Government extends assistance for first home buyers to stimulate building industry

- Written by The Conversation

In its latest stimulus measure, the Morrison government will extend its first home loan deposit scheme to an extra 10,000 home buyers.

But unlike existing arrangements, where people can purchase a new or existing home, these buyers will have to build a house or buy a newly-built property.

The condition is to direct maximum help to the residential building sector.

As with the existing program, the extended program allows people to buy with a deposit of as little as 5%, much less than the usual deposit of about 20%. The government guarantees the other 15% of the deposit.

The additional guarantee will run until June 30, 2021. The program has already assisted some 20,000 buyers since the start of the year.

Treasurer Josh Frydenberg said: “Helping another 10,000 first home buyers to buy a new home … will help to support all our tradies right through the supply chain including painters, builders, plumbers and electricians.

"In addition to the government’s HomeBuilder program, these measures will support residential construction activity and jobs across the industry at a time when the economy and the sector needs it most.

"At around 5% of GDP, our residential construction industry is vital to the economy and our recovery from the coronavirus crisis.”

The first home loan deposit scheme began in January, to provide up to 10,000 guarantees for the financial year to June 30, 2020. It saw strong demand in its first six months , with 9,984 out of a maximum of 10,000 guarantees offered.

Between March and June, the scheme supported one in eight of all first home buyers.

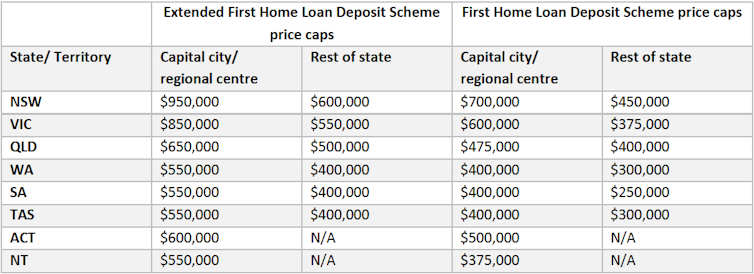

The government has announced new caps for the scheme, given newly built homes are usually more expensive than existing homes for first home buyers: