MoneyFitt™: Redefining Personal Finance for Singaporeans

SINGAPORE - Media OutReach - 4 August 2023 - MoneyFitt™, a Singapore-based FinTech, are excited to announce its official launch in Singapore. MoneyFitt™ aims to empower individuals to take control of their financial well-being by offering personalised tips, a network of trusted experts, and a wealth of educational resources.

The launch follows a successful proof of concept project in collaboration with Prudential.

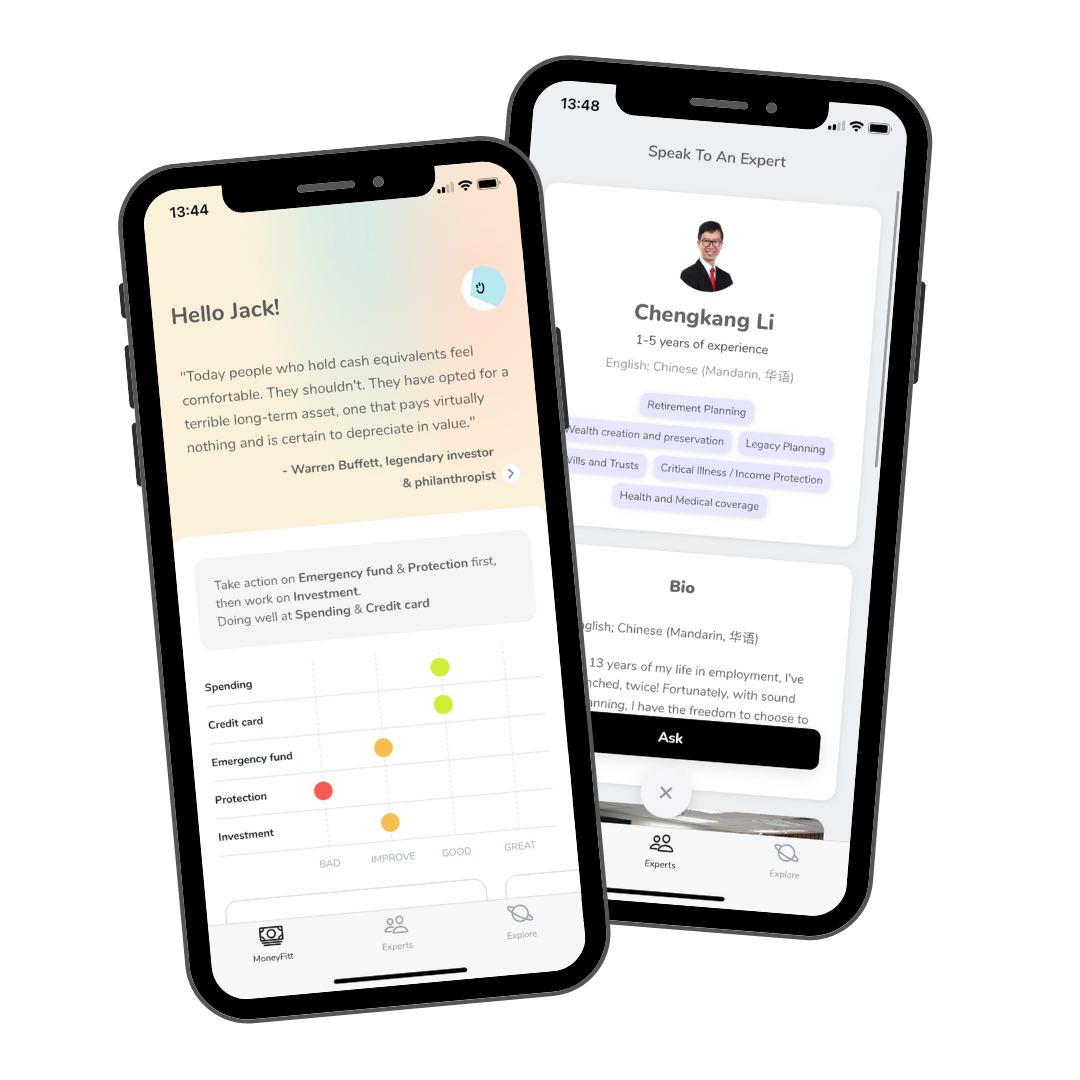

MoneyFitt™ recognises that each person has unique financial needs and goals. By leveraging advanced algorithms, the app provides users with actionable steps to improve five foundational areas of financial well-being: Spending, Credit Card, Emergency Fund, Protection, and Investments. Through the app's intuitive interface, users understand what to do, which steps to prioritise, and why they are essential.

One of the standout features of MoneyFitt™ is its access to a matching service of Singapore's trusted financial experts. Users can complete their profiles with relevant financial information and objectives, and then select a licensed financial advisor who users feel they can relate to and understand their needs. MoneyFitt™ does not charge users for connecting with advisors, nor does it take any commission from action taken through experts, for a transparent and hassle-free experience. It's the perfect platform for individuals seeking expert guidance without the risk of a hard sell.

"Our primary focus is to help individuals address multiple areas of personal finance, ultimately improving their financial, mental, and physical well-being," stated Lim Ka-ming, CEO of MoneyFitt™. The platform leverages content and customised suggestions to push action in every aspect, whether creating a budgeting template, developing an emergency fund, building an investment portfolio, or contacting a human advisor.

MoneyFitt™'s target audience for the Singapore launch comprises Gen Z and Millennial Singaporeans and working professionals who desire financial security but may lack the knowledge or confidence to attain it. The app caters to individuals who want to take action and are not afraid to ask for help from an expert.

Key features of the MoneyFitt™ app:

The app's features are designed to address the most important pain points faced by users, providing tangible benefits to enhance their financial well-being:

