing the integrity of the scheme will be vital to ensure it’s fair to all involved and to sustain public support for it. JobMaker is a welcome innovation, the logical next step after JobKeeper. If, together with a scaling up of existing wage subsidy schemes, it generates full and part-time jobs for people of all ages who would otherwise be left behind, it could make a real difference.

Source: ABS, RBA[6] Limited work experience and qualifications means many young people will find themselves out of paid work for a long time. But they’re not the only ones. There are already over 600,000 people long-term unemployed on benefits for more than a year, most of whom are over 40. Older unemployed people are right to be concerned the wage subsidy might encourage employers to overlook them for younger applicants. Room for improvement It’d be better to also target the subsidy to the duration of unemployment[7]; for example to young people unemployed for six months, and others out of paid work for at least a year. Otherwise a large and diverse set of talents might be wasted. The subsidies might also be too low. $200 per week is around a quarter of the full-time minimum wage, enough to encourage employers to expand entry-level jobs of around 20 hours a week but perhaps not enough to encourage employers to expand full-time jobs. Read more: Budget 2020: promising tax breaks, but relying on hope[8] This could hasten the shift already under way from fulltime to part-time employment in entry-level jobs in retail, hospitality and other industries. That might reduce unemployment in the short-term, but at the expense of entrenching higher levels of under-employment (people lacking the paid working hours they need). Another issue is administration. An employment service on the ground would be better at matching the needs of workers and employers and organising pre-vocational training than workers and employers left to their own devices. It’ll be important to avoid abuses That could also help ensure the integrity of the scheme. Wage subsidy schemes give rise to concerns that existing workers may be displaced, or that people could be laid off when the subsidy ends regardless of their performance. Guaranteeing the integrity of the scheme will be vital to ensure it’s fair to all involved and to sustain public support for it. JobMaker is a welcome innovation, the logical next step after JobKeeper. If, together with a scaling up of existing wage subsidy schemes, it generates full and part-time jobs for people of all ages who would otherwise be left behind, it could make a real difference. References

- ^ JobMaker Hiring Credit (www.ato.gov.au)

- ^ 450,000 jobs (ministers.treasury.gov.au)

- ^ 10% (docs.employment.gov.au)

- ^ $475,000 (twitter.com)

- ^ far more jobs (www.ceda.com.au)

- ^ Source: ABS, RBA (www.rba.gov.au)

- ^ duration of unemployment (www.ceda.com.au)

- ^ Budget 2020: promising tax breaks, but relying on hope (theconversation.com)

Authors: Peter Davidson, Adjunct Senior Lecturer, UNSW