Australian food and agriculture may have just passed ‘peak China’ exposure

- Written by Rabobank

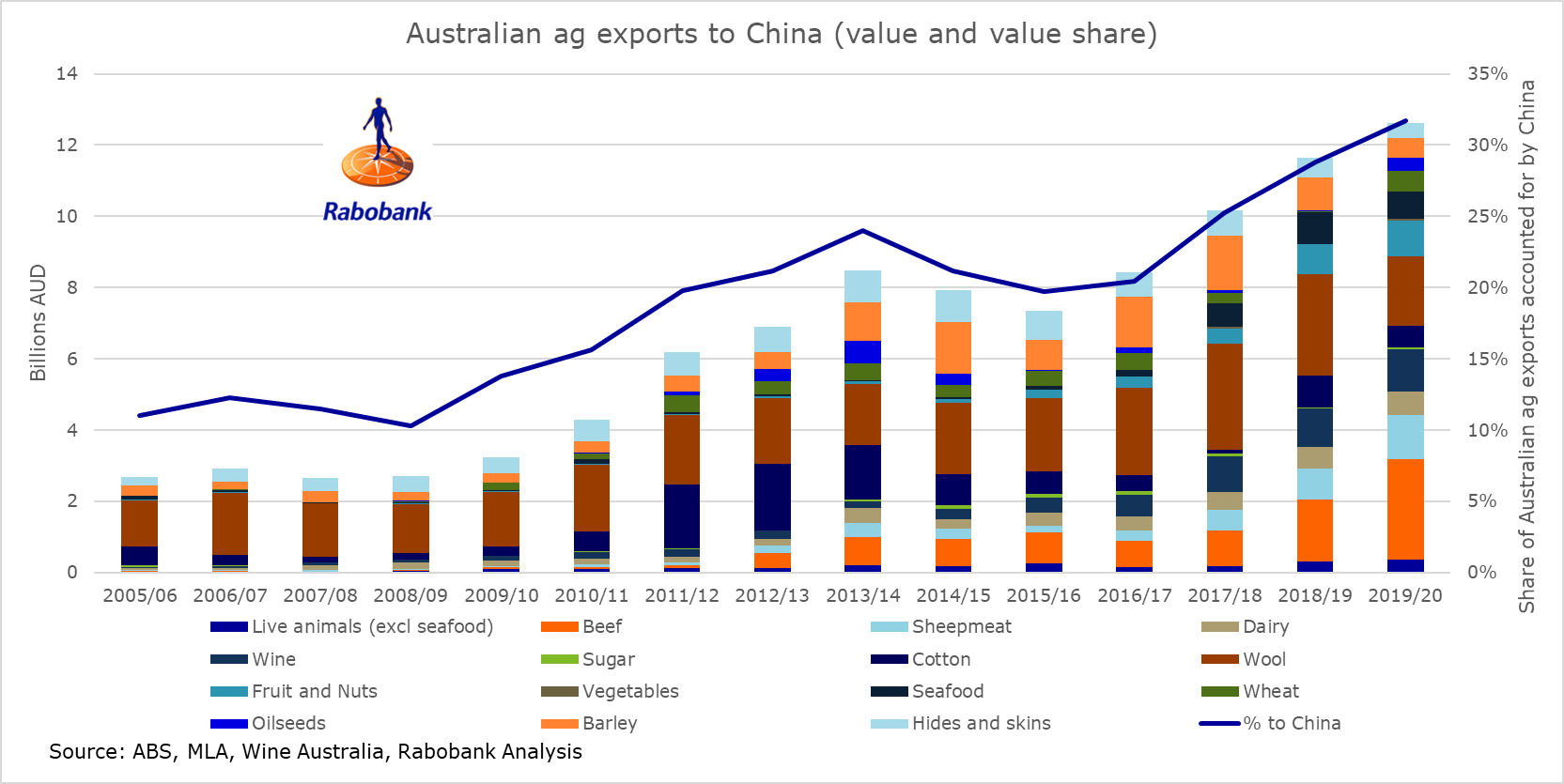

Australian exports of food and agricultural products to China rose by eight per cent in value terms in the 2019/20 season, reaching the highest level in the history of the China-Australia trading relationship. But that could well prove to be the peak of Australian agriculture’s exposure to China, agribusiness specialist Rabobank said in commentary released today.

