Grade A Office Rents in Mild Downward Adjustment of

Short-term retail leases in high demand

Expected boost of retail spending with Consumption Voucher Scheme roll-out

Despite this, the overall Grade A office rental level dropped by less than 1% q-o-q. With the pandemic situation starts winding down, and with new development projects due to complete, we expect the office leasing market to regain its momentum in the second half of the year. For the retail market, local retail sales in the first two months of 2022 dropped to a record low since the beginning of the outbreak, subsequently pulling down rents in the major retail districts by 3% q-o-q. However, with social distancing measures set to be eased in phases, combined with the beneficial knock-on effects of the Consumption Voucher Scheme, retail leasing activity is expected to recover after Q2 2022.

Office Market – Slight rental decline, net absorption recorded positive for three consecutive quarters

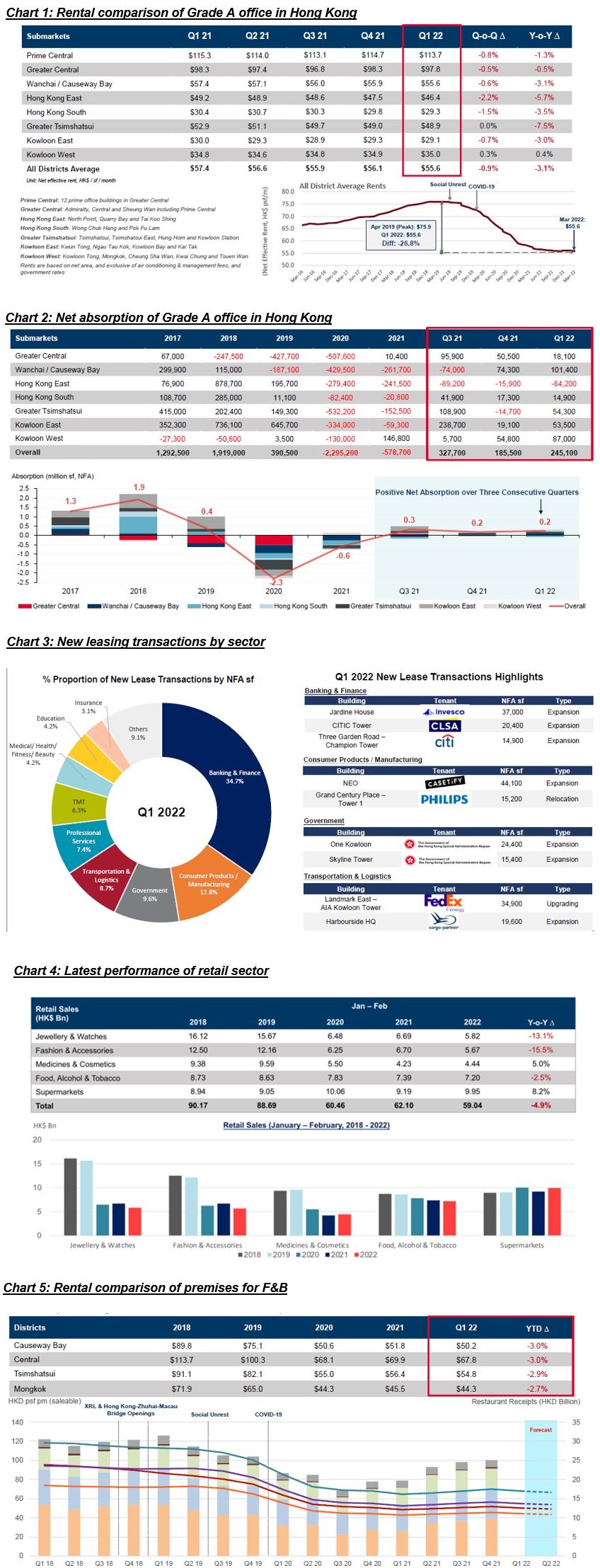

Office market rents demonstrated overall stable performance in January 2022. With the pandemic situation becoming more severe in February, leasing activities substantially slowed down, with overall rents dropped by 0.9% q-o-q and 3.1% y-o-y. In submarket terms, Hong Kong East and Hong Kong South showed notable drops in rental levels, falling by 2.2% and 1.5% q-o-q respectively (Chart 1). Nonetheless, the pandemic is expected to come under control, with social distancing measures set to be eased progressively. Given that office rental levels have now dropped with an accumulated plunge of circa 27% from the peak of 2019, we expect there is little room for further steep falls. We now anticipate a downward adjustment of 50 to 100 bps in Q2 2022, followed by a gradual recovery of leasing activities in 2H 2022 with subsequent stabilization in rental levels.

