Country and Sector Risk Barometer – June 2024 Turbulence ahead?

HONG KONG SAR - Media OutReach Newswire - 26 June 2024 - The year 2024 got off to a better start than the previous two years, which were marked by the final upsets of the pandemic, Russia's invasion of Ukraine and a banking crisis in the United States.

However, the first quarter of 2024 has seen a slowdown in US activity, with emerging countries acting as a relay for the global economy. Throughout the world, economic, social and political risks remain, such as the dissolution of the French National Assembly, a possible turning point for the country and Europe.

In this context, Coface has modified its assessments for 5 countries (4 upgrades and 1 downgrade) and 26 sectors (20 upgrades and 6 downgrades), reflecting a favorable outlook in the short term only.

The world economy above the waterline

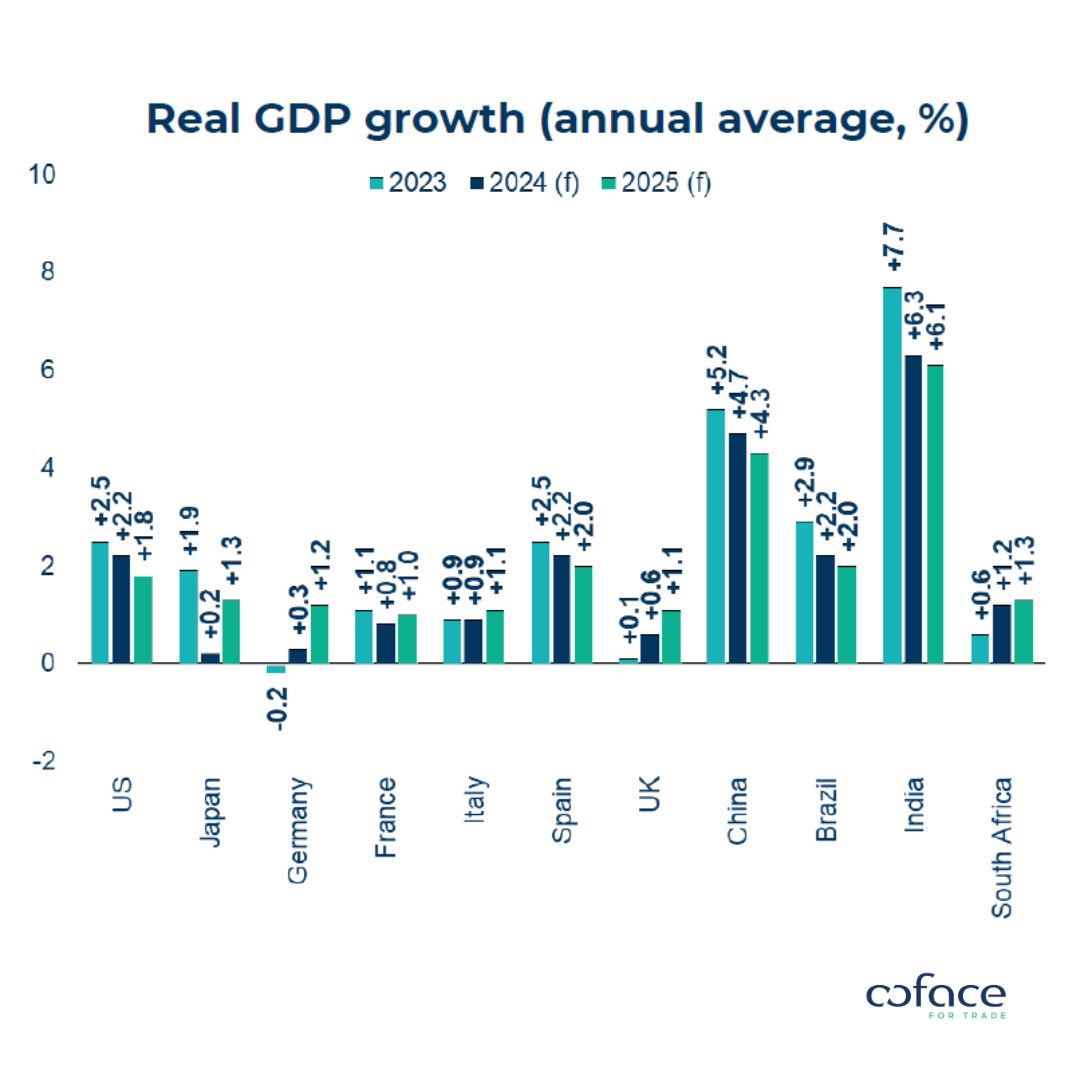

Our global growth forecast for 2024 has been upgraded to 2.5%, with stabilization expected at 2.7% in 2025. Moderate growth in the US and China should be offset by acceleration in several emerging countries.

