Trump Xi meeting: Why this meeting matters

- Written by The Times

The significance of the Trump-Xi rendezvous goes well beyond a photo-op. Some key strategic points:

-

The U.S. and China are the world’s two largest economies, deeply economically intertwined yet locked in a strategic rivalry. Analysts describe the relationship as oscillating between competition and co-dependence.

-

Trade and technology are front-line battlegrounds. For instance: China’s export controls on rare-earth and critical minerals, and the U.S.’s tariffs and investment/technology restrictions on China.

-

Non-economic issues such as the flow of illicit drugs—especially fentanyl and precursor chemicals from or routed via China or Chinese-linked networks—have entered the bilateral agenda.

-

Diplomatic signals now play a big part in managing risk: preventing escalation into conflict, stabilising markets, and giving businesses a sense of direction. A meeting like this helps set the tone more than delivering sweeping change.

In sum: while the meeting is high-stakes, many experts caution that the deliverables may be modest and more symbolic than transformational.

Confirmed Outcomes & Announcements

While the full face-to-face summit had not yet produced a publicly detailed full agreement (as of the latest reporting), a number of confirmed or strongly signalled outcomes stand out:

1. Meeting confirmed and timeline established

China officially confirmed that Xi will meet Trump in Busan, South Korea, on Thursday (Oct 30 2025) on the sidelines of the Asia‑Pacific Economic Cooperation (APEC) Summit.

The Chinese Foreign Ministry said: “The two heads of state will have in-depth communications on strategic and long-term issues.”

2. Framework signals on trade / tariffs / soybeans

-

One goodwill gesture: China’s state-owned COFCO purchased three cargoes of U.S. soybeans (first of current harvest) prior to the meeting, widely seen as a signal of positive intent.

-

The U.S. side (Trump) has publicly suggested willingness to reduce or soften tariffs on Chinese goods—e.g., talks about cutting the 20 % “fentanyl-related” tariff.

-

On China’s side, they are signalling restraint on immediate further escalation of export controls (e.g., rare earths) if talks progress.

3. Fentanyl / precursor chemical cooperation

-

Trump emphasised that his first question to Xi would be about fentanyl: “I’m putting it right at the front of the list.”

-

The U.S. indicated a possible reduction of the 20 % tariff on Chinese goods in exchange for Beijing taking steps to curb fentanyl/precursor shipments.

4. Tone of dialogue improved

From the Chinese Ministry of Foreign Affairs release after a prior call (Sep 19 2025): the conversation was described as “pragmatic, positive and constructive,” with Xi emphasising mutual respect, peaceful coexistence and win-win cooperation.

Trump described the phone call as “very productive.”

5. Agenda items clearly outlined (if not yet fully resolved)

Some of the major issues on the table include:

-

Trade balance, tariffs, market-access for U.S. firms in China.

-

China’s export controls on rare-earths and critical minerals (which feed into U.S. high-tech and defence supply chains).

-

The future of the popular U.S.-based app TikTok (Chinese-owned) operating in the U.S. — investment/algorithm ownership issues.

-

Fentanyl / precursor chemical flows and China’s cooperation in counter-narcotics.

-

Geopolitical and strategic issues: Taiwan, South China Sea, military posture, regional security. Although less likely to be “solved” in this meeting, they form the backdrop.

What this means: analysis of the implications

Given the above, what are the likely broader outcomes—both positive and cautionary?

Positive implications

-

Stabilisation of U.S.-China trade/tech relationship: By meeting and signalling willingness to engage, both sides may reduce the risk of a sudden escalation (e.g., massive tariffs or supply-chain decoupling). Markets seem to have responded somewhat positively.

-

Agricultural relief for U.S. farmers: China buying U.S. soybeans (and perhaps more broadly relaxing purchase restrictions) offers a tangible benefit to U.S. producers, and a political win for Trump domestically.

-

Drug-control cooperation: If China commits in some way to crack down on fentanyl/precursor exports, it could have meaningful public-health and socioeconomic benefits in the U.S., and boost the bilateral agenda beyond just economics.

-

Strategic reset or “risk-management”: Even if no sweeping breakthroughs occur, the meeting may serve as a moment for both sides to recalibrate expectations, set longer-term frameworks, and reduce immediate friction — which in itself can be valuable. Analysts describe this as “risk-management” rather than full resolution.

Cautionary/Limitations

-

No guarantee of a big deal: Many analysts caution that substantive breakthroughs are unlikely. The two countries remain deeply divergent on core issues (technology, supply chains, Taiwan, human rights).