In terms of absorption, a number of leasing transactions were recorded in the first half of Q1. Yet, the subsequent tightening of anti-pandemic measures suspended site inspection activities by landlords and tenants, resulting in fewer transactions. Overall, the city recorded positive net absorption over three consecutive quarters as of Q1, amounting to 245,100 sf (Chart 2). The banking & finance sector (34.7%) accounted for the lion's share of new transactions in Q1, followed by consumer products & manufacturing at 12.8% of the total. The government and transportation & logistics sectors were more active than before (Chart 3). With a new project in the pipeline in Q1, overall availability was maintained at 13.6%.

John Siu, Managing Director and Head of Project & Occupier Services, Hong Kong, Cushman & Wakefield stated, "We estimate a total net absorption of 300,000 to 500,000 sf in 2022, with the banking & finance sector leading demand for office space, while the professional services and logistics sectors will also remain active. From the supply perspective, three flagship projects in non-core areas are due to complete in 2H 2022, bringing 2.3 million sf of new floor area to the market. We believe these new completions will help fuel office expansion and relocation, although the influx of space will inevitably ramp up the overall availability rate to around 16% to 17%."

Retail Market – Supermarkets; Medicine & Cosmetics sectors show positive growth

As the city braces for the fifth wave of the pandemic, it prompted widespread curtailment of consumption and resulted in an inactive retail market. In January and February 2022, total local retail sales fell by 4.9% y-o-y, with jewellery & watches (13.1%) and fashion & accessories (15.5%) dropping the most. On the other hand, supermarkets and the medicine & cosmetics sectors were beneficiaries, with retail sales growing by 8.2% and 5.0% respectively (Chart 4). The unfavorable factors have led to downward adjustments of retail rents in multiple districts, with drops ranging from 2.7% to 4.5%. As the pandemic situation gradually comes under control and social distancing measures expected to be progressively relaxed, we now anticipate little room for further overall rent reductions, and the market is expected to gradually recover from Q3 2022 onwards.

The F&B sector has suffered most severely from the fifth wave of the pandemic, subsequently seeing rental level falls of around 3% in multiple districts (Chart 5). However, with the gradual stabilization of the pandemic situation, combined with the expected relaxation of dining restrictions and a new round of the Consumption Voucher Scheme, we believe the F&B sector will be on the way to steady recovery.

Kevin Lam, Executive Director and Head of Retail Services, Agency and Management, Hong Kong, Cushman & Wakefield, highlighted, "Retail vacancy rates in key districts have been impacted by the pandemic to different extents. Mongkok and Tsimshatsui have suffered the most, with vacancy rates at 16.4% and 14.3% respectively. Responses from landlords can be broadly classified into three approaches. The first group prefers to leave the space idle, pending quality long-term tenants; the second tends to take a lease term of two to three years from large reputable brands; while the third group will lease the space to short-term tenants, such as those selling face masks and anti-epidemic products. In fact, short-term leases are better received by tenants, and so some landlords are willing to follow such market trends and accommodate lease terms accordingly."

Please click here to download photos and slide deck.

Left: Kevin Lam, Executive Director and Head of Retail Services, Agency and Management, Hong Kong, Cushman & Wakefield

Right: John Siu, Managing Director and Head of Project & Occupier Services, Hong Kong,

Cushman & Wakefield

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 50,000 employees in over 400 offices and 60 countries. Across Greater China, 22 offices are servicing the local market. The company won four of the top awards in the Euromoney Survey 2017, 2018 and 2020 in the categories of Overall, Agency Letting/Sales, Valuation and Research in China. In 2021, the firm had revenue of $9.4 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.hk or follow us on LinkedIn (https://www.linkedin.com/company/cushman-&-wakefield-greater-china).

The issuer is solely responsible for the content of this announcement.