The government will underwrite risky investments in renewables – here's why that's a good idea

- Written by Tony Wood, Program Director, Energy, Grattan Institute

Climate Change and Energy Minister Chris Bowen today announced[1] a scheme to underwrite the risk of investing in new renewable energy generation and storage.

The expansion of the national Capacity Investment Scheme[2] follows a successful pilot study with New South Wales[3]. The government paid A$1.8 billion for just over a gigawatt of capacity, through a combination of batteries and other storage.

Bowen says the scheme “underwrites new renewable generation and storage, providing certainty for renewable investors and cheaper, cleaner energy for households and businesses”. And if all goes well, the scheme will provide a financial return to taxpayers.

Most of the country still relies on dirty coal-fired power. Several power stations have already closed[4] and many more have flagged intentions to close. The ageing fleet is also unreliable, causing power outages. Before coal exits the system, we need to replace it. This scheme will ensure that happens well in advance.

Read more: Why Australia urgently needs a climate plan and a Net Zero National Cabinet Committee to implement it[5]

What’s the problem?

The government was not on track to achieve 82% renewables by 2030. It was clearly under pressure to do something about that. And now it has.

If what’s been announced today actually is built, then it’s likely we will be able hit the target. The amount of new capacity being considered will certainly make a huge difference. So that’s 23 gigawatts of new variable renewables such as wind and solar, plus 9GW of “dispatchable” capacity, which involves storage – mainly batteries.

If the scheme does its job, it’s also likely to accelerate the closure of coal-fired power stations.

That will help us to reduce emissions but it also raises the risk of blackouts from grid instability. That’s a worry as we head into a long, hot summer.

We need to close the gap between closure of coal-fired power and new generators coming online to firm up the system.

Today’s announcement takes us to a total of 32GW nationally. Compare that to the total generation capacity of the National Electricity Market at about 65GW[6].

Read more: How could Australia actually get to net zero? Here's how[7]

How does the Capacity Investment Scheme help?

Under the original scheme, the federal government has begun to run competitive tenders seeking bids for clean renewable generation projects.

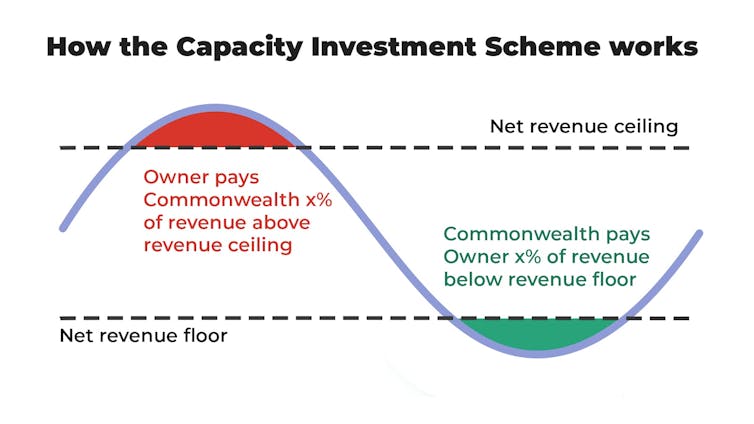

Under the expanded scheme, successful projects will be offered contracts in which a revenue floor and ceiling are agreed with the Commonwealth.

This scheme will be rolled out with regular six-monthly tenders from the second quarter of the 2024–25 financial year through to 2027.

In principle, it’s a good idea for two reasons. First, it provides a much greater level of certainty for investors. Difficulty getting people to invest in the renewable energy sector is one of the reasons why we’re not on track. In this case the government will be paying directly, holding auctions to guarantee a certain revenue for those who invest in these projects. In other policy instruments it’s really the consumer who ends up paying.

The way it’s done, through “contract the difference”, is pretty sensible, in that the government is only underwriting the risk, rather than the full amount of money. If the revenue the project actually generates in the market is within the agreed range, the government doesn’t pay anything.

But if the people who invested are not getting the agreed amount of financial return, the government will pay the difference. Or most of the difference anyway, through a formula yet to be worked out – but the government will certainly be contributing towards that difference.

On the other hand, it’s not a one-sided arrangement. If the project generates more revenue than the agreed ceiling, that money goes back to the government. So the government’s not signing up to an open chequebook.

Second, this approach puts all the responsibility for reliability of the grid in the hands of the states. That is, dealing with the closure of the coal plants and making sure there’s enough capacity to replace it.

That’s probably a good idea, because some of the states have different views about how reliability should be addressed. Some would not want to see any gas-fired generation being used to back up renewables; others may be happy to have gas-fired power or even a hydrogen power station to back up reliability. It will be up to them now.

Alongside these steps federal and state governments still need to step up the pressure on building transmission lines to connect all of this new renewable capacity to the grid. However, today’s announcement does nothing to address how this will be done.

What will this do to power prices?

I don’t expect it to make much difference to prices. While new renewables themselves are cheap, the transmission and storage needed to back them up will not be. So they’ll probably largely balance each other out.

The bottom line is we will be getting a more reliable and lower-emissions electricity sector at a relatively low carbon cost.

Read more: Unsexy but vital: why warnings over grid reliability are really about building more transmission lines[8]

References

- ^ today announced (minister.dcceew.gov.au)

- ^ Capacity Investment Scheme (www.energy.gov.au)

- ^ a successful pilot study with New South Wales (minister.dcceew.gov.au)

- ^ already closed (theconversation.com)

- ^ Why Australia urgently needs a climate plan and a Net Zero National Cabinet Committee to implement it (theconversation.com)

- ^ at about 65GW (aemo.com.au)

- ^ How could Australia actually get to net zero? Here's how (theconversation.com)

- ^ Unsexy but vital: why warnings over grid reliability are really about building more transmission lines (theconversation.com)