Despite the slowdown in the US economy, labor market figures appear to have returned to pre-pandemic levels, indicating a better balance between labor supply and demand.

In China, the economic rebound remains uneven. GDP exceeded expectations in the first quarter of 2024, thanks to investment in manufacturing, exacerbating concerns about production overcapacity. Given the weakness of domestic demand, Chinese producers will have to find outlets on foreign markets. Persistent deflationary pressures could continue to hold back corporate and household incomes.

Europe, with GDP growth of 0.3% in the first quarter of 2024, and activity set to pick up thanks to the services sector, seems to be out of recession.

More arduous disinflation

The slowdown in disinflation in the United States confirms that the last mile in the fight against inflation is indeed the most difficult. The cause lies in the persistently high prices of services, and housing. PCE[1] inflation, which at 2.7% remains above the US Federal Reserve's 2% target, confirms this point.

In Europe, inflation rebounded in May to 2.6%, after dropping to 2.4% in April thanks to a slowdown in unprocessed food and goods prices. While the likely rise in wages should boost consumption, it will slow disinflation. If inflation is to continue to fall to around 2%, it will have to do so at the cost of a deterioration in the labor market and corporate operating margins, with the risk of a further increase in insolvencies.

Emerging economies ready to accelerate, but constrained by the Fed

Markets are now expecting only 1 or 2 rate cuts, reflecting the Fed's cautious stance. The latest projections from US monetary policymakers confirm that rate cuts will have to wait until the end of the summer, or even the end of the year. For its part, the European Central Bank launched its monetary easing with a first cut of 25 basis points (bp) at the beginning of June.

Faced with the Fed's delayed timetable, emerging countries will have to slow down or delay their rate-cutting cycle to avoid a rebound in inflation via imports. Brazil, for example, cut its key rate by just 25bp in May, after 6 consecutive 50bp cuts. The Fed's postponement will also condition monetary policies in Africa and Asia. The central banks of the main emerging economies have not yet begun their monetary easing, limiting the scale of their economic rebound for 2024 and 2025.

Despite this delayed timetable, many regions will enjoy positive momentum. Some of Southeast Asia countries (Vietnam and the Philippines) will achieve growth rates more than 6%. India, despite a slight slowdown, should post growth of 6.1%. Africa is also set to outperform and exceed 4% growth, with acceleration in all major economies (Nigeria, Egypt, Algeria, Ethiopia, Morocco and, to a lesser extent, South Africa).

In addition to the current administration's decision, candidate Trump's campaign promises to implement global tariffs of 10% are fueling concerns surrounding US trade policy, while heightening fears of fragmentation in global trade.

In an increasingly uncertain geopolitical context, an escalation of customs barriers would mean higher costs for businesses, contributing to the risk of a more inflationary future.

Link to the full report: https://www.coface.com/content/download/57984/file/Barometer%20T2%202024%20-%20turbulence%20ahead%20-%20ENG.pdf

Hashtag: #Coface

The issuer is solely responsible for the content of this announcement.

COFACE: FOR TRADE

With over 75 years of experience and the most extensive international network, Coface is a leader in Trade Credit Insurance & risk management, and a recognized provider of Factoring, Debt Collection, Single Risk insurance, Bonding, and Information Services. Coface's experts work to the beat of the global economy, helping ~50,000 clients in 100 countries build successful, growing, and dynamic businesses. With Coface's insight and advice, these companies can make informed decisions. The Group' solutions strengthen their ability to sell by providing them with reliable information on their commercial partners and protecting them against non-payment risks, both domestically and for export. In 2023, Coface employed ~4,970 people and registered a turnover of €1.87 billion.

For more information, visit coface.com.hk