Evergrande may survive, but for its executives expect a fate worse than debt

- Written by Richard Holden, Professor of Economics, UNSW

A large, financially interconnected company is on the verge of collapse, weighed down by massive debt. The government ponders a bailout. There’s no easy answer. Doing nothing risks serious financial upheaval. But bailing it out will signal that greed, irresponsibility and moral hazard have no consequences.

It’s a tough call. And if this all sounds eerily familiar, then you’re right. In 2008 the US government faced the dilemma with what to do about Lehman Brothers, the nation’s fourth-biggest investment bank which found itself unable to pay debts totalling more than US$600 billion.

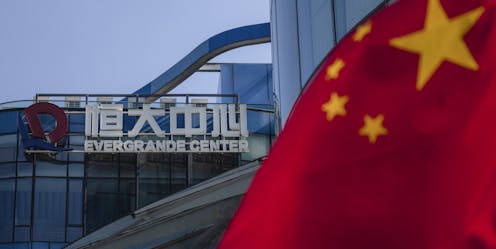

Now the Chinese government is facing a comparable situation with Chinese property and financial behemoth Evergrande.

Lehman Brothers, established in 1847, survived the US Civil War, the Great Depression and two world Wars. Then in the feverish bubble of risky bets on the US mortgage market in the 1980s, it got into deep trouble.

US Treasury Secretary Hank Paulson — a former senior Wall Street executive — was, by all accounts, offended that Lehman had so recklessly gotten into this position. Why not send a message that the US government wasn’t going to bail out big banks who behaved badly?

The answer, it turned out, is that letting Lehman fail ricocheted through the US and global economy.

When Lehman filed for Chapter 11 bankruptcy protection, it was facing the largest bankruptcy in history. Those to whom it owed money were immediately put under pressure. That put those to whom they owed money under pressure. Money markets almost completely froze up.

Read more: Vital Signs: the GFC and me. Ten years on, what have we learned?[1]

Even Goldman Sachs – Wall Street’s most venerable firm and basically on the good side of mortgage-market trades — was hammered. It took legendary investor Warren Buffett plowing US$5 billion into the company to avoid a modern-day bank run.

China’s Lehman moment?

Unlike Lehman Brothers, Evergrande isn’t an investment bank. Ostensibly it is a real estate developer, responsible for building apartments across China. But it has morphed into more than that — a highly leveraged and integrated company that does everything from banking to property development to selling electric cars.

Like many things in China, the true state of affairs is all a little unclear, but one reading is that Evergrande is basically a hedge fund with a property and vehicle business attached.

The proximate cause of concern is Evergrande missing an US$83 million interest payment on September 23. The clock is running, in that is has 30 days to “cure the breach” and figure out a way to pay. Otherwise things, as the cool kids say, will “start getting real”.

Read more: China's problem with property: the domino effect of Evergrande's huge debts[2]

For now disaster has been averted by Evergrande agreeing to sell off its stake in a local bank (Shengjing Bank) for nearly 10 billion yuan[3] (about US$1.5 billion) to the state-owned Shenyang Shengjing Finance Investment Group.

But Evergrande has US$300 billion in debt, so there’s really no running away from the issue for the Chinese authorities. If there are more dodgy dealings on Evergrande’s books then that US$1.5 billion will simply be buying time.

If things are as rotten in the state of Evergrande as many observers seem to think, then the Chinese government is going to have to bail it out, or let it fail.

In a sense, the CCP may be feeling “we’re all Hank Paulsons now”.

China’s extra tools

That said, there is an intriguing — if somewhat troubling — option available to Chinese authorities.

They could bail out the company but punish its top brass with serious personal sanctions. To put it bluntly, they don’t have to be concerned with the niceties of due process in the same way the US government does.

The Chinese government can, if it wishes, prevent the reverberations throughout the economy that would flow from an Evergrande collapse, but deter moral hazard in the future. It can send a very clear message of consequence for executives who engage in reckless and potentially corrupt behaviour. Maybe incarceration for life. Maybe worse.

It’s an interesting, if rather grim, example of the Tinbergen Rule — named after Jan Tinbergen, the winner of the first Nobel prize for economics[4]. This rule says for each policy challenge one requires an independent policy instrument. The US government had one. The Chinese regime has two.

This all raises bigger issues

Beyond this lie much bigger issues. How well have Chinese enterprises actually been performing? Up until now it looked like the answer was remarkably well. But is this all a mirage, sustained by the lack of transparency that shrouds all Chinese institutions?

Read more: China is financing infrastructure projects around the world – many could harm nature and Indigenous communities[5]

It looks as if there may be two types of Chinese corporation: the ones that “make” things, which have been successful and still are, and the ones that “bank” things, which look disturbingly similar to their capitalist counterparts in the Western world when moral hazard and corruption are allowed to run rampant.

The shakeout of the coming years will reveal a lot about the economic bedrock of Chinese global power.

References

- ^ Vital Signs: the GFC and me. Ten years on, what have we learned? (theconversation.com)

- ^ China's problem with property: the domino effect of Evergrande's huge debts (theconversation.com)

- ^ for nearly 10 billion yuan (www.reuters.com)

- ^ first Nobel prize for economics (www.nobelprize.org)

- ^ China is financing infrastructure projects around the world – many could harm nature and Indigenous communities (theconversation.com)