Chill, this week's news on wages points to anything but hyperinflation

- Written by Richard Holden, Professor of Economics, UNSW

Suddenly people are talking about inflation, even hyperinflation, in a way they haven’t since the 1980s.

In October the United States posted its highest annual consumer price index increase in 30 years, with inflation up 6.2%[1] and “core” (excluding volatile prices) inflation of 4.6%.

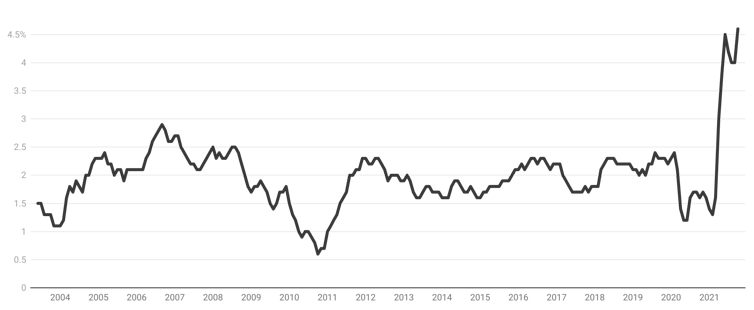

US underlying inflation

US consumer price index for all urban consumers, all items less food and energy, city average. US Bureau of Labor Statistics, St Louis Fed[2]Former US Treasury Secretary Larry Summers – arguably the finest policy economist of his generation – contends that what’s happening is not transitory.

He says soon inflation could soon climb to double digits, where it hasn’t been for 40 years.

There are plenty of other leading economists, including Nobel Prize winner Paul Krugman[3], who argue that what’s happening is just temporary, part of the adjustment to post-pandemic life, akin to the tyres of a car spinning uselessly[4] before they gain traction.

Closer to home, the data are less alarming.

Only 12 of the 55 top economists surveyed by the Economic Society of Australia and The Conversation saw a serious risk of prolonged above-target inflation.

US and Australian underlying inflation