1. Content Feature: A vast library of financial literacy content, including articles, videos, quizzes, infographics, and tools. Users can choose their interests to access relevant content related to investing, retirement planning, saving, and wellness. The content produced by MoneyFitt™ and trusted third-party sources ensures unbiased and engaging information, free from product sales pitches.

2. Sliders Feature: A personalised feature that provides actionable steps to address the five foundational areas of personal finance. By addressing pain points and providing guidance on prioritising financial actions, MoneyFitt™ helps users take crucial steps toward financial freedom.

3. Expert Matching Feature: MoneyFitt™'s matching service allows users to connect with financial experts who can understand and relate to their unique needs and aspirations with the touch of a button. MoneyFitt™ does not provide investment or insurance advice but arms users with knowledge they can use to address their financial needs.

4. MoneyBott AI Chatbot: MoneyFitt™'s innovative feature transforms how users consume information and enhances the overall experience, acting as an intelligent and interactive guide to answer key personal finance questions. By offering a more targeted content experience, users can learn more about subjects of interest, whether that be MoneyFitt™'s features or personal finance-related questions.

MoneyFitt™ has already received highly positive feedback from early Singaporean users, who noted the app is intuitive, proven effective, and action-driven.

The all-new MoneyFitt™ App is available for download on [August,22,2023] on both iOS and Android platforms.

To learn more about MoneyFitt™ and join the financial revolution, visit our website at www.moneyfitt.co. For more information and media inquiries about MoneyFitt™, please contact: feedback@moneyfitt.co

Hashtag: #moneyfitt #personalfinance #moneymanagement

https://www.linkedin.com/company/moneyfitt

https://www.facebook.com/moneyfitt

https://www.instagram.com/moneyfittsg/

The issuer is solely responsible for the content of this announcement.

MoneyFitt

MoneyFitt is a financial wellness platform that helps people cultivate good financial habits and achieve financial freedom. It can be hard to know what takes priority, so we provide actionable guidance and tools to help you make better financial decisions. We believe that everyone deserves access to financial education and resources, regardless of their income or background. Let’s get MoneyFitt.