-

Domestic politics constrain both sides: Trump has to deliver visible wins before major domestic elections or midterms; Xi must maintain an image of Chinese strength and avoid appearing to cave to U.S. demands. These tensions limit what either leader can realistically offer.

-

Underlying issues remain unresolved: Even if trade tariffs are mellowed, the structural concerns (e.g., China’s state-led industrial policy, U.S. export controls, Taiwan vulnerability) remain and may resurface later.

-

Risk of back-sliding or selective implementation: Agreements on paper may be weak, or enforcement may be patchy; history of U.S.-China engagements shows “frameworks” are often followed by renewed tensions.

What to watch for next

Here are key signals and indicators to follow in the weeks/months after the meeting:

-

Formal agreement announcements: Will the meeting produce a signed communiqué, or is it mostly a verbal framework? What exactly is the language around tariff reductions, soybean purchases, and fentanyl cooperation?

-

Implementation behaviour: For example, will China visibly ramp up soybean purchases? Will U.S. tariffs on Chinese goods be reduced or modified? Will China make public commitments on fentanyl/precursor export controls?

-

Rare-earth / critical mineral export policy: Will China delay or reverse certain export-controls? Will the U.S. respond by changing its investment or export-control policies? These are deeper structural issues.

-

Technology & TikTok resolution: Is there progress toward an outcome allowing TikTok (or similar Chinese-invested tech) to remain in the U.S. with acceptable safeguards?

-

Geopolitical ripple effects: How will allies, such as Australia and Japan, respond? Will there be signs of shifts in U.S. posture on Taiwan or in the South China Sea context as part of the broader accommodation with China?

-

Market & business signals: Are corporations adjusting supply-chains, investment plans, or risk assessments based on the summit’s outcomes? The reaction in export/import flows, capital markets, and commodity markets (e.g., rare-earths) will be telling.

Conclusion: a step, not a leap

In summary: the meeting between Trump and Xi is likely to produce meaningful signals, and potentially modest deliverables (e.g., soybean purchases, tariff tone adjustment, commitments on fentanyl cooperation). However, it is unlikely to yield a sweeping grand bargain that resolves the big structural issues in U.S.–China relations. Instead, the value lies in resetting dialogue, stabilising tensions, and setting the stage for longer-term management of competition.

For business, markets, and policy-makers, the key takeaway is manage expectations: this summit may defuse immediate risks, but the deeper strategic rivalry remains. In that light, both sides may declare a “win” (or at least no loss), but the real test will be in the follow-through over the coming months.

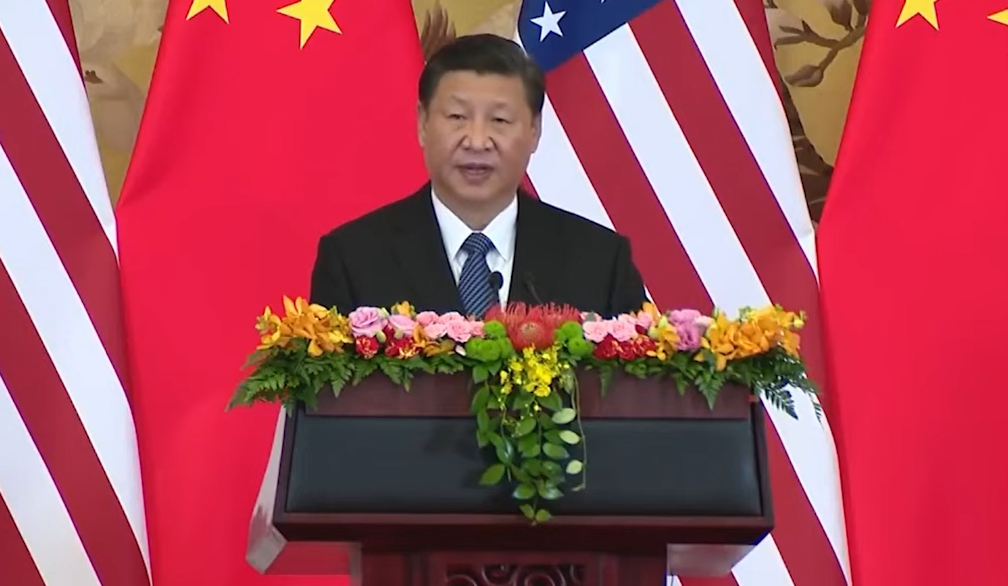

Image - File pic