Data released this month showed the biggest gains in Australian agricultural exports to China in 2019/20 were registered by beef and sheepmeat, as Chinese buyers looked to fill the hole left by African swine fever, which more than halved the Chinese sow herd in recent years and created a shortage of animal protein in the local market.

But shipments of dairy, wine, grains and oilseeds and fruit also all saw year-on-year gains, as “Australia continued to ride the wave of opportunity generated by China’s rising incomes, the 2015 China Australia free trade agreement, increasingly sophisticated ecommerce supply chains and the value consumers place on Australia’s food quality and provenance”, the bank said.

However, while there was a surge in shipments to China, the total value of Australia’s food and agri (F&A) exports “basically stood still in 2019/20” – with shipments down by just under two per cent.

As a result, China’s share of Australian F&A exports rose to 32 per cent for the 2019/20 period – up from 29 per cent in the prior year, and reaching the highest level in the history of the China-Australia trading relationship.

But the recent trajectory of Australian agriculture’s increasing exposure to China was not inexorable, the bank said, and 2019/20 could well prove to be the peak of Australian agriculture’s exposure to China.

Market concentration risk

Rabobank head of Food & Agribusiness Research Tim Hunt said “extracting one in three of our export dollars from one market” brought considerable concentration risk for the Australian food and agricultural sector.

“We haven’t been this exposed to one market since the 1950s, when we were still joined at the hip to the UK,” he said. “And that was a very different political relationship.”

Mr Hunt said in a year in which political relations with China had soured, the share of almost all of Australia’s agri exports destined for China rose. But trade was now starting to suffer.

“This shouldn’t come as a complete surprise,” he said. “China has often found reasons to reduce purchase of agri products from countries when tensions arise. And its most senior diplomat in Australia warned over two years ago that if political relations continue to deteriorate, trade could suffer.”

Now almost eight months into 2020, this is exactly what we are seeing, Mr Hunt said.

“Australia has five F&A exports to China that can be worth over a billion dollars in any given year. In 2020, China has so far impeded or threatened to impede three of these – via the removal of accreditation to supply some beef product lines from certain abattoirs, the imposition of an anti-dumping duty of barley, and now a threat to impose anti-dumping duties on wine also” he said.

Mr Hunt said yesterday’s announcement of a Chinese anti-dumping investigation into Australian wine was cause for significant concern in the sector.

“The investigation may ultimately find that no such dumping has occurred. But these investigations can take more than a year, and the uncertainty it creates can impact trade in the interim, and can undermine investment appetite in the sector.’

Peak China

In its commentary, the bank said 2019/20 may prove to be the peak of Australian agriculture’s exposure to China for several reasons.

Firstly, the likely rebound of wheat production this season will see a huge boost to shipments of a product that is typically sold to markets outside of China.

Secondly, China’s antidumping duty on barley will likely see most barley exports directed elsewhere for at least the next 12 months.

Meanwhile, with some rebound in the Chinese pig herd underway, the share of Australia’s beef and sheepmeat destined for China may also have peaked.

As we push into the longer term, regions like South-East Asia are also expected to play an increasing role in the textile milling industry, which will eventually see the share of Australian cotton sent to China drop off over the medium term.

But the size of the trade flow will be heavily influenced by the politics between the countries and the strategy of buyers and sellers, Mr Hunt said.

“The extent of exposure to China and the risks this is bringing may see many industries look to diversify markets in coming years,” he said.

“The Chinese market is hard to replicate in size, growth and value. But there are growth opportunities in other markets that Australian exporters can tap into in coming years, especially if progress is made in improving market access.

“The Australian F&A industry has been flexible and adept enough to navigate shifts in its customer base over many decades. This may prove to be the start of the next phase in that journey.”